SoftBank leads investment in UK tech as London continues to attract capital flows from Asia

Asian and Middle Eastern venture capital investment in UK tech startups accelerating in 2020, with Japan's SoftBank (SFTBY) leading the way.

Tech startups received nearly twice the amount of Asian capital in the first six months of 2021 as they did during 2020, with Asian investment in the UK exceeding £1.7bn ($2.4bn) in 2021, compared with £1bn last year. This equates to 13.2% of total investments made in the the UK.

This year is on track to be an even better year than 2020 for investment flows from Asia to the UK, according to data from Dealroom.co for the Department of Digital, Culture, Media and Sport’s Digital Economy Council.

Other big Asian investors in the UK in 2020 included: Singapore's GIC and Temasek, Hong Kong's DST Global, and Chinese tech giant Tencent (TCEHY).

There are currently 577 UK startups with Asian investors, including unicorns with a multi-billion dollar valuation like Checkout.com and listed tech companies like Farfetch (FTCH), according to the report.

Other fast-growing UK tech firms backed by Asian investment include eToro, Deliveroo (ROO.L), Cazoo, and Arrival (ARVL). The three most attractive sectors for Eastern capital are fintech, software enterprise and health.

Asian investors took part in a record number of deals in the UK last year, totalling 106, according to figures from Dealroom.co. The total for 2021 has already reached 95. They were involved in 28 fintech deals in 2020 alone, as well as 18 software enterprise deals and 17 healthtech deals.

Venture capital (VC) investment in the UK has reached £12.3bn in the first half of 2021, compared with £10.8bn for the whole of 2020.

This strong flow of capital from East to West saw Europe become the fastest growing major region by VC investment, faster than the US, China and Asia. The continent has the most unicorn cities with 170 cities playing host to at least one billion-dollar firm.

"The UK tech sector is home to the most innovative, most exciting and most globally scalable startups in the world, so it’s no surprise Asian investors are recognising just what a wealth of talent we have here," said Matt Warman, minister for digital infrastructure.

Warman added: "It’s also a huge compliment to have a region that has been at the forefront of tech and innovation for decades to believe so strongly in what we’ve built here in the UK and to want to be a part of that."

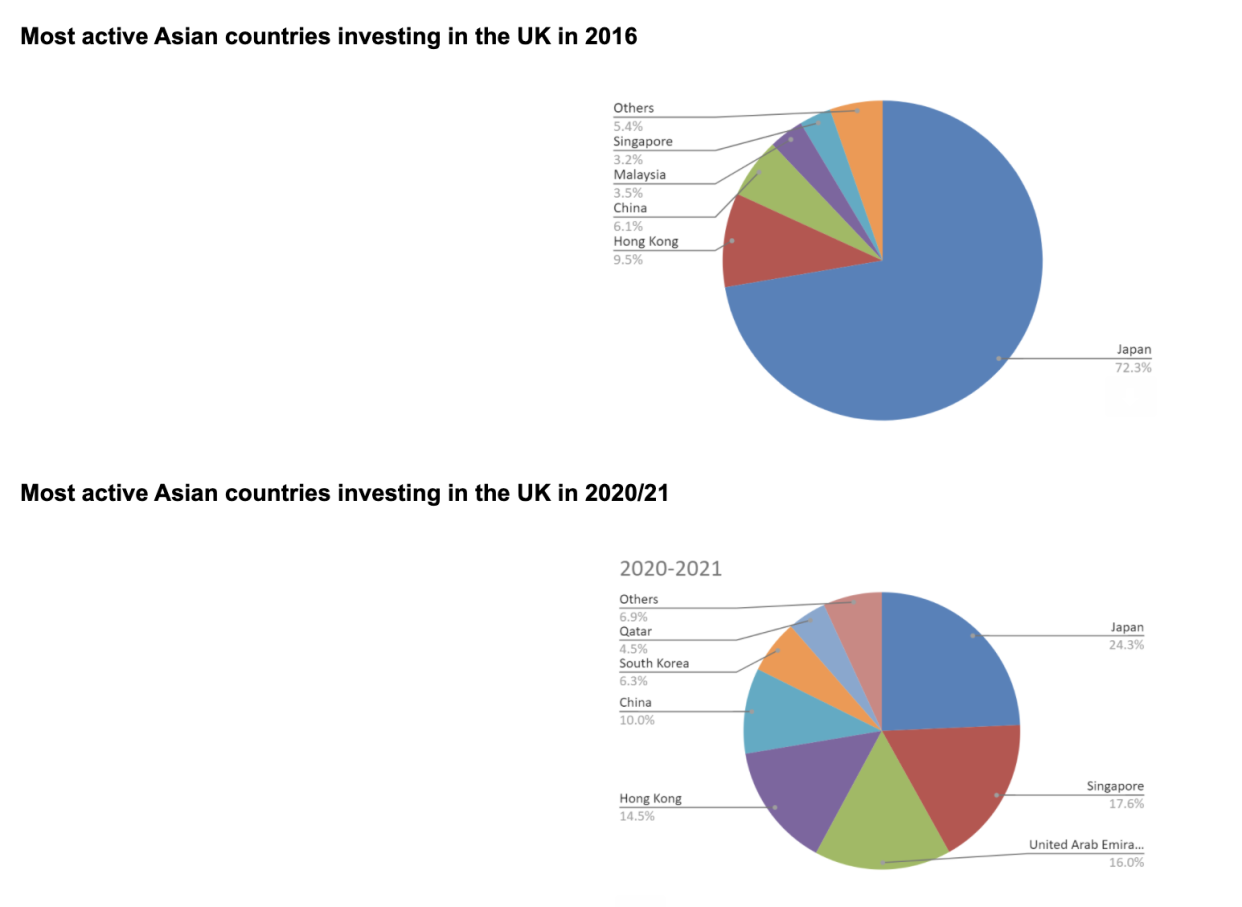

Investors from the Middle East, also included in Asian investment data, have stepped up their investment in the UK, challenging the dominance of Japan in particular.

Between 2016 and 2020, Japan’s investment in UK tech has shrunk from 72% to 24%, as other investors in the region have stepped up their backing for UK tech startups and scaleups.

Investors from this region include the Abu Dhabi Investment Authority, which invested in Cinch, and the Qatar Investment Authority, which were involved in UK mega rounds including Starling Bank and Tandem.

"The UK’s tech sector is thriving like never before and attracting the attention of forward-thinking Asian investors, in particular those long-term investors of sovereign wealth funds and pension funds," said Julia Hawkins, general partner at LocalGlobe. "If the benefits of the immense increase in value in tech are to be shared across UK society, our own long-term investors, pension funds and institutions need to wake up to the future economic power houses being built on their doorstep."

Read more: UK enjoys COVID recession wealth boom as savings rise by £200bn

The strong flow of investment is complemented by similar flows the other way, with leading UK-based venture capital firms increasingly investing in startups in Southeast Asia in particular.

In the last 18 months, VC firms headquartered in the UK invested £1.45bn in Asian startups. In 2020, the total was £720m over the course of the year — a figure that has already been reached in the first half of 2021.

This trend is led by the UK’s most active investors in Asian startups including Baillie Gifford, Eight Roads Ventures, Index Ventures (US-UK), RTP Global, and LightRock.

Watch: What are SPACs?