UK car market takes £1.3bn lockdown blow as new registrations decline

The month-long second lockdown in England saw the UK new car market suffer a £1.3bn ($1.7bn) revenue hit in November as 42,840 fewer new cars joined British roads, compared to the same month in 2019.

According to new figures released by the Society of Motor Manufacturers and Traders (SMMT) there was a 24.7% decline in new car registration.

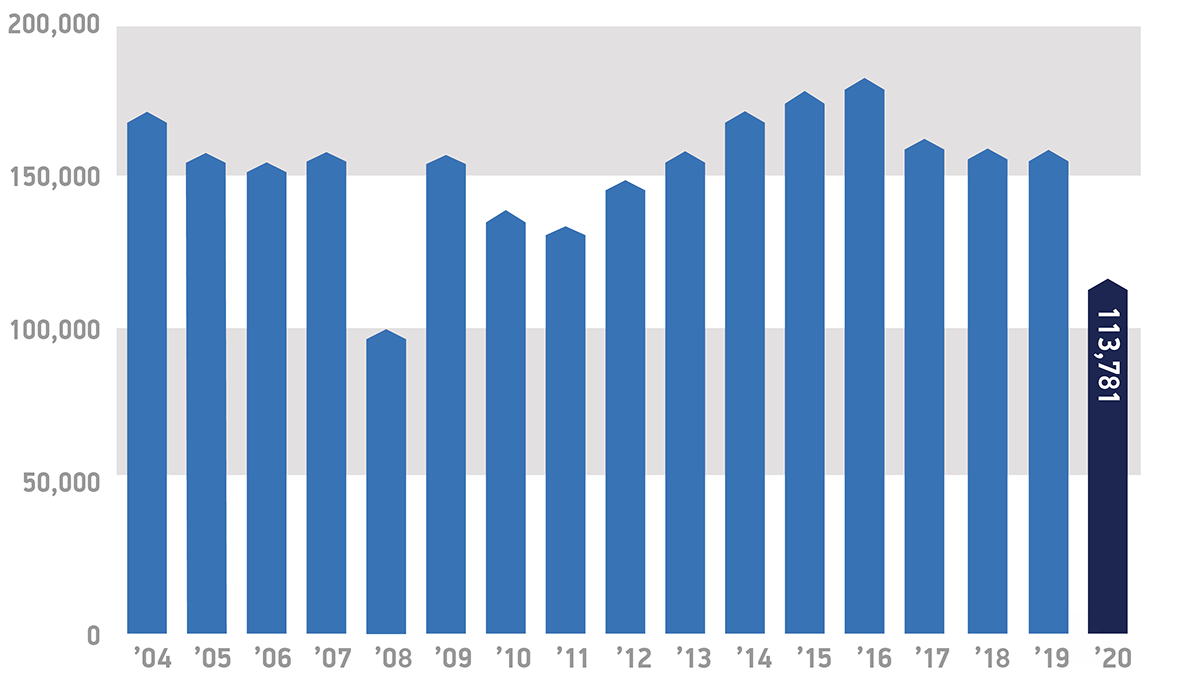

Overall, there were 113,781 new cars registered during the month, levels last seen since the 2008 recession.

WATCH: Why can't governments just print more money?

Meanwhile, the sale of petrol cars dropped by 41.9%, while diesel declined by 56.2% compared with same time period last year.

However, sales of electrified vehicles — battery-electric, plug-in hybrid, standard hybrid and mild hybrid — were up 74.1% on the same period a year ago, totalling 42,001.

Battery-electric vehicles recorded their third-highest ever monthly share of registrations at 9.1%.

The drop was less severe than that recorded during the first national lockdown which saw registrations decline by 97.% in April, largely due to retailers being better geared-up to offer click-and-collect or delivery services. But, despite this, the demand for private cars fell 32.2% while fleet registrations fell by 22.1%.

This means that around 31,000 cars would need to be registered during each working day in December for the car sector to achieve the level which was expected at the start of the year, with the car market having lost 663,761 units to date.

SMMT chief executive, Mike Hawes, said: “Compared with the spring lockdown, manufacturers, dealers and consumers were all better prepared to adjust to constrained trading conditions.

Hawes, said that the revenue hit made the importance of showroom trading to the UK economy more evident, adding “we must ensure they remain open in any future COVID-19 restrictions.”

“More positively, with a vaccine now approved, the business and consumer confidence on which this sector depends can only improve, giving the industry more optimism for the turn of the year,” he concluded.

English lockdown stalls November new car market as registrations decline -27.4%https://t.co/kr3dpLm7hRpic.twitter.com/Hd59enPkHa

— SMMT (@SMMT) December 4, 2020

Industry experts have said the November figures were “disappointing” and another “blow” for the car industry, which needed “something of a miracle” before the festive period.

Lex Buttle, director of used car marketplace Motorway.co.uk, comments: “Dealers were open for business during the second lockdown, with most reverting effortlessly to online sales and click-and-collect services, but many locked down consumers simply weren’t buying new vehicles.

Buttle said that electric and hybrid car sales “once again stand out amongst the gloom,” with battery electric car registrations in particular “continuing to climb upwards at a healthy rate.” He added that EV numbers are still some way off “filling the void left by falling petrol and diesel sales,” which were impacted by the government announcing it was moving the ban on new electric and diesel cars forward to 2030.

He added: “December is typically a slow month for new car sales and this year is likely to be slower than normal. With dealerships physically open again, we may see a slight uplift in trade, but the economic backdrop for 2021 is likely to drag down sales.

“Consumer appetite to purchase new cars is shaky. The second lockdown has really taken its toll on family finances and the new Tier system that kicked in after lockdown ended, has left most consumers feeling uncertain. The reality is, that a new car is a long way down most people’s wish list, especially with Christmas just around the corner.

“However, new car dealers are not giving up on December, with many offering generous discounts on new and pre-registered stock, in an effort to boost end-of-year sales figures. But even 10-20% discounts may not be enough to tempt consumers to buy before Christmas.

“There’s a maelstrom of uncertainty swirling around, with unemployment levels rising and an EU trade deal still not agreed with less than a month to go before the transition period ends.

“Even with consistent, upbeat news on the vaccine front, many consumers are likely to put off buying big ticket items such as a new car until the New Year. And even then, many will prefer to look to the booming used car market for more value with their purchase.”

Watch: Why tax rises may be inevitable in Britain