Electric cars could sink Tesla – not even Elon can stop it

There is a long-running debate about whether Tesla is a car or a technology company. For a while this was largely an academic question related to future potential and therefore valuation. But now Elon Musk’s baby has reached a crunch point and the search for an answer has become existential.

There are no prizes for guessing which side Musk comes down on. “If you value Tesla just as an auto company, you fundamentally have the wrong framework,” he said last week. “If someone doesn’t believe Tesla is going to solve autonomy, they should not be an investor in the company.”

Up until recently, most investors appeared to agree with him. When Tesla’s share price peaked in 2021 it was briefly trading on multiples that suggested it would eventually be churning out more cars than Toyota and earning higher profit margins than Ferrari. That was clearly nonsensical for a company that just made cars.

Reality has started to bite. Before Monday’s bounce – based on the news that Tesla had struck a data-sharing agreement with Chinese firm Baidu – Tesla’s share price had fallen 59pc from its 2021 high and 42pc this year alone. Last week, Tesla revealed pretty dire first quarter results including its first year-over-year quarterly sales decline in nearly four years.

What’s changed? In a word: competition.

For much of its history, Tesla was the only decent electric car marker in the world. Now traditional manufacturers have significantly upped their game, especially in producing hybrids. An even bigger threat has emerged in the form of Chinese brands whose battery technology and manufacturing techniques enable them to churn out seriously good cars at knock-down prices.

This presents Musk with an enormous dilemma. Should Tesla invest billions of dollars overhauling its own factories so that it can go toe-to-toe with the Chinese upstarts on price? Or should it double-down on its driverless technology and once again become the only real player in a new market?

If that decision wasn’t already hard enough, there’s an added complication: it’s not an either/or situation. Tesla needs to sell an awful lot of cars in order to generate the money it needs to pay for the huge numbers of expensive chips necessary to develop the full self-driving technology it’s working on. Last week’s results revealed the company suffered its first cash outflow since the start of the pandemic.

To make matters worse, the anemometer has swung around and the tail winds at Tesla’s back have become headwinds. Enthusiasm for EVs appears to be waning as doubts grow about governments building the necessary infrastructure, higher interest rates in the US are making car finance more expensive and Musk’s penchant for picking political fights is alienating some prospective buyers.

The entrepreneur has also been far from clear about how he plans to steer Tesla from Plan A to Plan B. Towards the end of last year he announced plans to overhaul factories in Mexico and Texas so they could produce a new lower-cost “Model 2”.

But rumours have started to circulate in recent weeks that the entrepreneur has cooled on this idea and is instead planning a budget version of the Model 3 built on existing production lines while throwing the bulk of Tesla’s resources into developing a self-driving “robotaxi”. When asked about this strategic switcheroo last week, Musk grew characteristically tetchy and evasive.

