FTSE 100 Live: Miners rise, Barratt and Ocado fall, index ends day up, oil price dips back below $95

Blue-chip shares rebounded from an early fall today as oil prices eased, having approached $100 a barrel early this morning.

The overnight rise in Brent Crude futures came as supply concerns intensified following a big drop in US stockpiles, but prices fell in the mid-morning, sparking a recovery for the FTSE 100 which was down by as many as 70 points at one stage.

On the corporate front, William Hill owner 888 Holdings today joined Entain in warning over recent difficult trading conditions.

FTSE 100 Live Thursday

Oil prices near $100 a barrel

William Hill owner in profit warning

Poundland owner launches review

FTSE 100 ends the day ahead

16:36 , Daniel O'Boyle

The FTSE 100 ended the day at 7,601.85, up 0.1%, despite being down almost 1% at one stage this morning.

London’s top flight fell to 7525 at one point, but improved in the late morning before edging into positive territory soon before markets opened.

The biggest riser of the day was engineering firm Smiths Group, after a fall following its results earlier this week. Mining stocks and fashion house Burberry were also among those with big gains.

The Spectator’s profits slip ahead of sale

16:14 , Daniel O'Boyle

Profits at the Spectator slipped to £2.6 million in 2022, the weekly news magazine revealed today, as receivers aim to sell the publication after seizing it from the Barclay family.

The decline was mostly due to more money being spent on expansion in the US and Australia, as well as investment in fine arts magazine Apollo. Turnover edged up to £20.8 million and UK profits for the Spectator rose to £4.8 million.

Of that turnover figure, roughly 80% came from subscriptions or newsstand sales, while ads made up 10% and events 6%.

FTSE 100 recovers

15:57 , Daniel O'Boyle

The FTSE 100 is close to flat again a little over half an hour before markets close, having at one point been down almost 70 points for the day.

The index sunk as low as 7525, but has picked back up and is now down just one point at 7,591.

Big risers include miners Anglo American, Rio TInto and Antofagasta.

Ocado is again the biggest faller, with its shares having now lost 35% of their value in less than four weeks.

City Comment: The ‘good old days’ of City M&A weren’t really all that great

15:49 , Jonathan Prynn

When I first began reporting on the post Big Bang City in the late Eighties scarcely a day would pass without the button being pushed on another takeover, buyout or mega-merger.

Many were hostile and contested, leading to protracted and aggressive battles for control. The corporate finance teams were rarely without lucrative work. The living and the bonuses were good; the top dealmakers were the kings of the Square Mile.

That golden era of M&A reached its zenith in the years leading up to the financial crisis with RBS’s 2007 takeover of Dutch bank ABN Amro. That proved one of the catalysts for the crash that came the following year. Frankly things have never been the same since.

S&P flat as US market opens

14:56 , Simon Hunt

The S&P 500 index has stayed flat in the opening minutes of trade on Wall Street.

Here’s a look at your key market data:

John Lewis to seek £150 million from sale of 12 Waitrose stores

14:40 , Bloomberg

John Lewis Partnership Plc is planning to raise as much as £150 million from the sale and leaseback of a dozen Waitrose supermarkets as the struggling retailer seeks more capital, according to people familiar with the matter.

The marketing of the stores will begin next week and mostly includes supermarkets in the south of England with 20-year inflation-linked leases, said the people, asking not to be identified as the information isn’t yet public.

CBRE is acting as agent for the partnership, which owns the upmarket grocer and the John Lewis department store chain, they said, adding that there’s no certainty a deal will take place. Spokespeople for John Lewis and CBRE declined to comment.

US GDP grows by 2.1%, pandemic rebound revised upwards

13:55 , Daniel O'Boyle

US GDP rose by 2.1% in the second quarter, in line with expectations, according to the Bureau of Economic Analysis.

Richard Flynn, Managing Director at Charles Schwab UK, said: “Today’s figures show the economy has grown in line with expectations. While there have been noticeable economic declines in areas like housing and consumer goods, those pockets of weakness have been more than offset by resilience in services and the job market.

“However, job growth, a key pillar of U.S. economic resiliency, has been slowing rapidly lately. Looking at the three-month average of monthly job gains, the fall to 150,000 in August marked the lowest since the pandemic began in March 2020. A sustained decrease in payroll growth would raise recession fears and pose a risk to some economic sectors that have shown signs of stabilising. As is consistent with history, spreading labour market weakness would likely coincide with the same fate for the stock market.”

