‘I doubled my pension to £745,000 after being sacked – can I retire at 60?’

Would you like Victoria to rate your portfolio? Email money@telegraph.co.uk with the subject line: “Rate my portfolio”. Please include a breakdown of your portfolio, your age and what your investing goals are. Full names will not be published.

Dear Victoria,

I’m 50 years old and have various pensions worth approximately £650,000 – I have £416,000 in a Hargreaves Lansdown self-invested personal pension (Sipp), £150,000 in a British Airways “AVC” fund and £30,000 in an Aviva Sipp.

I have an additional £50,000 built up in a local government scheme run by Prudential.

I plan to retire at 60 years old and I’m hoping to be on a pension of £50,000 per year plus full state pension on top. Is this realistic and achievable on my current pensions and taking into account inflation and future growth rates?

I worked for British Airways (BA) for 20 years, lost my job during Covid and transferred out my final salary pension at a value of £357,000, as I was confident I could grow the value and Covid created a once-in-a-lifetime opportunity to get into stocks at a lower value.

My BA pension was forecast to pay around £15,000 a year at age 65 had I not sold out of my final salary pension. I did however leave my BA additional voluntary contributions invested in the BA scheme, which were very well managed through their three main funds.

During Covid, I had managed to trade and grow the £350,000 in my Hargreaves account to £745,000 and unfortunately made some bad decisions chasing Covid stocks that dropped a lot.

I’ve now slimmed down my portfolio and my holdings are largely in airlines, an industry I know very well, with my aim to at least double my value. I’m prepared to take the risk to grow these as I have a local government pension building up since I joined in November 2020 and plan to stay with them until I’m 60 years old.

My aim once I have doubled my value in my Sipps is to diversify into a number of trusts and possibly hold a balanced portfolio of approximately 15 to 20 trusts and individual shares in total, which should derisk my holding.

I was fortunate enough to get a job quickly, after five weeks, with a local government authority. I earn around £57,000 a year, am a member of the career average defined benefit Local Government Pension Scheme (LGPS) with a 1/49th accrual rate and I’m paying 30pc of my salary in additional voluntary contributions.

There is currently £50,000 and I plan to grow it to £100,000. I also plan to buy additional pension contributions, within the LGPS.

I plan to keep the local authority pension for day-to-day expenses and general living and then use either some of my Hargreaves Sipp for drawdown to pay down and pay off my mortgage of around £480,000.

I’m currently showing 31 years’ contributions for the full state pension so expect to receive the maximum state pension.

As an avid reader of your columns, I welcome your expert advice.

Kind regards,

DT

Victoria says:

Dear DT,

It is great to see you’ve got a very healthy pension pot worth approximately £650,000 and it is impressive you’re able to contribute a hefty 30pc of your salary towards your retirement each month with the aim of giving up work in 10 years.

However, I am less convinced by your risk calculations and the make-up of your portfolio.

But before we dig into that, I want to address your question about whether it is realistic and achievable to secure a pension pot worth £50,000 with a state pension on top.

There are a lot of variables to consider, and a lot could be written on each. But given the limited space, I’ll try to briefly summarise the main points.

