DFS swings to record profit despite supply chain disruption

Furniture retailer DFS (DFS.L) swung back into profit in the year to the end of June, with its pre-tax figure at £99.2m ($135m), up from a loss of £81.2m the year before.

This was 55% higher than its profit before the pandemic in 2019, as more people spruced up their homes in the last year after being forced to stay in to stop the spread of coronavirus.

The company reported a 47% rise in sales to £1.1bn over the period, up from £725m a year ago, driven by market share gains, pent-up demand from national lockdowns, and the shift in consumer spending to the home.

Its new financial year has also started with “strong trading momentum” thanks to a large bank of orders. DFS said it was “well ahead” of its previous scenario of 7% growth compared to 2019.

“Our record profits delivery is a fitting tribute to all the hard work of our colleagues and testament to the resilience and flexibility of our integrated business model,” DFS chief executive Tim Stace said.

“Despite numerous operational challenges during the pandemic, I’m proud that we have remained focused on our strategic agenda to lead sofa retailing in the digital age.

“We also see further growth opportunities into the medium term derived from extending the reach of our retail brands and optimising our operating platforms.”

However, the firm admitted that it was facing demanding conditions, in particular from supply chain disruptions, that have also plagued other companies.

DFS said that revenue growth was constrained in the last year from container shipping delays, including the effects of disruption in the Suez Canal, as well as the availability of raw materials.

Read more: Brits spend £110bn on home improvements amid pandemic property boom

“It should be recognised that the short-term operational environment continues to be exceptionally uncertain and difficult, given well-reported logistics disruption, cost inflation pressures and unplanned COVID absences,” the company said.

DFS still expects to meet earnings expectations despite the supply chain challenges.

The London-listed firm is set to reinstate its dividend, with a proposed final payment of 7.5 pence per share.

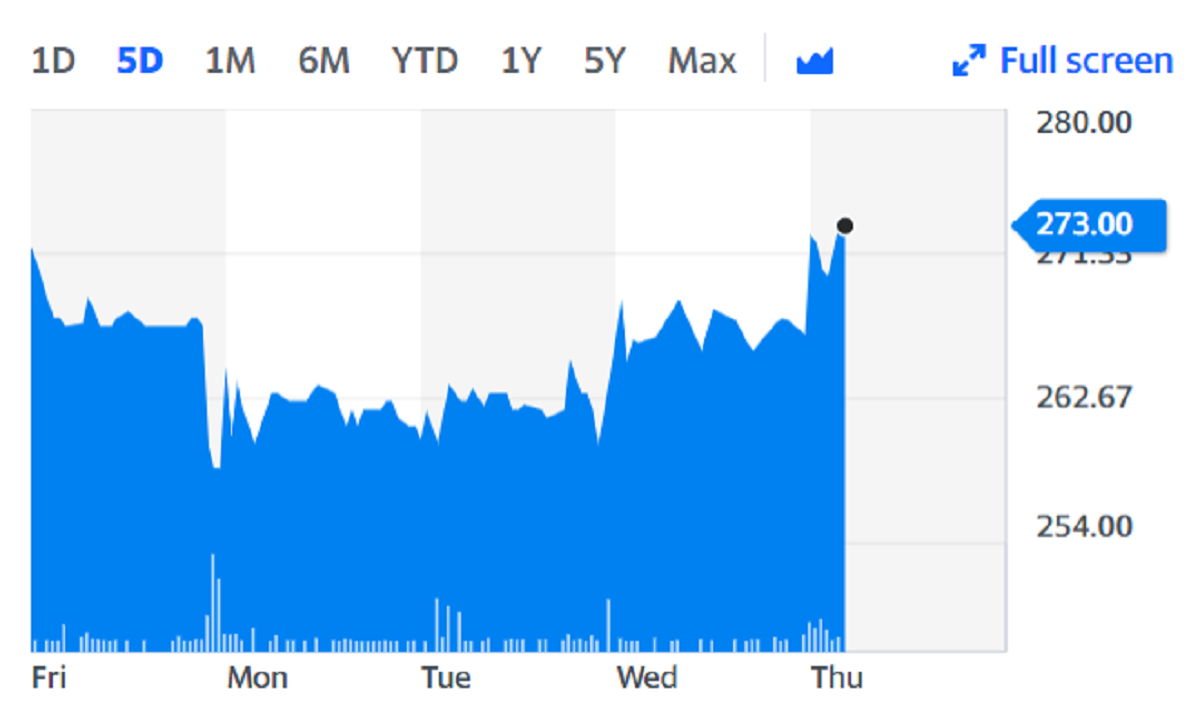

Shares on Thursday climbed 1.3% higher on the back of the news.

"DFS preliminary results proved to be quite positive, with improvements seen across the board indicating a strong recovery from the pandemic," Walid Koudmani, market analyst at financial brokerage XTB, said.

"The company not only saw growth in revenue from continuing operations, but also a significant boost in market share and an increase in online revenue of 184.3% year-on-year.

"While it will be reinstating dividends, today’s results illustrate the resilience of DFS in a difficult environment and showed the company's ability to remain competitive by adapting its strategy. ”