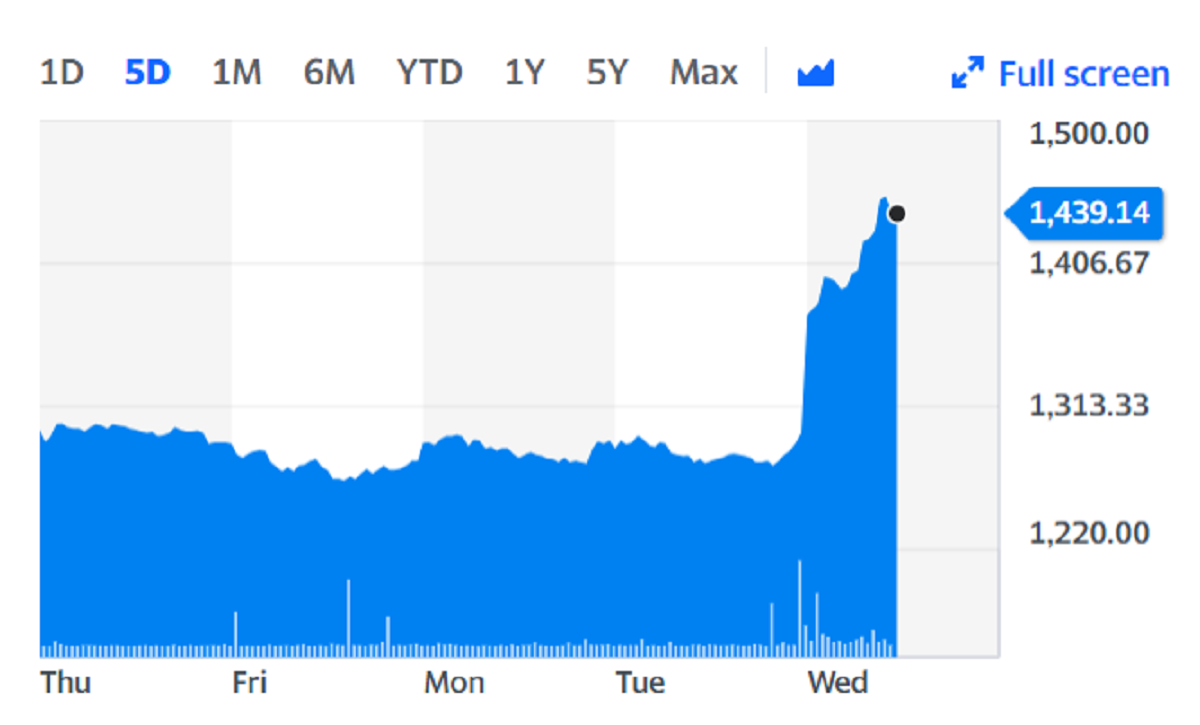

Dunelm shares surge 13% amid strong online sales

Shares in home furnishings group Dunelm (DNLM.L) climbed as much as 13% on Wednesday after it overcame the ongoing supply chain disruption to post strong online sales.

The company said total sales were up 26% in the year to 26 June, despite stores being closed for months during the coronavirus pandemic.

Pre-tax profits came in at £157.8m ($217.4m), a 45% rise, with online sales more than doubling at 115%.

The company made a major expansion to its Click and Collect offerings in order to be able to keep up with digital demand as people stayed at home to stop the spread of COVID-19 and turned to online shopping.

Dunelm also revealed that it would pay shareholders a special dividend of 65p per share, on top of a final dividend of 23p, after its payout was cut last year.

Read more: Halfords bike sales hit by supply chain disruption

It said it had encouraging sales growth in the first 10 weeks of the new financial year, despite the supply chain disruptions that has affected a string of companies, including Halfords (HFD.L), bakery chain Greggs (GRG.L), chicken restaurant Nando’s, and Wetherspoons (JDW.L).

Nick Wilkinson, chief executive of Dunelm, said: “Whilst the macro-outlook remains uncertain and we are seeing some industry-wide issues such as ongoing supply chain disruption and inflationary pressures from raw materials, freight costs and driver shortages, we feel well placed to continue managing these challenges.”

He added: “The digital investments we had made enabled us to rapidly adapt to the changing environment and deliver strong growth and an improved customer experience. We are emerging from the pandemic as a stronger and better business, having transitioned from being a physical retailer with digital aspirations to being a proven, digital first, multichannel retailer.”

The company increased its market share in the UK by 1.6 percentage points to 9.1%, with active customer growth of 8.5%.The majority of this growth occurred across digital channels.

“Dunelm has posted a strong set of results which should be music to investors ears, especially with a special dividend on offer to make up for no payout in 2020. But a warning around supply constraints may keep investors slightly more nervous than that,” Adam Vettese, analyst at multi-asset investment platform eToro, said.

Read more: UK service sector growth slows amid staff shortages and supply chain disruption

“But investors in the firm may be most happy with reinstatement of the dividend, plus the special dividend it is offering, rewarding those who have stuck with its shares during the darkest days of 2020.”

It comes as Halfords warned on Wednesday that supply chain issues may continue to affect the business for some time.

Like-for-like cycling sales at the firm were sharply lower than last year, down 23% for the 20-week period to 20 August. Halfords admitted it had struggled with low availability of some of its bikes.

Watch: Supply chain disruptions, wage growth are key factors for inflation outlook: strategist