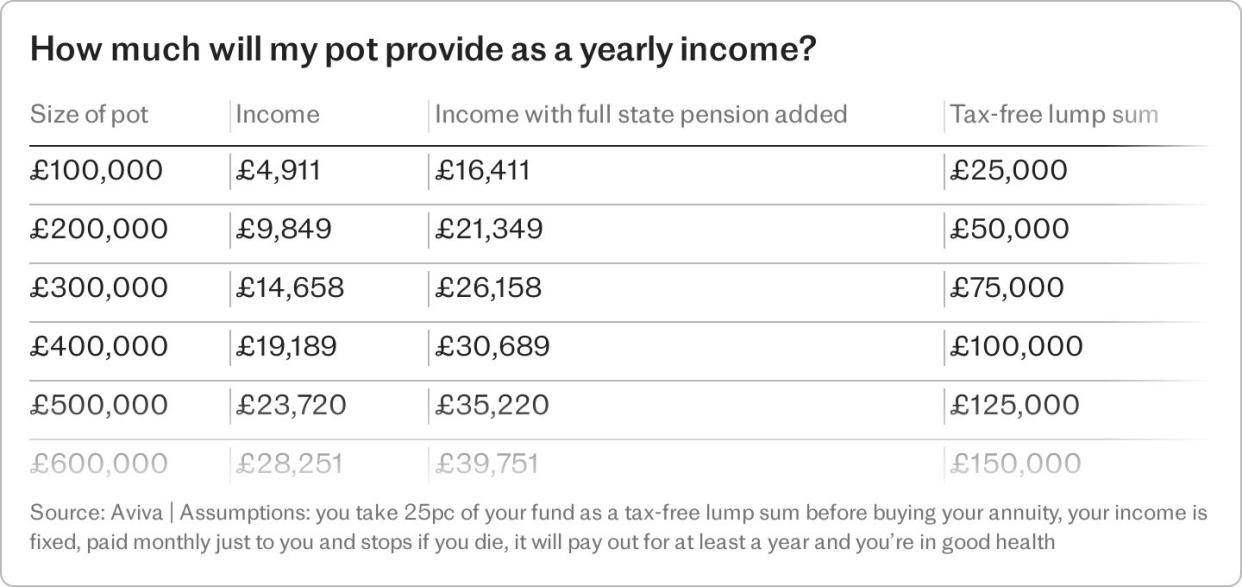

Using a conservative annual compound interest rate of 5pc, realistically you could grow your £650,000 to just over £1m in 10 years’ time. At age 60, you’ll have to think about funding your life privately by plugging the seven-year gap before your state pension kicks in at age 67.

Then in terms of paying off your £480,000 mortgage, remember only the first 25pc of your pension is tax-free so it is probably worth overpaying your mortgage by drip-feeding over time rather than paying it off in one big lump sum which would land you with a bigger tax bill.

The other thing to keep in mind is inflation which will, depending on the rate, to a greater or lesser extent, erode the value of your money each year, so your pension pot of just over £1m could be worth considerably less in real terms by 2035.

I appreciate there’s a lot to take in here, and I am not a pensions expert nor a tax expert. Therefore, I would recommend speaking to a specialist retirement financial adviser to get some more in-depth answers to your question. But hopefully this provides a starting point to help steer you in the right direction.

On to your portfolio, while there’s a chance you could achieve your goal to double the size of your pension pots this decade, there’s also a significant chance your portfolio could shrink, which would scupper your retirement plans, something we’d both hate to see.

You already found out about the perils of a high-risk strategy the hard way since your pension value initially doubled, but now it has fallen back and is not far off where it started.

It is no secret that stock markets can go down as well as up – AG, your biggest holding, is a prime example. British Airways’ parent company is down by almost 50pc over the past five years and there’s no way to guarantee that another “black swan” event like the pandemic won’t strike again.

So, I’d suggest making some considerable changes to your portfolio with diversification placed at the very heart and a renewed focus on risk management.

Even though you clearly understand the airline industry very well thanks to your career, having 80pc of your Sipp in three airline stocks is far too risky both in terms of the low number of holdings and your very heavy concentration in a single sector. Your longer-term plan to hold several trusts in a balanced portfolio sounds much more reasonable.

Think about moving away from a portfolio made up of a handful of single stocks, and towards adopting the “core-satellite” approach instead.

As I’ve written before, this means focusing on a pool of globally diversified funds as your “core” holdings, making up the majority of your portfolio that allow you to own the market. Then if you’d like to add a sprinkling of riskier ideas such as airline stocks you can do so with a much smaller “satellite” allocation around the edges.

For a core holding, I like Alliance Trust, which uses a multi manager approach to give 10 active fund managers 20 stocks to pick for the portfolio. Normally fund managers charge a lot for the privilege of investing with them, and some are even shut to retail investors, but Alliance Trust – ticker ATST – does it for just 0.62pc.

You could balance that out by adding a fund with a more “value” investment style to ensure you aren’t too concentrated in yesterday’s winners. Dodge & Cox Worldwide Global Stock fund is a good option here – its top stocks include European heavyweights GSK, Barclays, and Sanofi.

A trust which looks interesting currently is Impax Environmental Markets, which trades on an 11.5pc discount. It buys generally small- and mid-sized companies from around the world that make a contribution to sustainable living.

But the approach has been out of favour, largely due to rising interest rates, so a change in the economic backdrop could be a catalyst for a share price recovery.

Think about diversifying beyond just equities into bonds, too. UK government bonds or gilts have been attracting a lot of cash on the Interactive Investor platform, with one gilt – TN25 – attracting more cash than any other investments for the last 10 months owing to the high yields and tax breaks on offer.

Take a look at Royal London Corporate Bond, Vanguard Global Bond Index Hedged and M&G Global Macro Bond as a nice starting point.

Unfortunately, I haven’t got time to go through 20 trust ideas, so I think it’s useful to give you a framework to go out and do your own research. Aside from airlines, the Indian stock market has been getting a lot of attention lately and could be worth adding to your satellite pool. Popular funds worth investigating here include India Capital Growth and JP Morgan Indian.

Good luck on your investment journey as you head towards your well-deserved retirement years.

Victoria is head of investment at Interactive Investor. Her columns should not be taken as advice or as a personal recommendation, but as a starting point for readers to undertake their own further research.