Shell to ditch dual listing structure and move from Netherlands to UK

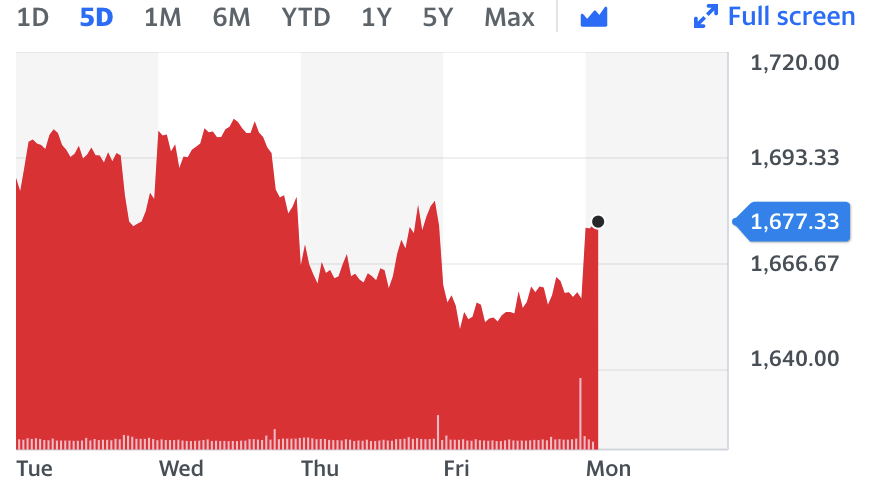

Shares in Royal Dutch Shell (RDSA.L) (RDSB.L) surged as much as 2.5% on Monday after it announced plans to scrap its dual listing structure and move its headquarters from the Netherlands to the UK.

The Anglo-Dutch energy firm will simplify its structure to a single class of shares to boost shareholders payouts, creating a larger single pool of ordinary shares that can be bought back by the company, it said.

It comes as a bid to “strengthen its competitiveness”, and less than a month after Wall Street activist Third Point revealed a stake in the company.

The investor, run by billionaire Dan Loeb, had previously called for the firm to split into multiple businesses to increase its market value and improve performance.

Shell, which has set targets to gradually shift from oil and gas to greener energy, said the changes would “increase the speed and flexibility of capital and portfolio actions”.

Read more: Why Shell is scrapping its dual listing structure

Sir Andrew Mackenzie, Shell's chairman, said: “The simplification is designed to strengthen Shell’s competitiveness and accelerate both shareholder distributions and the delivery of its strategy to become a net zero emissions business.

“The current complex share structure is subject to constraints and may not be sustainable in the long term.”

It added that its chief executive and chief financial officer would also be based in the UK, and that all meetings of executives and board members will happen in Britain as well.

Shell has been registered in the Netherlands for tax purposes since 2005 but its origins as a dual company date back to 1907 when Koninklijke Olie merged with Shell Transport and Trading.

Although still listed in London, Amsterdam, and New York, the oil giant plans to ditch “Royal Dutch” from its name. It will instead be shortened to Shell Plc.

The plans require at least 75% of votes from shareholders at a general meeting to be held on 10 December. If approved, the move would then take effect next year.

Read more: What is the metaverse and Web 3.0?

The UK’s business and energy secretary, Kwasi Kwarteng, praised Shell’s plan.

"Welcome news Shell is proposing to relocate its group HQ to the United Kingdom as part of their plans to accelerate the transition to clean energy," he said on Twitter.

"A clear vote of confidence in the British economy as we work to strengthen competitiveness, attract investment and create jobs."

However, the Dutch government said on Monday it was “unpleasantly surprised” by the announcement.

“We are in a dialogue with the management of Shell over the consequences of this plan for jobs, crucial investment decisions and sustainability,” economic affairs and climate minister Stef Blok said.

It follows a similar shake-up by consumer products giant Unilever (ULVR.L) last year which also ditched its dual Anglo-Dutch structure in favour of a single London-based entity. Unilever shareholders voted 99% in favour of plans.

Read more: European stock markets mixed as inflation and rising COVID cases weigh

Laura Hoy, equity analyst at Hargreaves Lansdown, said: "The long-term growth story for Shell still rests heavily on the oil price.

"For now, buoyant oil prices are keeping the group’s cash coffers topped up, which has had a positive impact on debt and given the group the means to boost shareholder returns. However, with the inevitable shift to more sustainable energy picking up steam we suspect the need to invest in greener operations will keep a lid on what the group can pass on to shareholders.”

Watch: Third Point buys stake in Shell