The US also revised a number of recent GDP readings upwards, as it became the latest country to have rebounded from the pandemic more strongly than first thought.

Phoenix Group shares slide

13:06 , Daniel O'Boyle

Pensions giant Phoenix Group saw its shares slide by 6.9% today despite reporting strong first-half financial results.

The business said that growth opportunities “are only being accelerated by the current challenging economic environment”, and reiterated its expectation that inflows to its active funds should exceed payouts from its legacy funds next year, for the first time in its history.

But shares were down in the first day of trading ex-dividend, after paying out 26p per share.

Diageo sticks by guidance despite cost pressures

12:13 , Daniel O'Boyle

The new boss of Guinness maker Diageo has said that cost pressures and the economic challenges are persisting, but stuck by the company’s guidance for the year.

In one of her first public statements for the company since her predecessor Sir Ivan Menezes died in June, Debra Crew said that the company is “well-positioned” to deliver 5-7% organic net sales growth between the 2023 and 2025 financial years.

She said the company was resilient and can navigate the headwinds caused by the economy.

HSS Hire sales slow ‘considerably’ as weak market conditions hit demand

11:50 , Daniel O'Boyle

Tool and equipment firm HSS said trading slowed considerably over the past 12 weeks as the company was knocked by weak market conditions.

HSS Hire Group shares dropped in early trading on Thursday as a result.

It came as the London-listed company revealed a dip in profits for the first half of 2023, while sales grew by 6.3%.

Average five-year fixed-rate mortgage falls back below 6%

11:19 , Daniel O'Boyle

The average five-year fixed-rate residential mortgage has dropped back below 6% today, in the latest sign of good news for homeowners and prospective buyers.

According to data from Moneyfacts, the average rate on a five-year deal fell to 5.99% today, from 6.03% on Wednesday.

The average two-year deal also declined, falling to 6.50% from 6.53%.

Mortgage lenders have been cutting rates for almost two months, after they peaked at 6.37% in early August, the highest rate in 15 years and beyond even the aftermath of last year’s mini-Budget.

IAG down 3% as FTSE 100 struggles, AB Dynamics rallies

10:30 , Graeme Evans

The FTSE 100 index came under fresh pressure today as worries that inflation will take longer to fall back to target levels were fuelled by higher oil prices. The top flight fell 57.85 points to 7535.37.

Stocks under pressure included British AIrways owner IAG, which dropped 3% or 4.55p to 144.1p, and BT Group after a decline of 2.75p to 114.5p.

Barratt Developments and M&G also tumbled 7% and 5% respectively as they began trading without the value of upcoming dividend awards.

A shortened risers board was led by Severn Trent, up 10p to 2320p as analysts at Barclays gave the water company an “overweight” recommendation and target of 3360p.

The FTSE 250 index retreated 107.75 points at 18,112.48, with big fallers including Royal Mail owner International Distribution Services down 7.6p to 255.8p.

On the risers board, defence engineering firm Babcock International surged 6% or 22.6p to 411p after it provided a reassuring update on its turnaround progress. The AGM statement highlighted improved cash flows compared with the previous year.

Top performing stocks on the AIM junior market included vehicle testing and simulation firm AB Dynamics, which lifted 28p to 1668p as it said better-than-expected trading left it on track for annual revenues above £100 million for the first time. Analysts at Liberum said the strong momentum justified a price target of 2700p.

Poundland owner launches review as Central and Eastern Europe arm struggles

10:11 , Daniel O'Boyle

Poundland owner Pepco said it will “refocus” on its struggling Central and Eastern Europe arm, as it reshuffled its management team following a second profit warning in two weeks.

The business said “record warm weather” in its core markets led to poor demand for clothes in countries like Poland and the Czech Republic, as sales declined year-on-year. It hasn’t yet benefited from a slowdown in inflation, as it’s still selling items that were bought earlier in the year at high costs.

The warning comes despite the Poundland arm of the business performing better, after record quarterly sales in the three months to 30 June.

Despite the strong performance in the UK, Pepco launched a strategy review, which will focus on getting the “core” Central and Eastern Europe business back on track. The group also reshuffled its management team, putting Poundland boss Barry Williams in charge of the Central and Eastern Europe-based Pepco brand instead, with the previous boss of that arm Anand Patel leaving with immediate effect.

Executive chair Andy Bond said: “We need to improve profitability and cash generation in our established business alongside a more targeted growth plan in markets where we have an existing presence.”

Earlier this month, Poundland expanded its UK estate when it agreed to buy 71 former Wilko shops. These stores will be rebranded as Poundlands.

