Rate cuts somewhat closer but risks of acting too early remain – Bank economist

The Bank of England’s chief economist has said interest rate cuts are “somewhat closer” than last month.

However, Huw Pill argued the economic outlook has “not changed substantially” and there are still risks if Bank policymakers reduce rates too early.

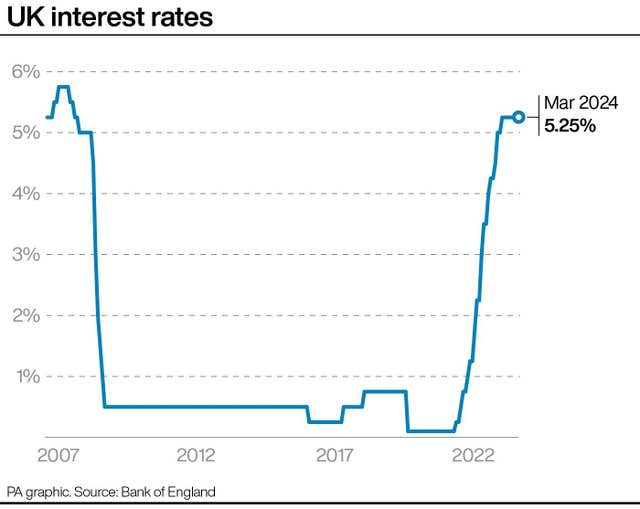

UK interest rates are currently at a 15-year high of 5.25%, after being held at this rate for the past five meetings of the Bank’s monetary policy committee.

There has been recent speculation the central bank could start cutting rates, although rate cut predictions were trimmed by many analysts and investors last month after March inflation dipped by slight less than expected.

Ratesetters at the Bank of England have highlighted caution over moving too quickly to bring rates down.

In March, Mr Pill said the Bank was “some way off” cutting interest rates.

In a fresh speech in London, the economist said: “The combination of little news and the passage of time have brought a bank rate cut somewhat closer.

“But the same lack of news gives me no reason to depart from the baseline that I already established.”

He added the steady decline in inflation means “the outlook for UK monetary policy in the coming quarters has not changed substantially since the beginning of March”.

Consumer Price Index inflation dipped to 3.2% in March and is expected to move closer to the Bank’s 2% target rate in April amid another fall in energy prices.

However, Mr Pill stressed there are risks if the Bank swiftly reacts to this by looking to cut rates amid signs of persistence in services and wage inflation.

He said: “After several years of above target inflation rates and given the threat of persistent inflation dynamics becoming embedded in expectations, in my view there are greater risks associated with easing too early should inflation persist rather than easing too late should inflation abate.

“This assessment further supports my relatively cautious approach to starting to reduce bank rate.”