NFL teams are paying up more than ever for established receivers. Is it worth it?

It costs a lot to acquire and keep a good wide receiver on an NFL team.

Not only have a record 10 wideouts agreed to new deals in 2022 worth at least $15 million a year in average annual value — seven of which were for more than $20 million annually — but two Pro Bowl starters were also traded away this offseason for huge draft pick packages.

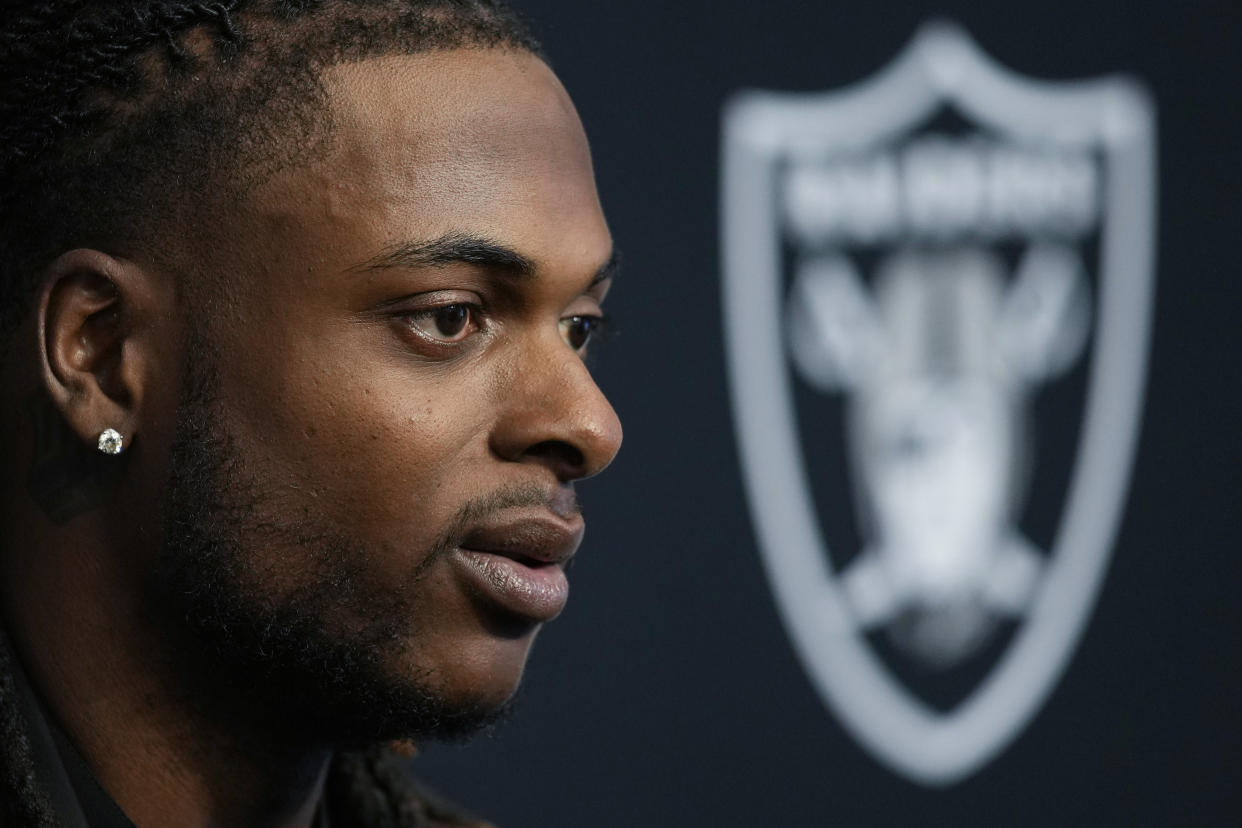

The Jacksonville Jaguars handed Christian Kirk an exorbitant contract, and that decision snowballed into blockbuster trades and record-setting extensions for Davante Adams and Tyreek Hill. The Las Vegas Raiders gave up a first- and second-round pick before giving Adams $28 million in AAV, while the Miami Dolphins traded a first, a second, two fourths and a sixth to the Kansas City Chiefs before signing Hill to a $30-million-a-year deal.

On Thursday during the first round of the NFL draft, the Philadelphia Eagles traded for Tennessee's A.J. Brown and promptly handed him a reported four-year extension that could reach $100 million in value. Other receivers like D.J. Moore, Stefon Diggs, Chris Godwin and Mike Williams also earned new deals worth at least $20 million a year.

Are these deals worth it? Should teams sign $20 million AAV contracts and/or give up multiple high draft picks in the process?

Teams will have to quickly make a decision. This trend appears to have cascaded down to the next crop of receivers in line for mega-deals: Seattle's DK Metcalf, Washington's Terry McLaurin and San Francisco's Deebo Samuel. The latter two already plan to skip voluntary on-field activities this spring, while Samuel requested a trade from the 49ers despite the Niners' willingness to iron out a new contract.

The price of doing wide receiver business

Ten years ago, Detroit Lions receiver Calvin Johnson signed a seven-year, $113 million contract that would have paid him $16 million annually. That mark set the record for the position in the NFL at the time, but would now sit 22nd on the list of all-time yearly salary for a receiver.

