Oil prices climb as crude rally predicted for autumn

Oil prices rose on Monday, continuing a recent run of three weekly gains, as Goldman Sachs (GS) predicted a significant rally for crude this autumn.

The investment bank said that crude was likely to lead an upward movement in commodities due to a strong demand and growing scarcity of supply.

“We see oil as the catalyst this autumn to attract investors back,” Goldman said.

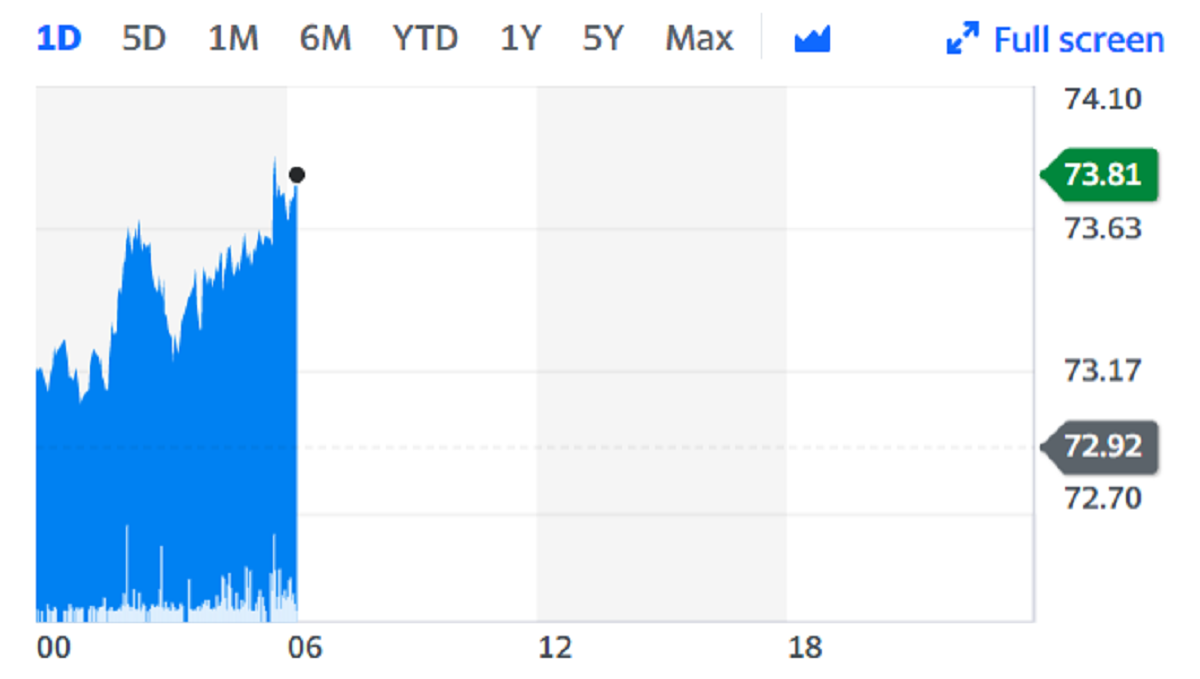

Brent crude oil (BZ=F), the global benchmark, was up 1.1% on Monday to $73.72 (£53.31) per barrel, while West Texas Intermediate (WTI) also added more than 1%.

Brent has been range bound between $70 and $74 per barrel in the last three weeks.

Last week, US Energy Information Administration (EIA) said in a report that it expects Brent prices to remain near current levels for the remainder of 2021, averaging $71 per barrel during the fourth quarter of 2021.

It comes after Hurricane Ida hit the US Gulf of Mexico and plugged around 1.1 million barrels of daily production.

According to the Bureau of Safety and Environmental Enforcement, almost half of crude output in the key producing region has yet to resume.

Goldman expects a peak demand impact of about 450,000 barrels per day from the hurricane, largely due to disruptions to downstream petrochemical plants in the Gulf of Mexico. These account for a large share of petrochemical capacity.

"On net, we believe the storm will have left the US short of around 30 million barrels of total oil, almost entirely in products due to the impact on refinery runs versus demand," Goldman said.

"While there is pessimism on the oil demand recovery due to the storm, reducing COVID infections, particularly in the US, could offset the fall in the coming weeks, with both higher US. margins and a tightening WTI-Brent differential."

Read more: IEA: Oil demand will exceed pre-COVID levels by end of 2022

It also comes as key economies such as China are dealing with another outbreak of coronavirus infections. This month it made an intervention in the global oil market, releasing crude from its strategic reserve for the first time with the explicit aim of lowering prices.

The Chinese stockpiling agency also said a “normalised” rotation of crude oil in the state reserves is “an important way for the reserves to play its role in balancing the market”, highlighting that it may continue to release barrels.

The agency added that putting national reserve crude oil on the market through open auctions “will better stabilise domestic market supply and demand”.

China said on Monday it will announce details of planned crude oil sales from strategic reserves in due course.

Stephen Brennock, an analyst at brokerage PVM Oil Associates, told Bloomberg: “The broader global oil-demand picture is showing signs of normalising on the back of rising mobility trends.

As OPEC+ is firmly in control of supply, and maintaining its cautious stance, the crude market should continue to tighten further in the year-end period.”