VW Golf best-selling car in Britain as sales pick up in May

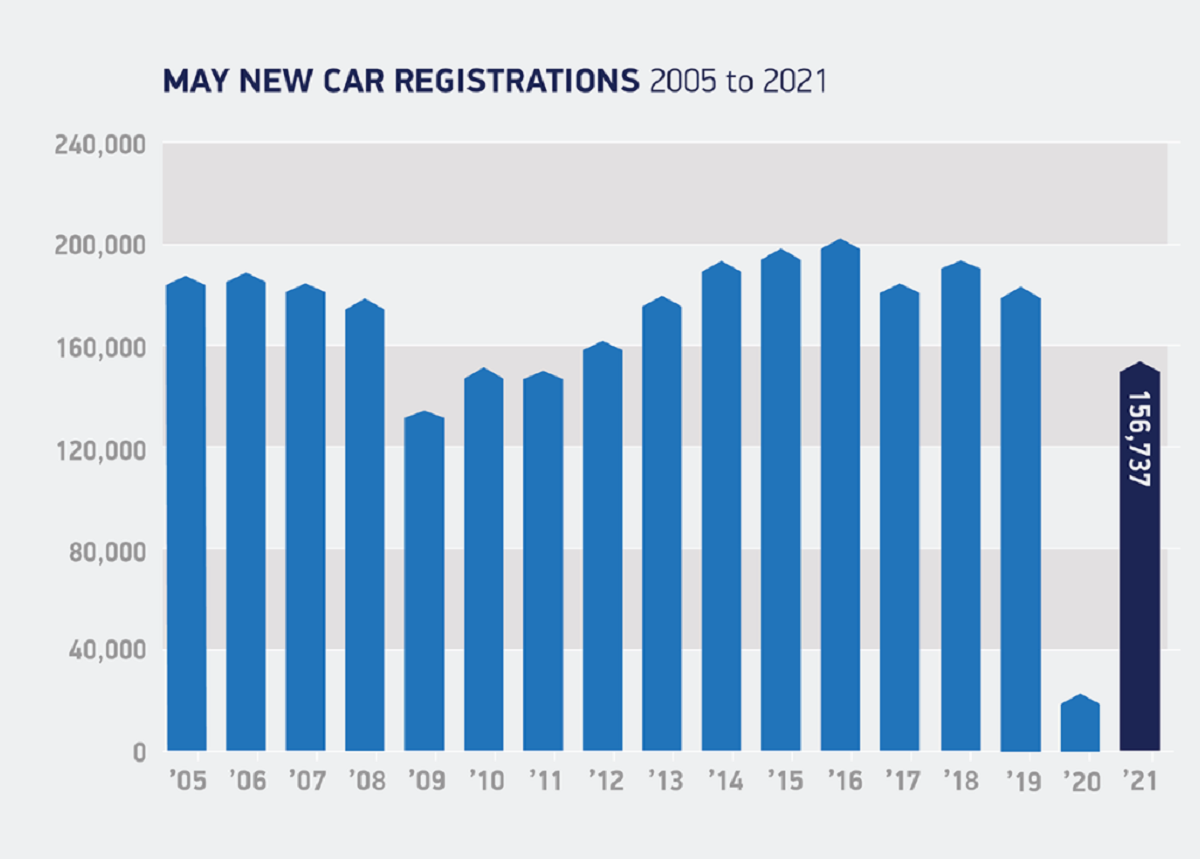

The Volkswagen (VOW3.DE) Golf has been crowned as the best-selling car in Britain last month as UK new car registrations rose 674% to 156,737 in May.

This was compared to the same period last year when showrooms across the country were closed in a bid to curb the spread of coronavirus. Dealers reopened their doors to the public on 12 April in England.

However, sales were below the 183,724 purchases made in 2019, new data from the Society of Motor Manufacturers and Traders (SMMT) showed, meaning sales are still languishing behind pre-pandemic levels. Total registrations over the year to date remain 29.1% down on a 10-year average.

The SMMT said that volumes last month were boosted by business fleet demand, while the plug-in vehicle market also continued to rise, accounting for 13.8% of registrations in 2021 so far, sending a message that UK consumers are keen to go green.

While large fleets accounted for 50.7% of all new vehicles hitting the road, dual purpose vehicles saw a small decline in market share in the month, down to 26.7%.

Superminis remained Britain’s most popular car choice, with a 31.1% share, with 4,181 sales of the VW Golf topping the list in May, followed by 3,643 of Vauxhall's Corsa and the VW Polo in third place with 3,518.

“Increased business confidence is driving the recovery – something that needs to be maintained and translated in private consumer demand as the economy emerges from pandemic support measures,” said Mike Hawes, SMMT chief executive.

Watch: How to prevent getting into debt

“Demand for electrified vehicles is helping encourage people into showrooms, but for these technologies to surpass their fossil-fuelled equivalents, a long-term strategy for market transition and infrastructure investment is required.”

The industry forecasts full-year sales of 1.86 million new cars.

Seán Kemple, managing director of Close Brothers Motor Finance, said: “Severe supply issues caused by COVID-19, Brexit, and now a global semiconductor shortage, are choking the new car market, causing long delays and slow delivery times for new orders. This is pushing people toward the used car market instead.”

The global chip shortage has put pressure on a number of carmakers who are competing directly with tech companies and the consumer electronics sector for supply.

Read more: The chip shortage bringing car factories to a standstill

At the beginning of the pandemic, many car manufacturers cancelled orders due to fear of a long downturn in sales. However, as sales have started to recover they have now found themselves at the back of the queue for these microchips.

Jaguar Land Rover (JLR), the UK’s largest car manufacturer, temporarily shut down production at two of its main plants in April, while Nissan (7201.T) announced that it would furlough around 10% of employees (800 people), at its UK plant in Sunderland amid the supply chain issues.

Other carmakers have made similar moves. Earlier this year, US company Ford (F) announced that it will cut car production due to the global chip shortage and said profits could be hit by $1bn.

Renault (RNO.PA) and Honda (HMC) also flagged similar plans, with the latter previously pausing production at its Swindon plant. General Motors (GM) warned that it could face a $2bn profit hit.

The entire global car industry buys approximately $37bn (£26.5bn) worth of computer chips.

Watch: COVID-19: Chip shortage throws spanner in the works as car industry struggles to recover from coronavirus crisis