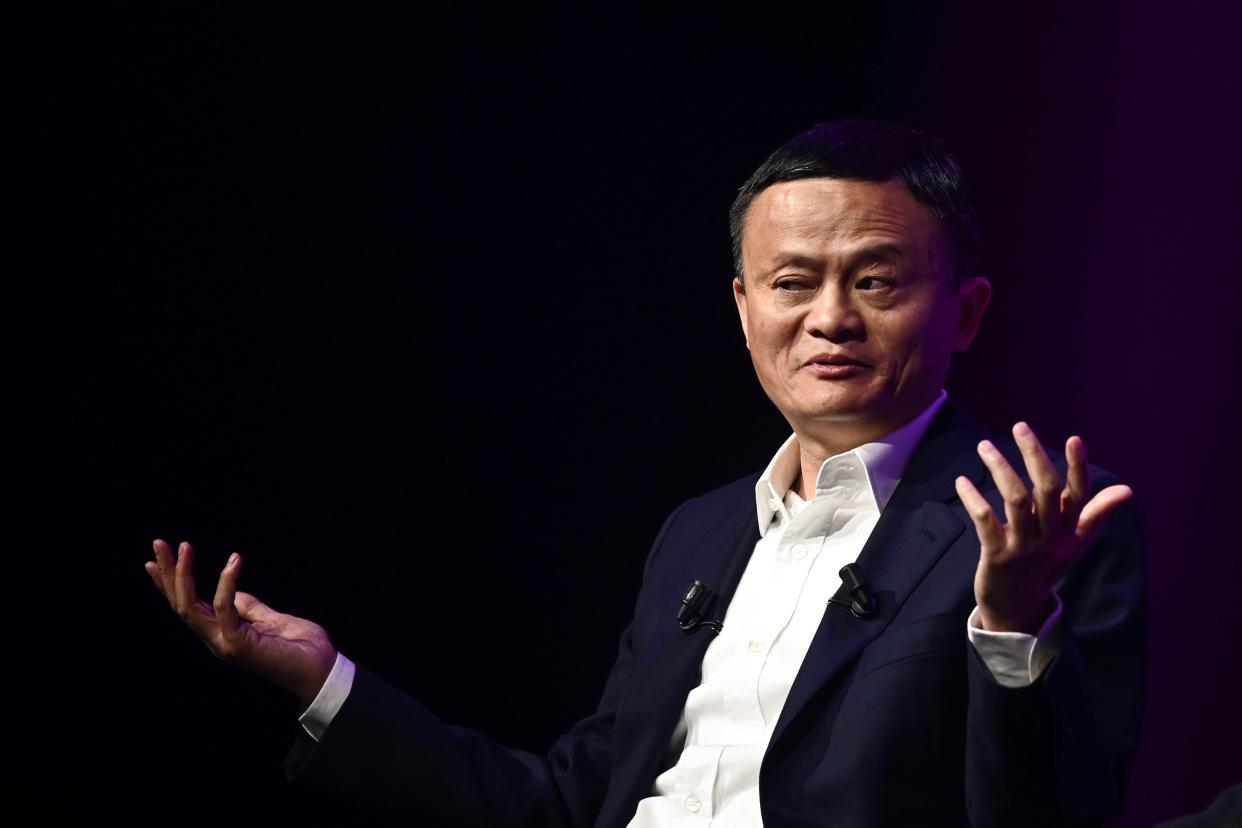

10:09 , Simon Hunt

Jack Ma-owned London fintech WorldFirst has shifted its Asia business away from UK oversight in a major restructuring, the firm’s accounts published today show.

WorldFirst Asia, a business unit which accounted for around two-thirds of the company’s revenues and 70% of its profits, has been transferred to an Asian subsidiary of billionaire Ma’s Ant Group. WorldFirst said it took the decision in January based on “the strategic alignment of the legal entities.”

In July, Ant Group was fined around £800 million by the Chinese financial regulator after it was accused of violating rules on corporate governance, financial consumer protection, payment and settlement business, as well as anti-money laundering obligations.

WorldFirst, which was acquired by Ant Group in 2019 in a deal thought to be worth more than $700 million (£550 million), last year began an internal overhaul dubbed the ‘Global Base Line’ project, in which a string of management, risk, and oversight functions at the firm were moved from the UK to China.

Apple’s ex-design chief seeks $1 billion to build iPhone rival

08:52 , Simon Hunt

Apple’s former head of design is in talks to raise $1 billion dollars to take on its iPhone with an AI-powered rival.

