Trending tickers: Tesla, Intel, Disney and Ryanair

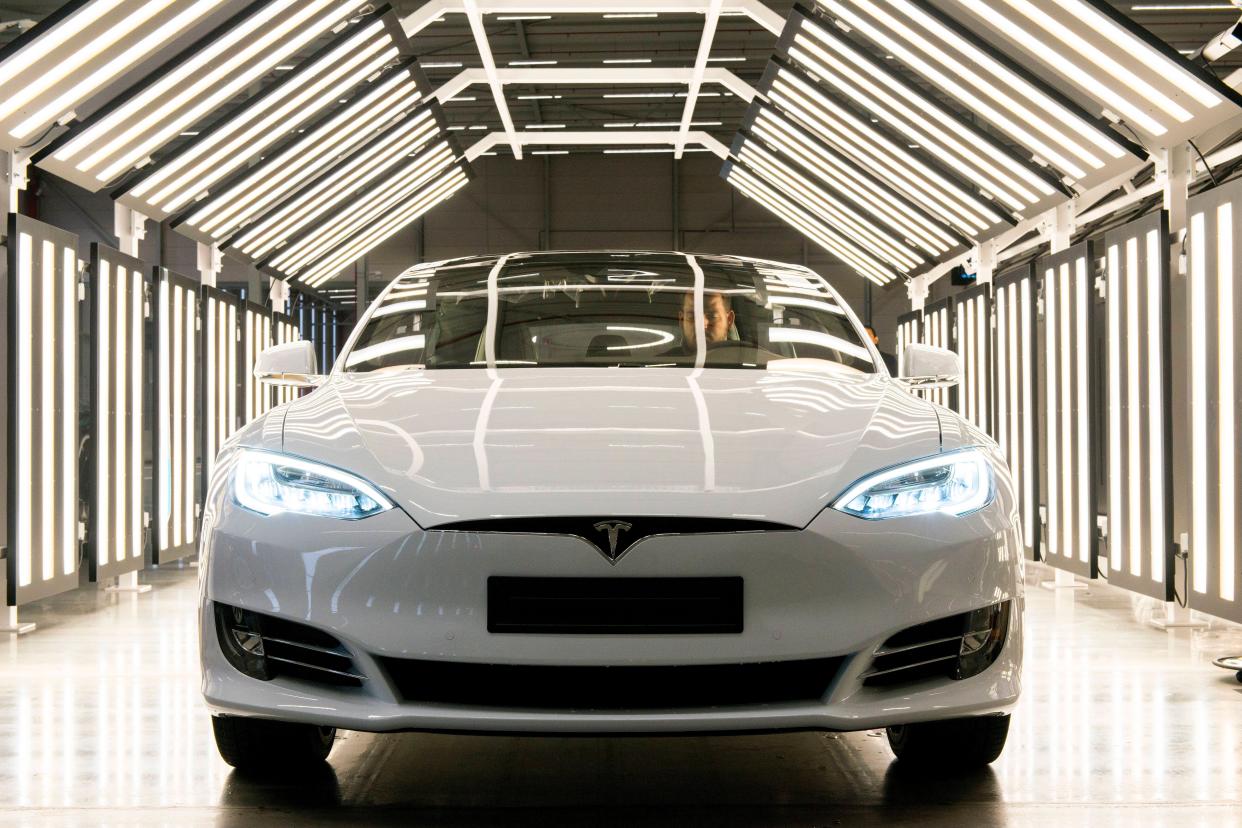

Tesla (TSLA)

Shares in the EV maker were the most traded in premarket hours as Tesla risks losing its Magnificent Seven status due to slowing demand and growth concerns.

Tesla delivered 386,810 vehicles worldwide from January through March, almost 9% below the 423,000 it sold in the same quarter of last year. It was the first year-over-year quarterly sales decline in nearly four years.

Wedbush Securities analyst Dan Ives described the update as an "unmitigated disaster ... that is hard to explain away".

Elon Musk’s company said the drop in volumes was partially due to its efforts to prepare the Fremont factory in California to increase production of the updated Model 3 and shutdowns at its plant in Berlin caused by shipping diversions due to the Red Sea conflict and an arson attack in early March.

Read more: UK mortgage approvals rise to levels seen before Liz Truss’ mini-budget

Tesla’s shares have fallen nearly 30% in value so far this year, closing 4.9% lower on Tuesday.

“So, Tesla, I think, we've been hearing for some time that it could get the boot from the Mag Seven. And I just think that the stock price right now down more than 30% year to date, 20% year-over-year. Investors don't seem that confident in this company,” Yahoo Finance reporter Alexandra Canal said.

Intel (INTC)

Intel shares fell over 4% in extended trading after the company revealed that its Foundry segment lost $7bn (£4.13bn) in 2023, widening from a loss of $5.2bn in 2020.

This is the first time that Intel has disclosed revenue totals for its foundry business alone. Historically, Intel has both designed its own chips as well as done its own manufacturing, and reported final chip sales to investors.

The unit had revenue of $18.9bn for 2023, down 31% from $27.49bn the year before.

The company expects 2024 to be the peak of its losses and that Intel Foundry will be profitable, on an operating level, “midway between now and the end of 2030.”

"In the post EUV era, we see that we're very competitive now on price, performance (and) back to leadership," CEO Pat Gelsinger said.

Disney (DIS)

Shares in Disney were lower as the company enters the final stretch of its proxy battle, with the shareholder vote deadline expected to be announced at the annual stockholders meeting later this Wednesday.

Nelson Peltz, the activist investor trying to force through changes at Walt Disney, appears set to lose the battle against CEO Bob Iger.

Sources told Reuters enough votes had been cast Tuesday night to put Disney's board directors safely ahead of their challengers.

Institutional investors Vanguard, BlackRock, and State Street serve as Disney's three largest shareholders. According to the Wall Street Journal, BlackRock has voted in favour of the company's current board.

Reuters reported that Vanguard also has voted to back the existing board. The position of State Street is still unknown.

Read more: The benefits of being an ISA early bird

Peltz’s Trian Partners, which nominated two candidates for seats on Disney’s board, is locked in an argument over how much money Disney should be making with its wealth of intellectual property and theme parks.

Peltz says the company needs to unlock more free cash flow. Iger says it’s already back on track.

Ryanair (RYA.IR)

Low-cost airline Ryanair reported an 8% jump in March traffic as it operated over 77,000 flights.

The Irish budget airline said 13.6 million passengers in the month, up from 12.6 million in March 2023. The load factor – or the amount of seats filled on each flight – remained at 93%.

On a rolling 12-month basis, passenger numbers grew 9% to 183.7m and the load factor ticked up to 94%.

The company operated over 77,000 flights, with 950 cancelled due to the Israel-Hamas war.

Watch: Fed still likely to cut mid-year: Former Fed Vice Chair

Download the Yahoo Finance app, available for Apple and Android.