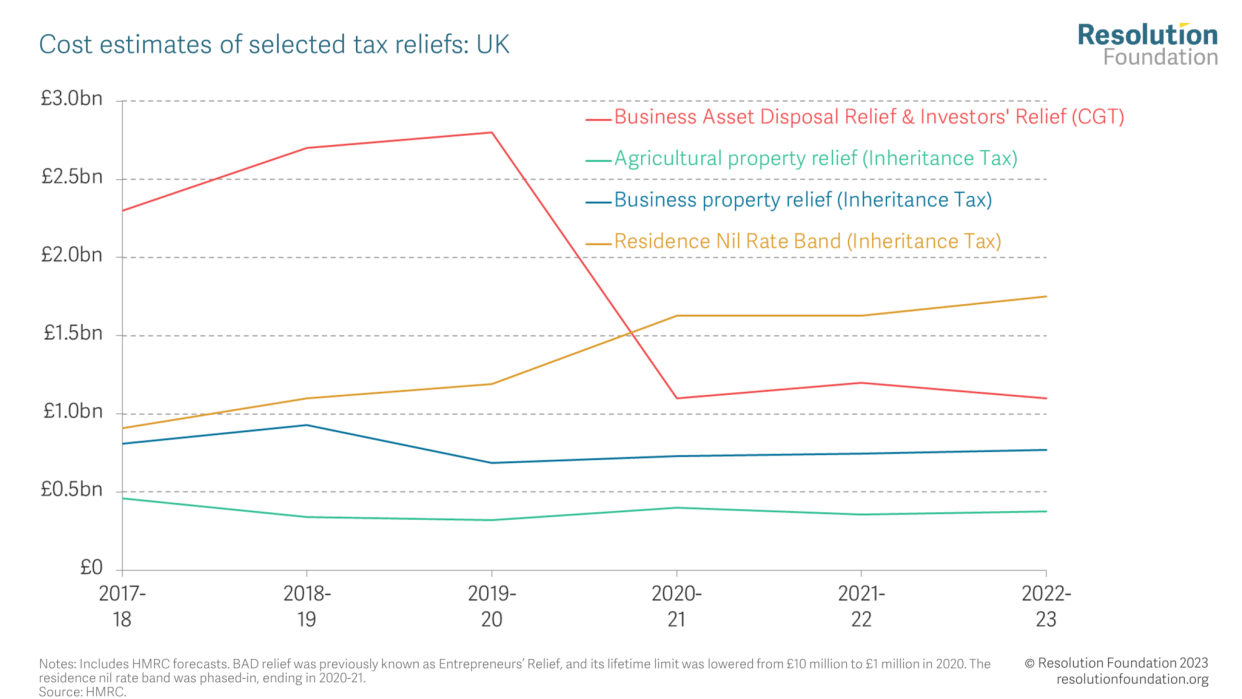

Tax breaks for 0.1% of Brits cost taxpayers £4bn a year

Five tax breaks which hand £4bn a year to 0.1% of the population have been branded "terrible" and "poorly justified" by experts.

According to new analysis of HMRC tax relief statistics by the Resolution Foundation, 70,000 individuals are claiming these tax breaks at a cost of £4bn a year to other taxpayers, gaining on average £50,000 each.

Read more: How much tax do we pay in the UK compared to other countries?

The specific taxes are: business asset disposal (BAD) relief; investors' relief in capital gains Tax (CGT); business relief; agricultural relief; and the residence nil-rate band in inheritance tax.

Adam Corlett, principal economist at the Resolution Foundation, said the "UK's myriad of tax reliefs" are "rarely scrutinised for their value for money".

He said: “Five terrible tax reliefs for capital gains tax and inheritance tax are being used by just 70,000 individuals, who stand to gain around £50,000 each, and are costing other taxpayers around £4 billion a year.

“There are far better ways for the government to spend £4 billion, and the chancellor should have these poorly justified tax breaks in his sights as he approaches a tax-reforming budget in March.”

According to the Resolution Foundation, the UK's 105 non-structural tax reliefs – meaning tax breaks designed to encourage particular activities or behaviours in order to achieve economic or social objectives – cost the Treasury £195bn in 2020/21.

The single biggest tax break – private residence relief on capital gains tax – cost £37bn.

Overall, the figure has increased by 18% (£30bn) compared to last year.

Read more: These are the taxes voters would most like to see rise

It comes after chancellor Jeremy Hunt in November admitted everybody in the UK would have to pay more tax.

“Well, we are all going to be paying a bit more tax, I’m afraid … but it is not just going to be bad news," Hunt told Sky News.

“I think what people recognise is that if you want to give people confidence about the future.

"You have to be honest about the present, and you have to have a plan - and this will be a plan to: help bring down inflation; help control high energy prices; and also get our way back towards growing healthily, which is what we need so much."

Watch: HMRC failing to collect £42bn in taxes - MPs say windfall could fix 'black hole' in UK's finances