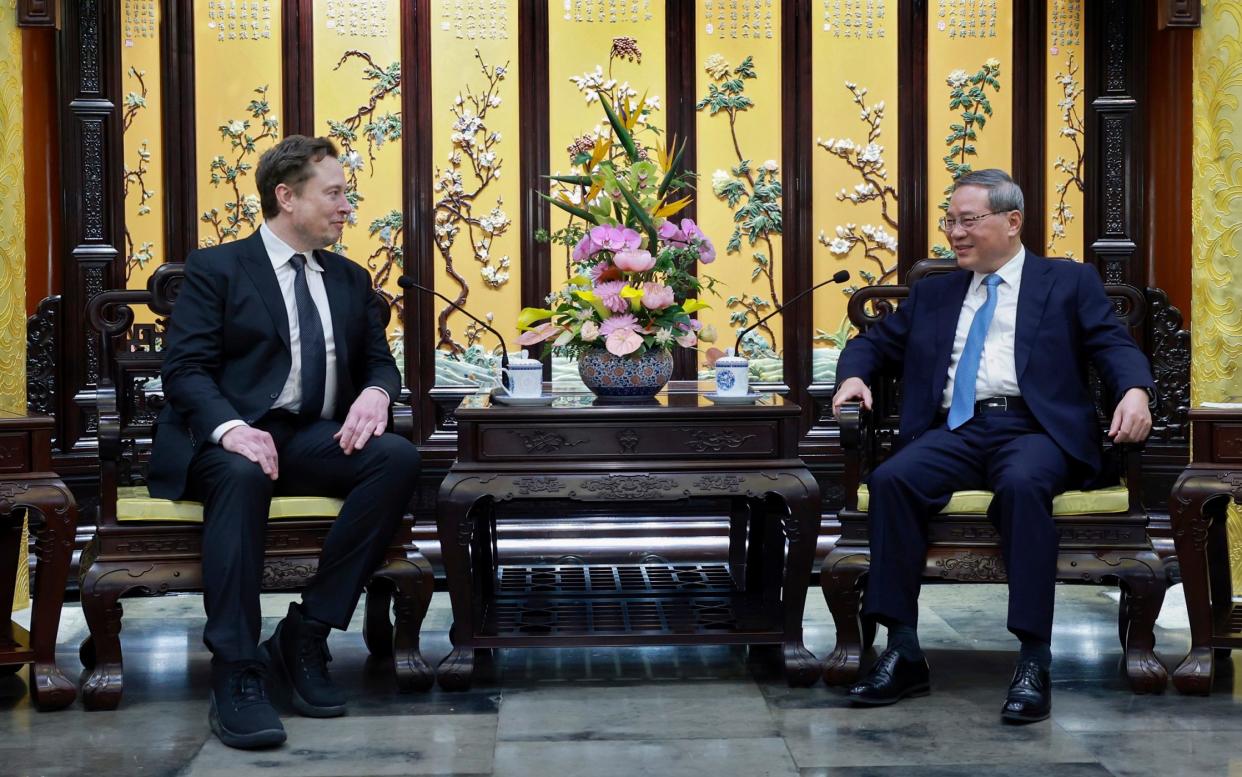

This is the backdrop to a surprise trip to China on Monday, during which Musk met the country’s political number two, Premier Li Qiang, and unveiled a tie-up with search giant Baidu to develop mapping and navigation technology.

Such deals are driven by regulatory necessity: foreign players wanting to sell smart cars in China have to team up with local suppliers of mapping and navigation systems. It is also a stepping stone to Tesla rolling out its “full self-driving” system – which controls the car but is not fully autonomous – in the world’s largest EV market.

Nevertheless, there are big question marks over the tactical and strategic rationale for such tie ups. For starters, will they work? International carmakers struggle to compete with the likes of BYD on price. They are therefore hoping to gain a share of the most important electric car market in the world by packing their cars full of superior gizmos.

But given their cars can be somewhere between three and five times more expensive than BYD’s cheapest model, the tech will have to be incredibly impressive. Among the gadgetry displayed at the Beijing Auto Show last week were seamless connectivity with smartphones, assisted driving systems and in-car entertainment functions. These all sound like added-extras rather than game-changers.

Then there’s the fact that so many car companies are entering into these partnerships. Volkswagen has a long track record of striking deals with Chinese technology companies. Last week, Toyota unveiled a new partnership with WeChat-owner Tencent. Nissan is, like Tesla, teaming up with Baidu.

Given all this, isn’t there a danger that Musk’s outfit, which currently has roughly 7pc of the Chinese EV market, risks being swamped by the general influx? And how savvy is it for a company that bills itself as a tech company rather than a car company to team up with a tech company to help build the tech for its cars?

Lastly, there’s the question of whether today’s partners might become tomorrow’s competitors. There’s a long history of foreign companies forming partnerships or joint ventures with domestic firms in order to gain access to the vast Chinese market only to be unceremoniously ditched after a few years.

One thing’s for sure: Musk needs his latest China gambit to pay off. If not, Tesla’s growing list of problems as a metal-bashing carmaker today may destroy its chances of building a driverless tomorrow.