End of stamp duty holiday hits UK mortgage approvals

Bank of England (BoE) data released on Tuesday morning showed that UK mortgage approvals fell 6.4% in July, down to 75,200 from 80,300 in June as the end of the stamp duty holiday set in.

Approvals for house purchases, an indicator of future borrowing, hit the the lowest levels since July 2020, but remained above pre-February 2020 levels. Economists had expected approvals of around 79,000 for July.

Despite this reduction, they were still 16% ahead of the 10-year average.

"It seems there was no 'cliff edge' to the first stamp duty holiday reduction, and if mortgage approvals were to continue to drift slowly back to their pre-pandemic levels most would view that as a good result," said Anthony Codling, CEO of Twindig.

"The Stamp Duty holiday still has one month left to run, and will end during the important autumn selling season, but so far the giant cliff for the housing market looks like one small step for homebuyers..."

Others put the trough in borrowing down to the summer period, which is usually quieter due to the school holidays and the dip in available housing stock following a rush to market.

Last week, housing website Zoopla said that there is an “acute” shortage of homes available for sale, with the market facing its greatest shortage since the property listing portal’s records began in 2015.

Read more: Acute’ shortage of UK homes expected to run until 2022

This comes as the average price of a house went up by 7.6% over the last 12 months. Buyer demand remains strong, up 20.5% in July compared to the 2020 average.

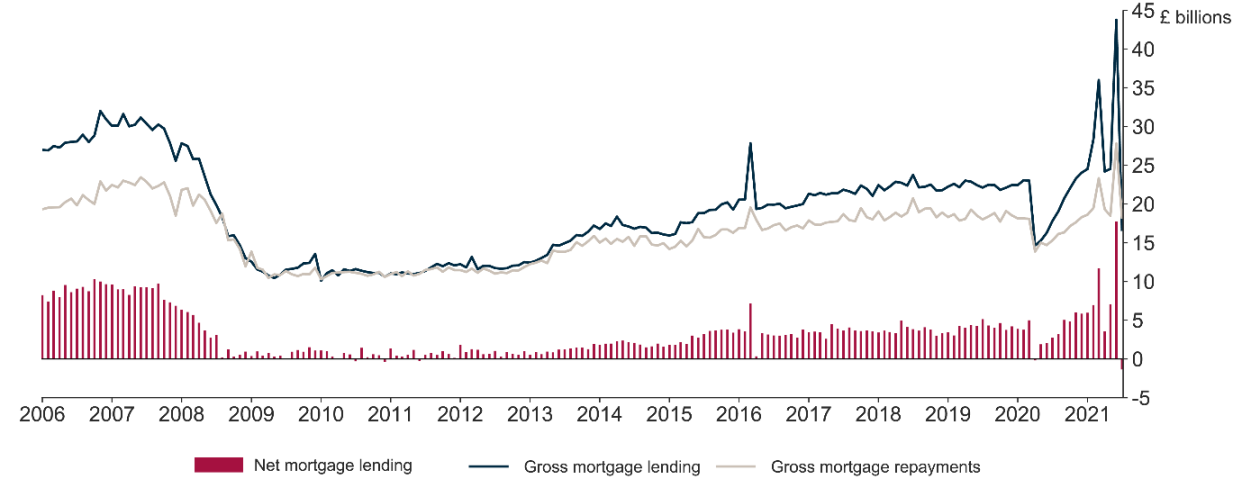

The data also showed that individuals repaid £1.4bn ($1.9bn) in mortgage debt on net in July, following record net borrowing in June of £17.7bn. Net repayments are relatively rare, with only one other repayment (in April 2020) in the past decade, according to the BoE.

Elsewhere in borrowing, the BoE said consumers did not borrow additional consumer credit, on net. The effective rate on new personal loans remained low at 5.85%, but was the highest since March 2020.

Households’ net flow in to deposit accounts decreased in July, to £7.1bn. Deposit interest rates continued to fall slightly, to new historically low levels.

Watch: How much money do I need to buy a house?