Government borrowing hits second highest April on record

The level of Government borrowing fell in April as the easing of lockdown restrictions started to regenerate the UK economy, according to new data.

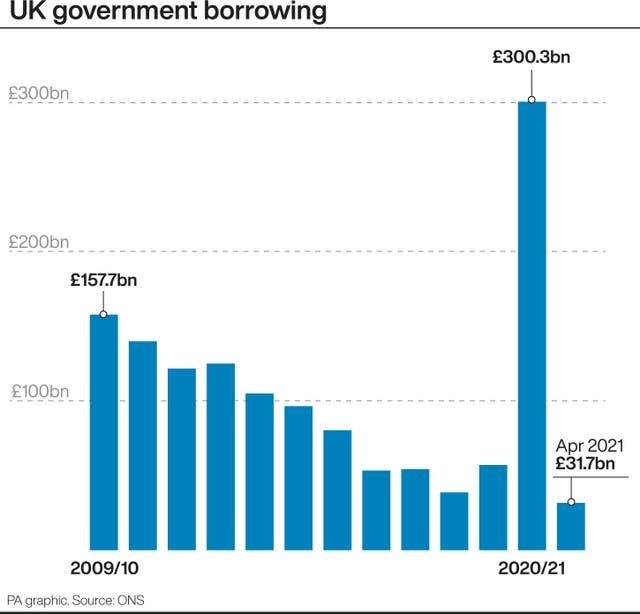

But levels of debt remain high, with the Office for National Statistics (ONS) revealing that borrowing hit £31.7 billion in April – the second highest April on record.

Public sector net borrowing was £15.6 billion less than the same month a year ago, with central Government receipts at £58 billion – up £3.8 billion on April 2020.

Central Government bodies spent £95.9 billion – down £12.9 billion on a year earlier.

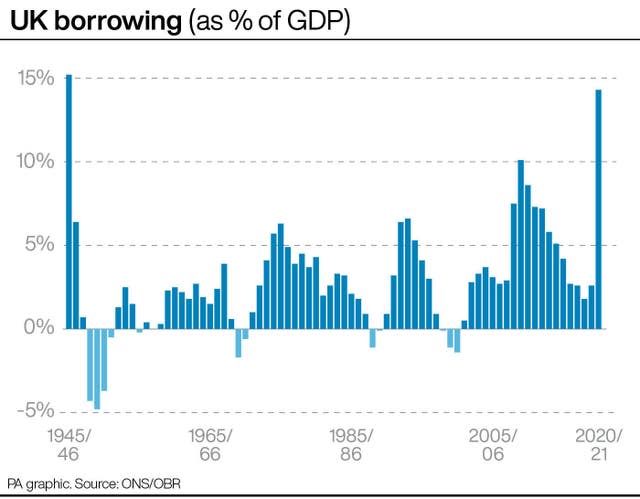

The ONS also revised down its estimates for last year’s total deficit, which hit levels not seen since the Second World War Two, from £303.1 billion to £300.3 billion – or 14.3% of gross domestic product (GDP).

This was £27.1 billion less than the Office for Budget Responsibility’s (OBR) most recent forecasts as the economy starts to recover following the vaccine rollout and lifting of Covid restrictions.

The amount of Government debt now sits at £2.17 trillion at the end of April 2021, or around 98.5% of GDP, the highest ratio since the 99.5% recorded in March 1962.

A large proportion of the additional spending by Government was generated from the various support schemes for businesses and workers during the Covid-19 pandemic – increasing day-to-day spending by £204.1 billion to £942.7 billion.

Tax and National Insurance contributions in the financial year to the end of March was down £32.7 billion to £670 billion, the ONS added.

Chancellor of the Exchequer Rishi Sunak said: “At the Budget, I set out the steps we are taking to keep the public finances on a sustainable footing by bringing debt under control over the medium term.

“But we also need to focus on driving a strong economy recovery from the pandemic. That is why the Government is continuing a comprehensive package of support to help businesses and workers get back on their feet – and the evidence shows that our Plan for Jobs is working.”

Isabel Stockton, research economist at the Institute for Fiscal Studies, pointed out that borrowing over the last 12 months is now falling rather than rising.

She added: “But at an estimated £32 billion, April’s borrowing was still £21 billion above – or almost three times bigger – than the £11 billion borrowed in April 2019.

“How quickly it comes down will be mainly driven by how swiftly, and how fully, the economy recovers as the lockdown eases.

“Growth prospects for 2021 have increased materially in recent months which, if realised, should deliver greater tax revenues in the current financial year.”