Brexit: UK manufacturers’ decline in EU exports could be ‘permanent’

2020 saw UK manufacturers’ exports to the EU fall significantly due to political uncertainty around Brexit, as challenges around logistics and customs continue.

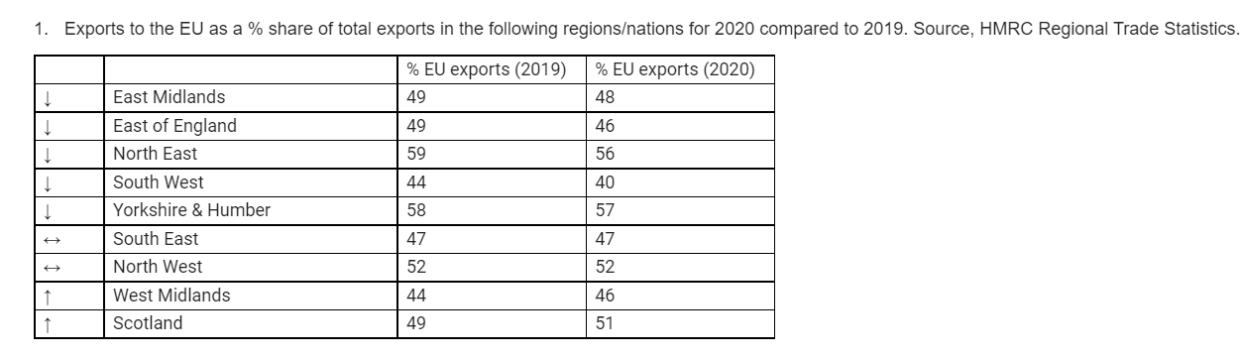

A report by Make UK, a body representing manufacturers, and business advisory firm BDO said that, as per HMRC data, five English regions together with Wales saw their percentage of exports going to the EU fall last year. The report also noted the “brutal” impact of COVID-19 on the industry.

In two regions the share stayed the same and only the West Midlands and Scotland saw the share of exports to the EU increase slightly.

Make UK CEO Stephen Phipson said if the government doesn’t smooth out critical issues such as customs procedures “there is a risk that the drop in exports to the bloc we have seen over the last couple of years will become structural and permanent.”

The report noted that political uncertainty caused by leaving the EU was beginning to be felt even before the actual departure and the signing of the trade deal at the end of last year.

The most recent quarterly trade data shows exports to the EU in Q1 were still 27% below Q1 2019.

This backs Make UK’s anecdotal evidence that many companies were already choosing not to supply the EU or that EU customers are turning away from UK- based companies.

Read more: Morrisons takeover: Deadline looms for potential CD&R bid

Make UK is calling for the government to work with the EU to ensure greater cooperation on customs procedures, creating systems for single digital submission and enhanced trusted trader schemes.

The organisation added that manufacturers still need support from qualified and experienced customs experts, which has been a challenge to find for the sector.

“While opportunities are opening up elsewhere the EU will remain our biggest trading partner through sheer fact of geography,” said Phipson.

The analysis of manufacturing performance from the start of Q3 2020 highlighted the brutal impact of the pandemic on the sector, with approximately £18bn ($25bn) output in value lost between 2019 and 2020.

But due to a surge in growth, Make UK has upgraded its growth forecast for this year for manufacturing from 3.9% to 7.8%.

“Assuming there are no further setbacks, industry should have recovered all lost output by the end of 2022, some six to nine months earlier than expected,” the report said.

Watch: What are freeports?