London-born Jony Ive, whose work was instrumental to the design of a suite of Apple products including the iPod, iPhone and MacBook, is seeking to raise the funds from Japanese investing giant SoftBank in a partnership with ChatGPT maker OpenAI, according the FT.

Ive and OpenAI boss Sam Altman are exploring what an AI-powered consumer device would look like, including how to make the user experience more intuitive than the iPhone.

Ive left apple in 2019 after a near 30-year career there.

Oil stocks support FTSE 100, Babcock shares surge 10%

08:40 , Graeme Evans

The FTSE 100 index is broadly unchanged this morning after shares in oil majors BP and Shell rose by around 1% on the back of last night’s latest surge in Brent Crude futures.

Severn Trent is the best performing blue-chip company, up 38p to 2348p as analysts at Barclays gave the water company an “overweight” recommendation and target of 3360p.

At the top of the FTSE 100 fallers board, Barratt Developments and M&G are down by 5% and 3% respectively as they are now trading without the value of upcoming dividend awards.

The FTSE 250 index is 18.83 points lower at 18,201.40, with shares in WIlliam Hill owner 888 Holdings down 12% or 12.85p to 97.65p after today’s profit warning.

On the risers board, defence business Babcock International is up by 10% or 39p to 427.4p following a reassuring update on its turnaround progress.

And pubs group Mitchells & Butlers is 5.4p higher at 220p after forecasting results at the top end of expectations as cost pressures abate.

Brent crude up 0.75%

08:27 , Simon Hunt

A few minutes into the day’s trading session in London, the FTSE 100 is flat while brent crude is up 0.75%. Here’s a look at your key market data:

Oil prices near $100 a barrel, Asia markets struggle

07:21 , Graeme Evans

Brent Crude futures today stood at $97.53, the oil benchmark’s highest level since last November after figures yesterday showed a big drop in US stockpiles.

The bigger-than-expected fall of 2.2 million million barrels has added to supply concerns after Saudi Arabia extended its voluntary output cut through to the end of the year.

The recent climb in oil prices has fuelled worries that inflation will take longer to fall back to target levels, forcing central banks to keep interest rates high for longer.

The S&P 500 index is at a three-month low after a 4% decline in the past week but steadied last night. The FTSE 100 index, which fell by 0.4% last yesterday, is forecast by CMC Markets to open 17 points higher at 7610 as traders carry out quarter-end positioning.

In Asia, Tokyo’s Nikkei 225 and the Hang Seng are both down by more than 1% as the Hong Kong-based benchmark heads for its lowest close of the year.

The selling came as it emerged that shares in China’s debt-laden property giant Evergrande have been suspended.

888 warns on profits days after rival Entain

07:17 , Daniel O'Boyle

William Hill owner 888 has become the second gambling giant in four days to warn investors of the impact of factors including new UK safer gambling rules.

The business issued a profit warning today, revealing it now expects revenue to decline by a larger-than-thought 10% and margins to come in lower than expected at 10%.

Like Entain earlier in the week, 888 blamed bettor-friendly sporting results and the safer gambling reforms that the Government announced in April. 888 also noted an “ongoing significant impact from compliance changes implemented in dotcom markets”, where the legal status of online gambling is often ill-defined. 888 made major changes to its policies in these countries after launching an internal probe in January into the checks it performed on Middle Eastern high rollers.

Executive chair Lord Mendelsohn said: “We are making significant strides to improve the quality and long-term sustainability of our revenues, but performance in Q3 has been below our expectations, and this means we now expect to end the year with EBITDA below our prior expectation.”

888 shares closed at 109.9p yesterday, up 24.9% for the year but down 80% from their peak in 2021. They are down 8.2% over the last week, mostly due to read-across from the Entain revenue warning.

Recap: Yesterday’s top stories

Wednesday 27 September 2023 22:35 , Simon Hunt

Good morning. Here’s a summary of our top headlines from yesterday:

Dramatic sterling slide continues as US economy data runs hot

H&M Autumn ranges sales hit across Europe by September heatwave with revenue down 10%

Land Securities says its London office portfolio is now 96.9% let

Saga profits halved as motor insurance arm hit by higher claims - but cruise division bounces back

Pendragon mulls three takeover offers as first half profits rise 10%

Flutter buys Serbian sport betting company for £121 million

Shepherd Neame sees big recovery in sales in pubs within M25 - but inflation concerns remain

Chapel Down in line for record harvest as first half sales and profits surge