China’s coal addiction puts spotlight on its climate ambitions before Cop28

China’s addiction to building new coal-fired power plants is becoming increasingly entrenched, even as the country is on track to reach peak CO2 emissions before its 2030 target.

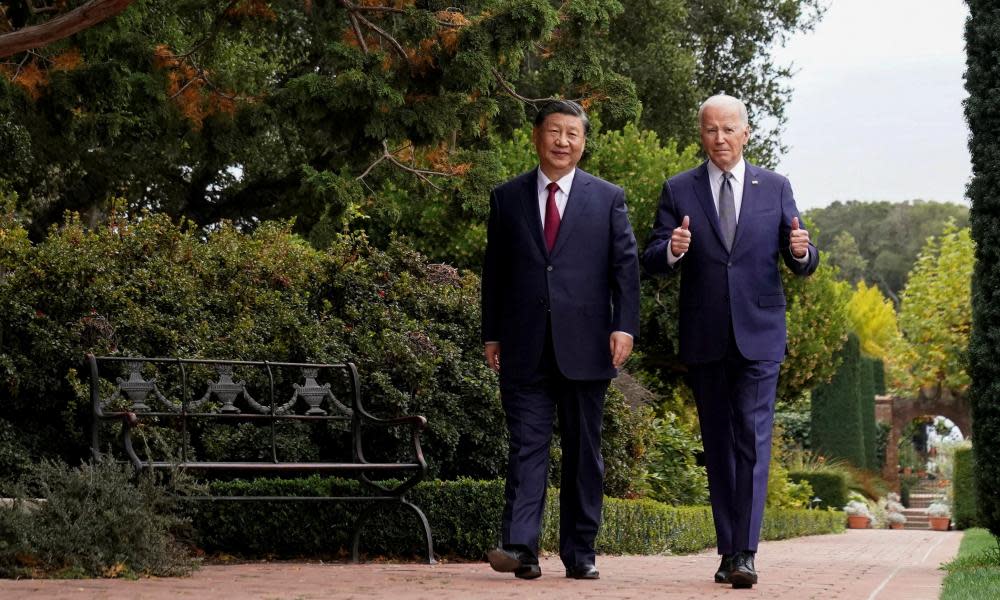

As climate officials from around the world prepare to meet in the United Arab Emirates for Cop28, many are hoping that the recent joint climate agreement between the US and China, released days before Joe Biden and Xi Jinping met in California, can lay the groundwork for positive commitments at the UN’s climate conference.

The last major breakthrough involving China at Cop was at Cop26 in Glasgow, in 2021. At that conference, China pledged CO2 emissions would peak by 2030. Xi said that China would “strictly control coal-fired power generation projects”.

But 2021 was also the year in which severe power outages blighted many parts of China, leading to rationing, closed factories and cold homes as local authorities struggled to cope with sudden shortages of energy.

In 2022, further energy crunches in south-west China underlined the importance of stable energy supplies to Chinese officials. That has put the commitment to reduce reliance on coal-fired energy in direct tension with the new emphasis on energy security.

“Chinese officials view coal as the primary guarantee of energy security,” said Anders Hove, senior research fellow at the Oxford Institute for Energy Studies. “For this reason, it is now considered sensitive to criticise the country’s present investments in coal.”

Local governments in China approved 50.4GW of new coal power in the first half of 2023. And in 2022, construction started on 50GW of coal capacity, an amount six times as large as the rest of the world combined.

Despite growing demand for energy, China still has far more coal power capacity than it needs. Last year the average utilisation rate for coal power plants was just over 50%.

Experts say that the way to ensure China’s energy security is to improve the technological infrastructure of the grid to make it more stable and efficient, not build new dirty generators.

“Energy storage is the key for China’s energy transition,” said Gao Yuhe, a senior campaigner at Greenpeace East Asia. Energy storage can enable “renewable energy to take a leading role in the whole energy transition”.

Coal power plants take a long time to power up and cool down, meaning that they are relatively inflexible. Renewable energy storage enables the grid to overcome the challenge created by the fact that most of China’s renewable energy is generated in the west of the country, while most of the energy consumption happens in the east.

Getting the energy to the right place at the right time is one of the biggest challenges facing China’s energy transition. Local government officials, who are more concerned with keeping the lights on than with green targets, see coal as a safety net.

During last year’s power crunch in Sichuan, a heatwave raised the demand for energy as people turned on air-conditioning units. At the same time, a drought meant that there was much less hydropower energy generation.

“Sichuan suddenly couldn’t meet their electricity export obligations and meet local demand,” said Lauri Myllyvirta, lead analyst for the Centre for Research on Energy and Clean Air. A rigid energy planning system meant that Sichuan continued to export energy, even when it created local blackouts.

“Local governments do not want to phase out coal as soon as possible,” said Gao, adding that the central government’s emphasis on energy security empowers local officials further to permit new coal.

Hua Wen, a China project director at the Natural Resources Defence Council, notes that the top five provinces that have approved the most new coal power since 2021 “are China’s industrial powerhouses and net electricity importers. These provinces are seeking to reduce their reliance on imported electricity to meet their increasing electricity demand [and] to prevent or reduce the risk of future power shortages”.

Wen added that some smaller and more inefficient coal power plants have been closed in recent years, partially offsetting the surge in new approvals.

Recent policy developments suggest that China is doubling down on coal, even as the rapid construction of green energy infrastructure means that the average annual increase in China’s energy demands can be serviced entirely by low-carbon energy. China’s solar capacity now exceeds the rest of the world combined, but coal still accounts for more than half of total energy consumption.

In November, the Chinese government released a long-awaited coal capacity compensation mechanism. The policy, which comes into effect on 1 January, guarantees payments to coal-fired power producers based on their installed capacity. This could incentivise the building of more coal, according to Hove. Other analysts say that the policy will allow more renewables to enter the energy mix without compromising stability.