Johnson's average annual salary is now the norm for a good receiver, and the bar to sign the best at the position keeps being raised. Julio Jones broke the $20-million-per-year threshold in 2019 with the Atlanta Falcons, while DeAndre Hopkins pushed that number to $27.25 million in 2020 with the Arizona Cardinals. This offseason, Adams broke Hopkins' record before Hill took the top spot eight days later.

The money won't stop flowing, but it comes at a major cost to a team's ability to build a winning roster.

Seven receivers agreed to a new contract that will account for at least 10 percent of their team's salary cap when the extension hits, but only one of them (Adams) added more than 0.50 Wins Above Replacement (WAR), according to Pro Football Focus, with 0.78. For reference, PFF likens a player with a WAR of 1.0 to a player worth $40 million to $50 million annually. In this case, Adams is worth the $28 million the Raiders will pay him in 2022, but Hill's $30 million annual salary is an overpay considering his WAR was 0.47 in 2021.

That's a lot of money to pour into a player who won't affect a team's ability to win during the regular season, and the best teams in the NFL last season didn't spend that much on receivers. Only eight of the top 20 spenders at the position made the playoffs, and the two Super Bowl teams in 2021, the Bengals and Rams, spent 8 and 10 percent of the salary cap, respectively, on their entire receiver corps.

Giving up more to pay even more

The Cardinals, Raiders and Dolphins didn't sign Hopkins, Adams and Hill outright. They had to trade away assets for the right to pay these receivers their record contracts. They weren't the only ones to do that. The Cowboys dealt for Amari Cooper in 2018 before signing him to a $20 million AAV deal in 2020, and the Bills acquired Stefon Diggs in 2020 and signed him to a $22 million annual contract this past offseason.

That's a lot of potential surplus value lost for a team.

Let's take a look at the Adams and Hill trades. The Raiders lost an estimated 0.947 WAR after sending the Nos. 22 and 53 picks to the Packers, Pro Football Focus' draft pick WAR estimation, while the team earned back Adams' perceived 0.78 WAR. The Dolphins overpaid even more for Hill, sending an estimated 1.275 WAR to the Chiefs but returning only 0.47.

On its surface, these were both "losses" for the teams that acquired and paid for the star receivers. Especially because Adams and Hill will count for 13.6 percent and 13.9 percent of the cap for their respective teams starting in 2023.

But it's impossible to completely ascertain their value relative to the value the Raiders and Dolphins gave up, considering the new offenses and because we won't know what the Packers and Chiefs will do with their extra picks.

Arizona grossly underpaid for Hopkins when the Cardinals sent running back David Johnson, a 2020 second-round pick and a 2021 fourth-rounder to the Texans in 2020. The Cardinals already won the perceived WAR calculation by adding Hopkins' 0.702 WAR and losing 0.686, but the trade looks even worse for the Texans after Houston used the second-round pick on a player with just two sacks and 24 tackles in two seasons in nose tackle Ross Blacklock.

On the other hand you have the Diggs trade, which looks like a net positive for both sides. Buffalo sent the Nos. 22, 155 and 201 picks in the 2020 draft as well as the No. 134 in the 2021 draft to Minnesota for Diggs and the No. 239 pick. The Vikings won the trade by PFF's WAR estimation by adding 0.904 WAR and losing only 0.63. However, the Vikings drafted receiver Justin Jefferson at No. 22, and his 0.55 WAR almost equaled Diggs' 2020 total but at a fraction of the cost. Diggs has a $11.7 million cap hit in 2022, while Jefferson has a $3.5 million cap hit.

So, are these moves worth it?

Football is all about risk management. And trading away multiple draft picks — and their cheap rookie deals — just to spend at least $20 million a year on a player who could touch the ball only 15 times a game is a massive risk.

That gamble hinges on where a team feels it is competitively. Adams, Hill, Hopkins, Diggs and Brown are arguably among the 10 best receivers in the league who can completely take over games if used properly, and a draft pick could turn into a bust within one year.

If a team feels more comfortable with a proven asset at wide receiver who either knows the system or can learn the system and has a quarterback it trusts to properly utilize that $20 million weapon, the deal is probably worth it. Acquiring such a player can help teams answer questions about their quarterbacks too, which seems to be the case with the Dolphins bringing in Hill for Tua Tagovailoa, for example.

Here's a bit of caution for teams looking to spend big on Metcalf, Brown, McLaurin or Samuel: Neither the Cardinals nor Bills have made it past the conference championship since adding Hopkins and Diggs, and only one of the top-15 active receiver contracts won a Super Bowl after signing their new contract. That player is Mike Evans, and it was after the Buccaneers signed Tom Brady in 2020. Only three of the teams ranked in the top 10 in receiver spending have double-digit win totals (per BetMGM) this upcoming season as well.

The draft has also proven to be fertile grounds for young receiver stars in recent years and could be again in 2022. Those rookie contracts are enticing for teams who believe they have bigger needs elsewhere and could keep franchises from spending more on receivers after seeing the little impact they can possibly add to a team.

What happens with Samuel — either a deal with San Francisco or a trade elsewhere — could be the first indication of the direction of this trend.