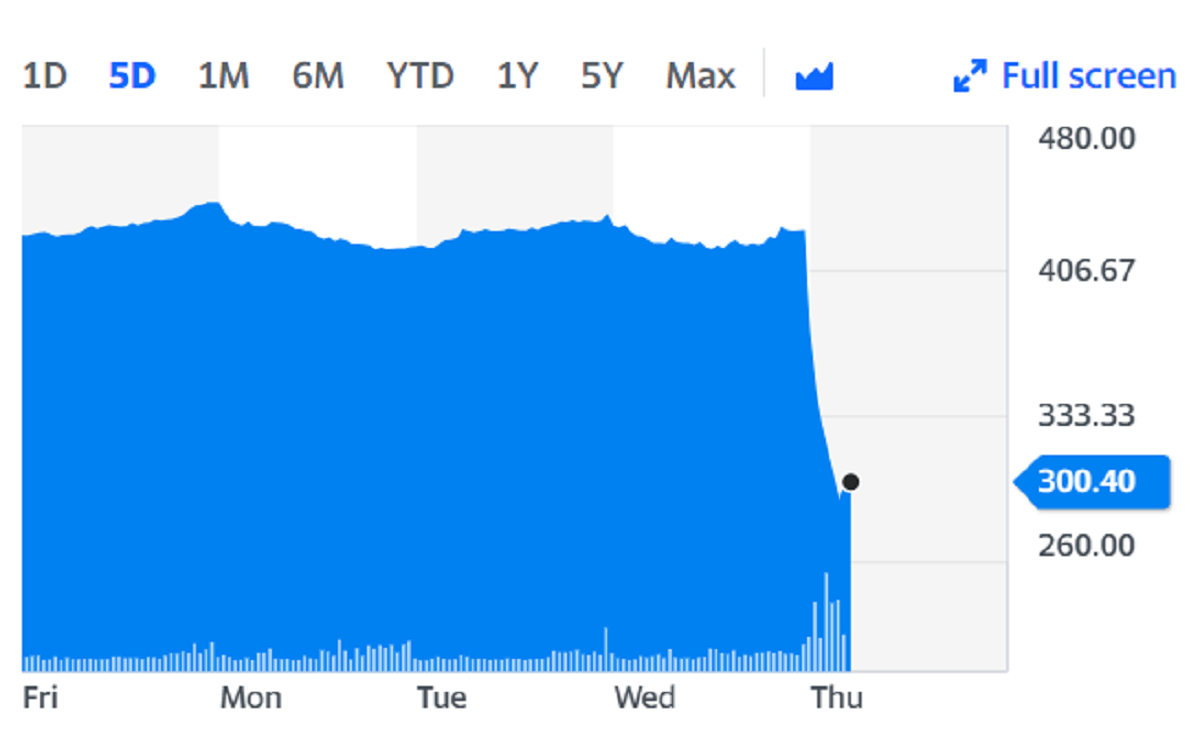

Trainline shares crash 30% amid major rail shake-up

Shares in ticketing firm Trainline (TRN.L) lost almost a third of their value on Thursday, crashing as much as 31%, after the UK government unveiled a state-backed rival.

The long-awaited shake-up will see the formation of a new public body called Great British Railways, with digitised train ticketing as part of the overhaul, creating direct competition for Trainline which has been the go-to destination for many rail passengers.

The move, which is the biggest shake-up since the 1990s, will mean that the rail industry will still be run by private companies but under a management contract, similar to the system in place on the London Overground.

Ministers said that passengers will be able to buy tickets on a website run by Great British Railways, as it aims to better integrate the current fragmented system.

According to the Telegraph, it will take around nine months to get the new site up and running. Britain's 26 rail operators will migrate onto the platform as their contracts with companies such as Trainline expire.

The shake-up will bring new, flexible pricing plans, with streamlined fares and a simplified refund system. It will also provide smartphone ticketing, including bringing contactless and pay-as-you-go systems to more parts of the country.

UK prime minister Boris Johnson said: “For too long passengers have not had the level of service they deserve.”

Watch: Landslip wreaks havoc on travel plans

Meanwhile, transport secretary Grant Shapps said passengers had been failed by “years of fragmentation, confusion and overcomplication”.

He said Great British Railways would “become a single familiar brand with a bold new vision for passengers – of punctual services, simpler tickets and a modern and green railway that meets the needs of the nation”.

Trainline, which listed on the London stock market in 2019, sells rail and coach tickets and railcards through its website and app. It currently sells about 70% of all digital tickets, and has its commission rates guaranteed until 2024 through an agreement with the Rail Delivery Group.

Disruption from the coronavirus pandemic caused Trainline to fall to a £100m operating loss, however, it invested in new personalised and go-location technology to win market share amongst customers.

Read more: EasyJet hopes for green list boost after £700m loss

A spokesperson for Trainline said it would continue to work with the British government around future proposals and reform.

“Trainline had been glimpsing light at the end of the tunnel as lockdown eased, but the government’s shake up of the railways has seriously pulled the brakes on prospects for recovery,” Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said.

“In its prospectus issued before its IPO in 2019, Trainline had warned changes to government policies or regulations, affecting the rail network could have a material adverse impact on the Group’s results of operations, financial condition and business prospects.”

She added: “If National Rail Enquiries starts issuing tickets it is likely to gobble up a significant share of the market currently enjoyed by Trainline, due to the strength of its nationally recognised brand, which could seriously impact the company’s sales volumes and revenue.”

Watch: Shapps: 'Great British Railways will put passengers first'