Trust in insurers nosedives as car insurance premiums soar

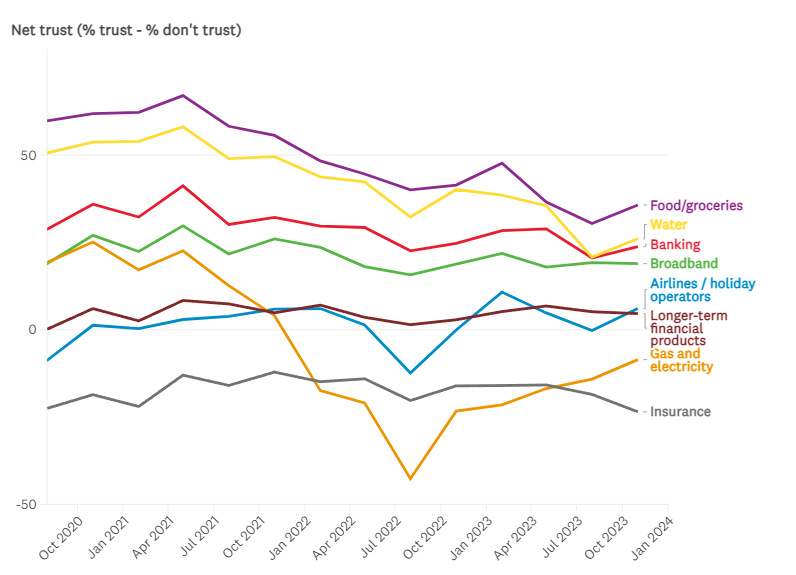

Trust in the insurance industry has nosedived to record lows as millions have experienced a surge in the premiums charged.

Which?'s monthly consumer insight tracker revealed that confidence in insurers plunged to -24, the lowest score since tracking started in August 2020.

The figures showed that only 21% of consumers trust insurance companies, with 44% expressing distrust. The negative view consumers have of their insurance provider comes as premiums surge, particularly car insurance costs.

“With insurance premiums continuing to soar and many consumers reporting bad experiences with their insurer, it's hardly surprising that trust in the industry has continued to fall,” said Rocio Concha, Which? director of policy and advocacy.

Read more: Revealed: The best car insurance policies

According to data from Confused.com, car insurance costs escalated by nearly 60% in the 12 months leading up to October 2023.

The average comprehensive car insurance policy now stands at £924, reflecting a £338 jump from the previous year.

‘Insurance is overpriced’

Consumers are questioning the reasons behind the premium hikes as some accuse insurers of focusing solely on profits.

"Insurance companies go to great lengths to maximise their profits and minimise the odds of having to pay out to customers. It has nothing to do with protection and everything to do with profit over the welfare of people," one respondent told Which?.

“I think insurance is overpriced, and that prices have increased a lot over the last year or so without any real reason," another person said.

A woman from the North East said she had a “really bad experience in the past where they didn't have my best interests at heart and [my claim] rumbled on for about two years”.

Which? said insurers need to ensure they are offering value for money and that their customer service is up to scratch when a consumer needs to make a claim.

Contents cover insurance among most difficult

Figures from the Financial Conduct Authority (FCA) reveals that among the 34 insurance types they monitor, standalone buildings and contents cover are among the least likely to pay claims.

While car insurance claims were accepted at an rate of 99% last year, standalone buildings cover, crucial for events like fire or flood, saw only a 68% acceptance rate.

The financial regulator's new consumer duty emphasises higher standards for consumer protection, urging insurers to ensure value, support, and transparency.

Which? has called on the FCA to take action against any firms falling short.

“Anyone who isn’t happy with their current insurer should consider switching or haggling. Our research shows the price quoted by your insurer isn’t necessarily the best price available and doing your research on comparison sites, haggling and switching can offer savings,” said Concha.

Which? advises people to always compare deals from different insurers to get the best rate. When speaking with an insurer on the phone, have both a competitor's rate and current rate on hand, including this year's offer and the previous price being paid.

Watch: Chancellor denies tax cuts were 'pre-election giveaway'

Download the Yahoo Finance app, available for Apple and Android.