UK’s strong recovery gives Rishi Sunak chance to tackle cost of living crisis

Better than expected public finances have given a way for chancellor Rishi Sunak to ease the pressure on UK households at his Spring Statement this Wednesday.

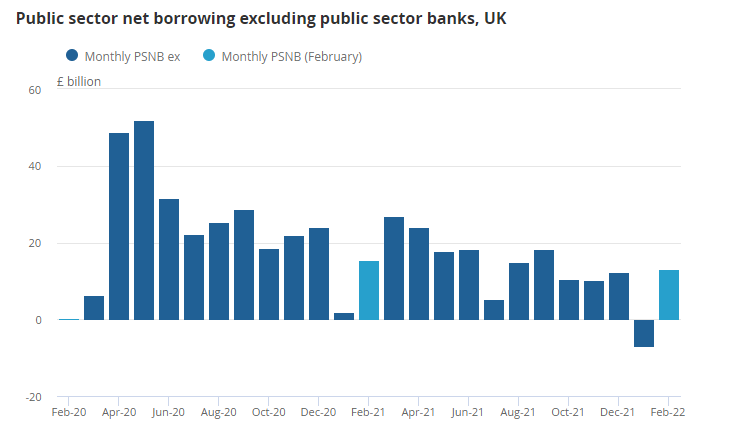

Figures from the Office of National Statistics show that the budget deficit the gap between spending and income – was running £26bn below official forecasts in the first 11 months of the fiscal year.

Borrowing was £138.4bn, 52% below the record £290.9bn from April 2020 to February 2021, when public finances took a pandemic-induced hit.

With March borrowing expected to be around £15bn, the total deficit for the year is now likely to be around £153bn, some £30bn lower than the OBR forecast from last October.

This windfall gives Sunak some extra headroom to tackle the UK’s deepening cost of living crisis during Wednesday’s spring statement.

Commenting on the figures, Sunak hinted again that he was getting ready to help families with the cost of living crunch.

“Look at our record, we have supported people – and our fiscal rules mean we have helped households while also investing in the economy for the longer term,” the chancellor said.

But he also urged caution as he pledged to restore order to public finances, after borrowing during the pandemic hit levels not seen since World War II.

“The ongoing uncertainty caused by global shocks means it’s more important than ever to take a responsible approach to the public finances.

“With inflation and interest rates still on the rise, it’s crucial that we don’t allow debt to spiral and burden future generations with further debt.”

In February the budget deficit came in at £13.1bn, the second-highest borrowing figure for that month since records began in 1993.

Read more: Can Rishi Sunak rescue the UK from a cost of living crisis?

James Smith, research director at the Resolution Foundation, said Treasury must use this opportunity to help families.

“The chancellor will approach the UK’s latest crisis – the tightest income squeeze in generations, exacerbated by the Russian invasion of Ukraine – with the public finances in better shape than expected, increasing the chance of significant policy action to support families through the tough year ahead,” Smith said.

“The chancellor should take this opportunity to provide emergency income support to families through this cost of living crisis, starting with a £9bn boost to working-age and pensioner benefits.”

Most economists, however, expect Sunak to offer relatively limited support now to hard-pressed households, in order to reduce government borrowing further after its COVID-19 surge and allow tax cuts nearer to a national election due by 2024.

Laith Khalaf, head of investment analysis at AJ Bell, said: “The chancellor is clearly under huge pressure to fork out to help out with the cost of living crisis, but record levels of borrowing, combined with rising interest rates, will probably temper his generosity.”

Shaun Moore, tax and financial planning expert at Quilter believes Rishi Sunak has two options to soften the blow of higher energy bills.

Read more: Sunak to have extra £6bn to help ease UK’s cost of living crisis

“One option would be to expand the previously announced energy support package. The measures already announced cover around half the increase in domestic energy costs, so if the Chancellor wanted to expand the scheme to offset half the £43bn increase in costs, it would cost an additional £12.5bn, on top of the £9bn already announced. This is extremely expensive, and actually might not target those households most in need. Instead, the chancellor may uprate benefits by an amount greater than the 3.1% currently pencilled in,” Moore said.

“The IFS estimates this would cost an additional £9bn for the exchequer. Moderately cheaper and more targeted, but middle-income households may feel they’ve been left out in the cold.

“A final option could be to look at VAT on energy supplies, including fuel. The IFS estimates that reducing VAT down to zero on domestic fuel would be £2.4bn, so a significantly cheaper option, but it would be very broad-brushed and not targeted. The Chancellor has already ruled out a reduction in VAT on energy bills for precisely that reason.

“No choice is easy, and no choice is cheap.”

Sunak is due to deliver his spring statement on Wednesday.