‘Ticking time bomb’: Homeowners face biggest hike in interest payments ‘on record’

UK mortgage holders are facing the biggest hike in interest payments on record amid the worsening cost-of-living crisis, according to analysis by the Liberal Democrats.

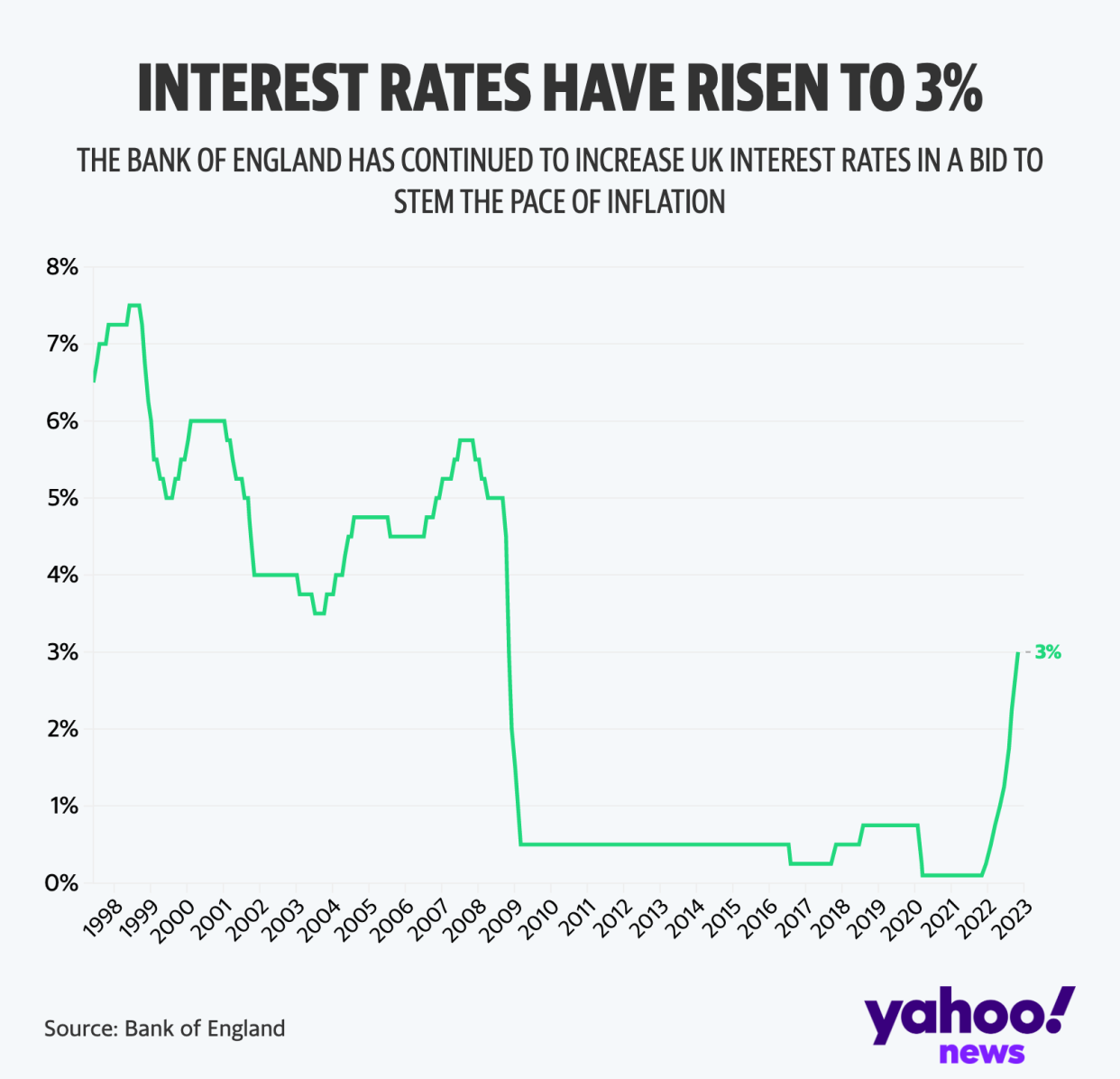

Earlier this month, the Bank of England (BoE) raised interest rates from 2.25 to 3% in a bid to curb spiralling inflation, driving up mortgage repayments for homeowners on variable rates or those looking for a new deal.

Interest rates are expected to continue to climb, peaking at around 4.5% next year according to Deutsche Bank.

Rates have already risen sharply. According to Bloomberg, Moneyfacts data on 21 November showed the average two-year fixed mortgage rate was 6.21% - which is up from 2.34% in December 2021. For five year mortgages the rate was 6.01%, up from 2.34% in December 2021.

Read more: Bank to pay homeowners £2,000 to make house more energy efficient

Watch: How does inflation affect interest rates?

On Thursday, the Office for Budget Responsibility (OBR) released its latest set of forecasts in response to Jeremy Hunt's Autumn statement – including a dire warning to homeowners.

The Liberal Democrats have said figures "buried" in the report reveal that mortgage interest payments are forecast to double in the year to September 2023, increasing by 100.5%.

This is substantially higher than the previous record, when interest payments increased by 63.9% in the year to July 1989.

The Lib Dems say households with an outstanding mortgage of £236,000 will see an increase of £2,851 a year, or £237.58 a month, to their interest payments on average.

“The mortgage ticking time bomb has only seconds left," said Liberal Democrat Treasury spokesperson, Sarah Olney.

"The coming months will see mortgage payments implode, leaving families paying hundreds of pounds more a month.".

Earlier this month, debt charity StepChange warned rising interest rates would have a "dramatic effect" on households.

“Rising rates are the price being paid for high inflation – and both create trouble for people experiencing problem debt," said Richard Lane, director of external affairs.

Read more: Jeremy Hunt's budget will see millions paying more in tax and energy bills to rise to £3k

"The cost of living is hitting everyone, but is especially hard for households on lower and fixed incomes, while rising rates have a dramatic effect on those mortgage holders rolling off fixed rates who have had little time to plan for much higher costs."

The Liberal Democrats are calling for a "rescue fund" of up to £300 a month to help households struggling with payments to prevent them falling into arrears or losing their homes.

They say the policy would be paid for by reversing the cuts the government made to the surcharge and bank levy in the Autumn statement.

The Treasury has been approached for comment.

It comes as the OBR report Brits are facing the biggest drop in living standards on record amid rising inflation and soaring energy bills - with the average household income predicted to drop 7% in real terms over the next two years.