The supermarket that has seen prices go up the most in the past year

Inflation slowed for many goods and services last month, official figures revealed today, led by sharp drops in the cost of household energy and an easing in the rate for everyday groceries such as rice, pasta and soft drinks.

However, despite the good news for consumers, not all items saw a slowdown, with inflation jumping for tea, olive oil, potatoes and others, official figures show.

The figures show that overall grocery costs have continued to rise, but increases have fallen to single digits for the first time in 16 months, according to data from analysts Kantar.

Prices across grocers were 9.7% higher than a year ago over the four weeks to 29 October, down from the previous month’s 11%.

It is the eighth consecutive decline in the rate of price rises since the figure peaked at 17.5% in March, and the first time the figure has fallen below 10% since July last year.

But what does this mean for consumers and their weekly shop and which supermarkets are managing to keep their prices most under control?

Recommended reading

UK supermarkets' sales of general merchandise dip ahead of festive season (Reuters)

Asda sales growth slows after poor weather hits clothing (PA)

UK inflation: Milk and butter prices drop but sugar rises (Yahoo Finance)

Rising supermarket prices

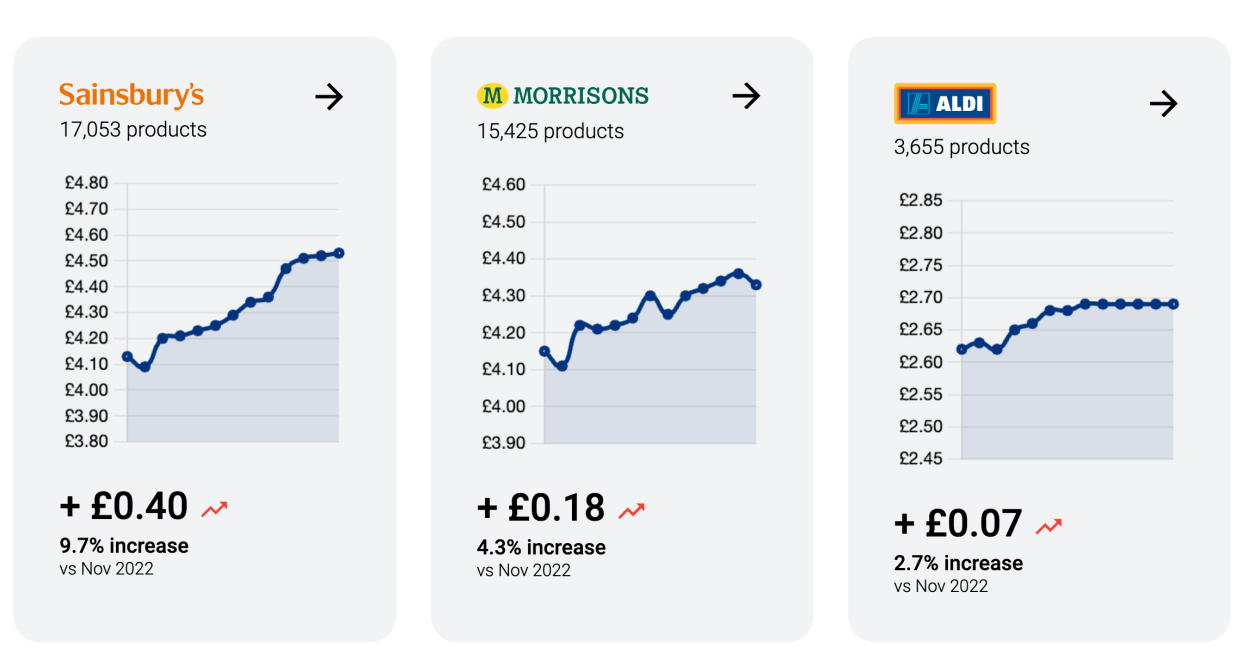

The Trolley.co.uk Grocery Price Index (GPI) monthly tracker monitors and records the prices of products from various supermarkets.

The tracker not only calculates the percentage increase in prices but also keeps track of the highest increase in terms of money.

It showed Sainsbury’s had seen the highest spike in prices since last year, with an average increase of 40p per item, which translates to a 9.7% increase.

Asda followed with an average increase of 27p per item (6.9%), Tesco was next with a rise of 25p (5.7%), Co-op came in fourth with a 16p spike (4.7%) and Iceland was in fifth place with an average increase of 18p per item (4.6%).

On the other end of the scale, Aldi had the lowest average increase in money terms with only 7p per item, equating to a 2.7% increase.

Ocado followed with 21p per item (3.4%), Waitrose was next with 21p (4.2%) and then Morrisons with an average increase of 18p per item (4.3%)

Supermarket sales increase

Latest data from market researcher NIQ shows that total supermarket sales rose 8.7% in the four weeks to 4 November.

Sales on a volume basis, or the number of items sold, fell 0.2%, continuing an improving trend after a 0.4% drop in NIQ's October report.

It said Tesco, Sainsbury's and Marks & Spencer had strong sales growth over the 12 weeks to 4 November up 9.6%, 10% and 14.4% respectively.

The researcher added discounters Aldi and Lidl continued to grow market share with sales growth of 17.7% and 19.1% respectively.

Last month marked the first time in two years that food and non-alcoholic drink prices were lower than the previous month.

According to NIQ, food price inflation in October fell for the sixth month in a row to 8.8%.

Food prices rose slightly month-on-month after the first such fall in more than two years in September.

Despite recent macro data and a raft of consumer surveys being downbeat, retailers including Tesco, Sainsbury's, Next, Primark and M&S have all made confident comments about prospects in the so-called "Golden Quarter".

NIQ estimates that over the 12 weeks to 30 December, Britons will spend more than £37 billion at UK supermarkets, a 6.5% increase on last year.

The Trolley.co.uk GPI monthly tracker has been tracking prices since 2019 and is updated on a monthly basis.

The tracker also provides information on the cheapest and most expensive supermarkets for a variety of products, including fresh produce, meat, and household items.