Rishi Sunak sets out plan to hike corporation tax in his Budget

Rishi Sunak set out plans to freeze income tax thresholds and increase corporation tax as he began the process of repairing the nation’s finances following the coronavirus crisis.

The Chancellor used his Budget to set out a £65 billion spending package this year and next year to support the economy as it recovers from the pandemic.

But he warned that the unprecedented spending could not continue and he had to be “honest” about putting the nation’s finances back on a sustainable footing.

In 2023 the rate of corporation tax, paid on company profits, will increase to 25%. Even after this change we’ll still have the lowest corporation tax rate in the G7.

We’ll also protect small businesses so only 10% of companies will pay the full higher rate #Budget2021 pic.twitter.com/izwsLRLiXZ

— Rishi Sunak (@RishiSunak) March 3, 2021

The point at which people begin paying income tax will increase to £12,570 in April but will be maintained at that level until April 2026, meaning more people will be dragged into paying tax as wages increase.

The 40p rate threshold will increase to £50,270 and then be frozen.

Mr Sunak said: “Nobody’s take-home pay will be less than it is now, as a result of this policy.

“But I want to be clear with all Members that this policy does remove the incremental benefit created had thresholds continued to increase with inflation.”

Corporation tax will increase from 19% to 25% in 2023.

But a new “small profits rate” will maintain the 19% rate for firms with profits of £50,000 or less – meaning around 70% of companies – 1.4 million businesses – will be “completely unaffected” by the tax hike.

And there will be a taper above £50,000, so that only businesses with profits of £250,000 or greater will be taxed at the full 25% rate – around 10% of firms.

Mr Sunak said: “So yes, it’s a tax rise on company profits. But only on the larger, most profitable companies. And only in two years’ time.”

Mr Sunak said there would be a “super deduction” for companies when they invest, reducing their tax bill by 130% of the cost.

While economists have largely agreed that measures to repair the nation’s finances are not needed immediately, while the economy is still being hit by the coronavirus crisis, the need for medium-term action was underlined by the Office for Budget Responsibility forecasts.

Mr Sunak said: “The OBR’s fiscal forecasts show that this year we have borrowed a record amount: £355 billion. That’s 17% of our national income, the highest level of borrowing since World War Two.”

Next year borrowing is forecast to be £234 billion, 10.3% of gross domestic product (GDP), a measure of the size of the economy, “an amount so large it has only one rival in recent history – this year”.

“Without corrective action, borrowing would continue at very high levels, leaving underlying debt rising indefinitely.”

The Budget measures will see borrowing fall to 4.5% of GDP in 2022-23, 3.5% in 2023-24, then 2.9% and 2.8% in the following two years.

Underlying debt rises from 88.8% of GDP this year to 93.8% next year, it then peaks at 97.1% in 2023-24, before stabilising and falling slightly to 97% and 96.8% in the final two years of the forecast.

The Chancellor said the recovery from the economic damage caused by coronavirus will be “swifter and more sustained” than previously thought.

But he warned it would take “a long time” to rebuild and pledged to do “whatever it takes” to support people.

The OBR expects the economy to return to its pre-Covid level by the middle of next year – six months earlier than they previously thought – but Mr Sunak acknowledged that “coronavirus has done and is still doing profound damage”.

He told MPs that despite the £280 billion of support already committed to protecting the economy the damage done by the virus has been “acute”.

“Our economy has shrunk by 10% – the largest fall in over 300 years. Our borrowing is the highest it has been outside of wartime.

“It’s going to take this country – and the whole world – a long time to recover from this extraordinary economic situation. But we will recover.”

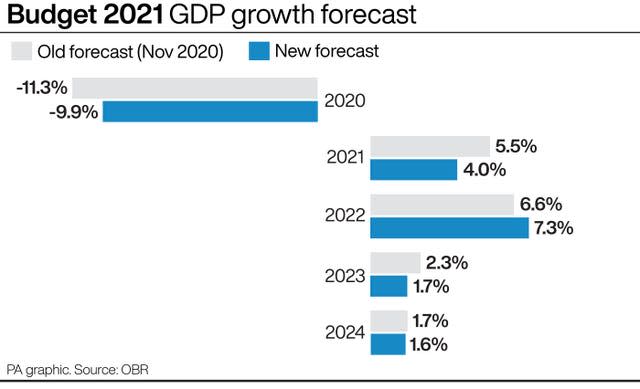

The Chancellor said the OBR expects the economy will be 3% smaller than it would have been in five years’ time because of the coronavirus crisis, but that the economy is forecast to grow this year by 4%, by 7.3% in 2022, then 1.7%, 1.6% and 1.7% in the last three years of the forecast.

A tapered extension of the stamp duty holiday until 30 September, helping more people to purchase their homes before the deadline and supporting jobs. #Budget2021 #PlanForJobs pic.twitter.com/VavhpunPMH

— HM Treasury (@hmtreasury) March 3, 2021

In his Budget the Chancellor:

– Extended the stamp duty holiday from the end of March until the end of June, then a new £250,000 threshold will apply until the end of September.

– Confirmed the extension of the furlough scheme until the end of September, although employers will be expected to make a contribution from July.

– Extended the 5% reduced rate of VAT for the tourism and hospitality sector to the end of September, with an interim rate of 12.5% for another six months after that.

– Continued the business rates holiday for the retail, hospitality and leisure sectors until the end of June, with a two-thirds discount for the remaining nine months of the year.

– Announced the temporary £20-a-week increase in Universal Credit payments will continue for a further six months.

– Set out a new Recovery Loan Scheme to replace previous coronavirus loan packages, allowing businesses of any size to apply for loans from £25,000 up to £10 million through to the end of the year, with the Government providing lenders with an 80% guarantee.

– Froze all alcohol duties for the second year in a row and scrapped a planned increase in fuel duty.