Bitcoin climbs above $40,000 as crypto market rallies

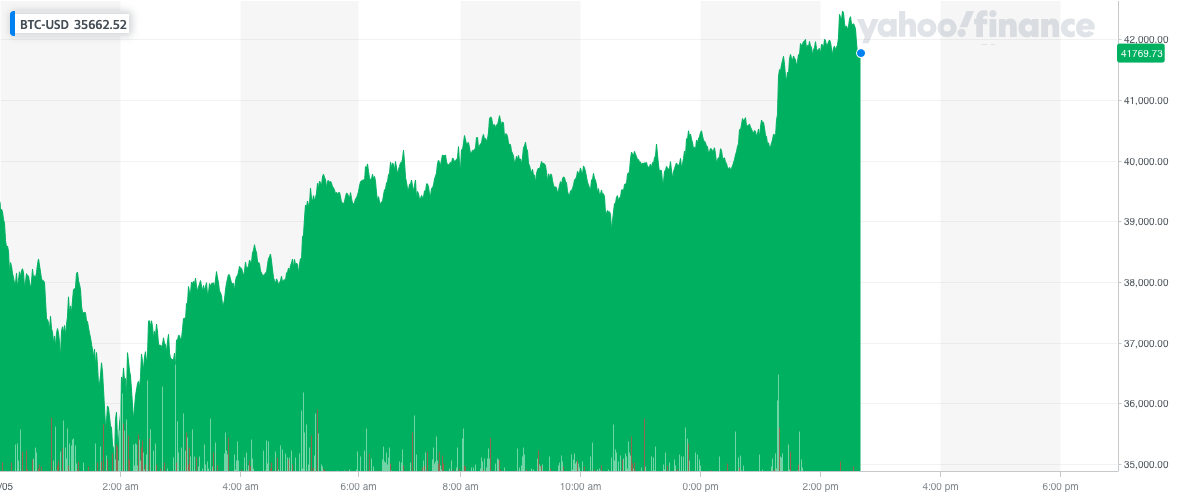

The price of bitcoin (BTC-USD) climbed back above $40,000 (£28,329) on Thursday, a day after a sharp sell-off across the market shook confidence.

Bitcoin was up 18% to $41,769 by mid-afternoon in London.

Bitcoin had dropped below $32,000 on Wednesday as selling gripped the cryptocurrency market. News of a renewed crackdown in China was blamed but prices had been under pressure since Elon Musk said Tesla was abandoning plans to accept bitcoin as payment last week. The broader crypto market sunk as much as 20% on Wednesday.

Watch: How to prevent getting into debt

Read more: Cryptocurrency carnage: Billions wiped off market as Musk says Tesla has 'diamond hands'

"Bitcoin, the biggest crypto-asset, shed as much as 25% yesterday, while ethereum, the second largest, tumbled as much as 40%," said Michael Brown, a senior market analyst at Caxton. "Even accounting for the heightened volatility which comes with this territory, these are sizeable moves."

Genesis, a crypto prime broker and the world’s largest institutional digital currency lender, said the sell-off appeared to be partly driven by forced closures of positions based on leverage. Trading desks reported cash buyers for ethereum coming into the market as the price fell to the mid-$2,000s and renewed appetite among institutional investors for bitcoin as it reached $35,000.

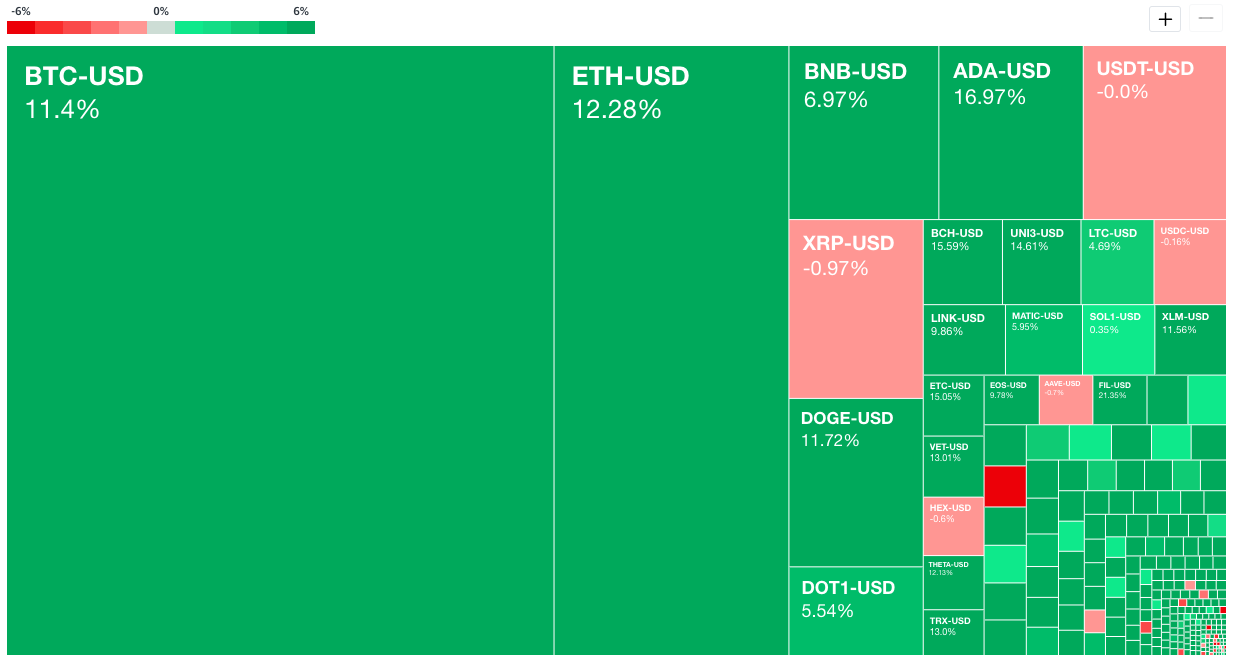

The broader crypto market rallied alongside crypto on Thursday. Ethereum (ETH-USD) was up 12.5% to $2,913. Dogecoin (DOGE-USD), a Musk favourite, was up 13.9% to $0.41. The joke token was helped by another tweet from Tesla boss.

Wednesday's sell-off once again highlighted the extreme volatility that characterises the cryptocurrency markets. Unlike past corrections, analysts said this week's slump had more consequences for the mainstream financial system and corporate world.

Several institutions have invested billions of dollars into cryptocurrencies, including Tesla (TSLA) and MicroStrategy (MSTR). Traditional financial firms like PayPal (PYPL) and Goldman Sachs (GS) have also begun handling the asset on behalf of clients, leaving them with potential exposure.

Read more: How bad is bitcoin for the environment?

"Typically, moves in the crypto arena are rather isolated," said Brown. "Yesterday, though, was different, with the sell-off in the crypto arena sparking some notable risk aversion elsewhere.

"This was particularly evident among those companies which have been major advocates of crypto, with the price of stocks such as Tesla, Coinbase and Microstrategy tumbling. There was also a broader negative impact on the tech sector at large, which led losses on Wall Street yesterday.

"This ripple effect seems to be a strong illustration of how large crypto markets have become. The correlation between these assets is, at least intraday, fairly clear to see."

Watch: What are the risks of investing in cryptocurrency?