UK mortgage deposit soars to 110% of average pay

House price growth has exceeded earnings growth in the UK, and raising a deposit continues to be a major obstacle for first time buyers, a new report has shown.

According to the latest Nationwide house price index, a 20% deposit is now equivalent to 110% of the pre-tax income of a typical full-time employee, a record high and up from 102% a year ago.

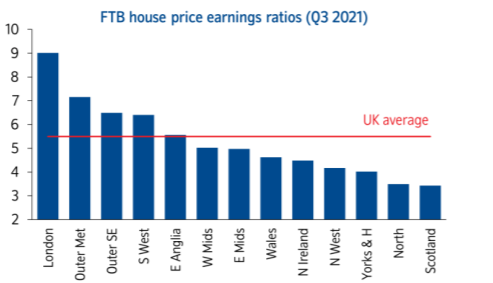

In the third quarter of 2021, the UK first-time buyer house price to earnings ratio stood at 5.5, above the previous high of 5.4 in 2007, and well above the long run average of 3.8.

“House prices have continued to rise more quickly than earnings in recent quarters, which means affordability is becoming more stretched,” said Andrew Harvey, senior economist.

He said that due to the historically low level of interest rates, the comparative cost of servicing a typical mortgage is still well below the levels recorded in the run up to the financial crisis.

But even on this measure, affordability is becoming more challenging.

A significant proportion of first-time buyers take advantage of help from friends and family or an inheritance to help raise a deposit.

And while there continues to be a significant gap between the least affordable and most affordable regions across the UK, this has remained broadly stable over the last year.

London continues to have the highest house price to earnings ratio at 9.0, although this is still below its record high of 10.2 in 2016.

Scotland continues to have the lowest house price to earnings ratio in the country at 3.4, closely followed by the North region at 3.5.

Read more: UK's cheapest cities to rent a flat

The cost of servicing a typical mortgage as a share of take-home pay is now above its long-run average in the majority of UK regions. By contrast, pre-pandemic, this was only the case in London.

Meanwhile there has been increased speculation that the Bank of England’s Monetary Policy Committee will increase interest rates in the coming months.

“Providing the economy does not weaken significantly, the impact of a limited rise in interest rates for existing borrowers is likely to be modest, especially given only 20% of outstanding mortgages are on variable rates,” said Harvey.

This is because the vast majority of new mortgages in recent years have been extended on fixed rates.

He added that if the economic recovery remains resilient, higher interest rates are likely to "exert a moderating influence on the housing market, as well as dampening price pressures across the economy more generally.”

Watch: How does the 95% mortgage scheme work?