Luxury stocks rise as LVMH results signal strong demand

Luxury retailers received a boost on Wednesday after LVMH Moët Hennessy Louis Vuitton (MC.PA) revealed a rise in demand in its third quarter last night.

Sales at the French group’s fashion and leather goods division jumped 38% to €7.4bn (£6.3bn, $8.6bn) on an organic basis compared to the same period in 2019.

Its Louis Vuitton brand, which brings in the majority of profit, continued to see strong demand in the US and China, it said, with quarterly revenue across the business at €15.5bn. Analysts had expected revenues of €15bn.

The company, which owns brands including Dior, Givenchy, and Marc Jacobs, said it was “confident” the current momentum would continue even if the recovery from the pandemic is becoming less dramatic. Its luxury products also span Moët & Chandon champagne and Bulgari timepieces.

The world's biggest luxury firm added that there were no signs that a feared crackdown on the mega-rich in China, its second-biggest market, was affecting sales. However, overall revenue growth in Asia and the United States eased from their strong first-half.

In August, China’s president Xi Jinping called for "common prosperity" and wealth redistribution, causing investors to worry that Beijing might promote measures to reduce the country’s wealth gap.

Jacques Guiony, chief financial officer, said: “It’s difficult to analyse the potential impact but there is nothing alarming so far. The bulk of our customers in China are not billionaires but the affluent and upper middle classes.”

He added: “Our growth rate remains strong and we have almost completely erased the impact of the health crisis in under a year.”

Read more: European markets slump as UK economic growth falls short of forecasts

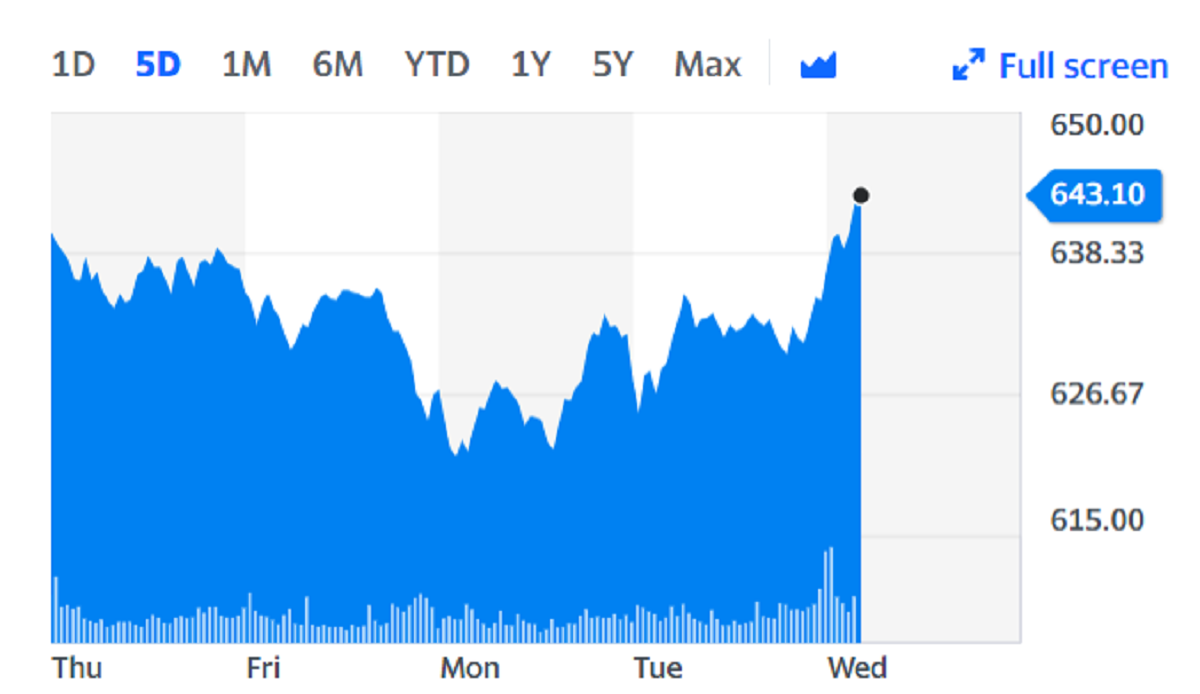

The news pushed shares in the company 1.5% higher in Paris while Gucci owner Kering (KER.PA) was up 0.3%, and Hermes (RMS.PA) saw a climb of more than 1.1%. Both Kering and Hermes will report third-quarter sales later this month.

"LVMH delivers another strong quarter," analysts at Jefferies said in a note. "While we remain cautious on the sector in the short term, we continue to view LVMH as the structural winner."

Meanwhile, Christopher Rossbach, manager of the World Stars Global Equity Fund, said: "We believe that market concerns about ‘common prosperity’ are misplaced. Its essence is a policy reset to reduce income inequality, address the income gap between rich and poor and form an ’olive-shaped’ social structure that has large share of middle class in the middle and a small number of people being very rich or very poor.

“LVMH, the leader in the luxury sector, offers an incredible breadth of products to offer and has price points to suit all budgets. We believe it is positioned for share gain and will emerge as a major beneficiary of the ‘Common Prosperity’ policy.”

Watch: What are SPACs?