Auto Trader shares surge as UK customers turn to buying cars online

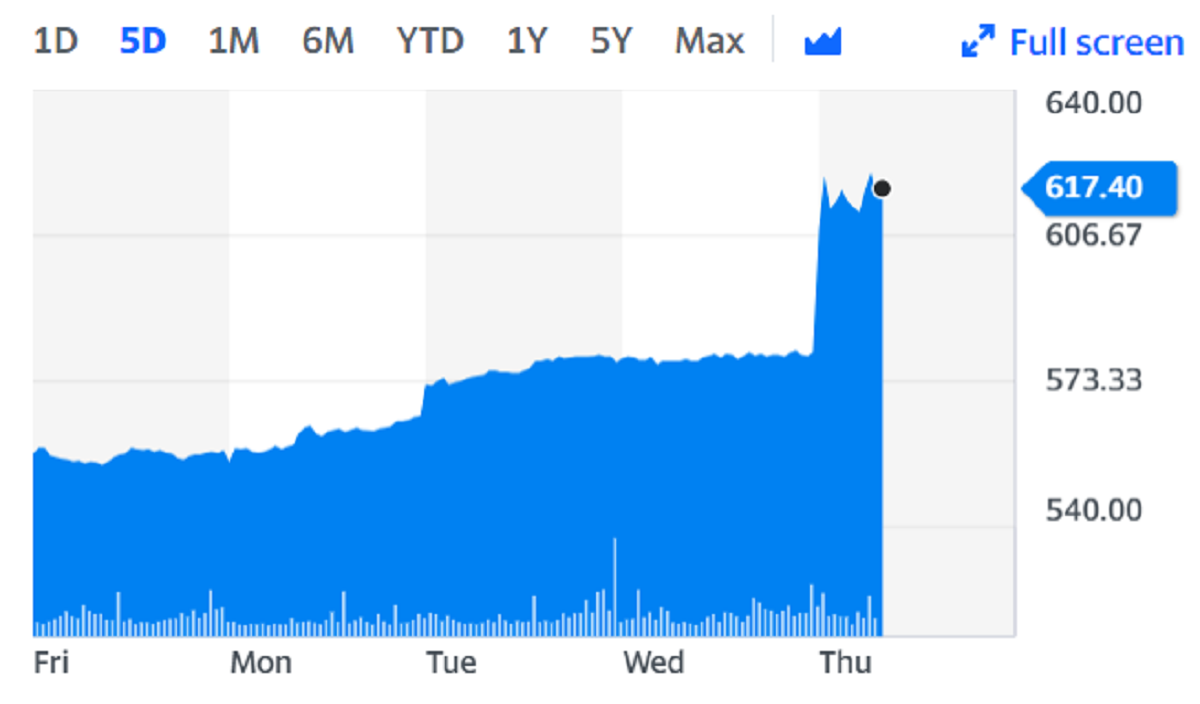

Shares in Auto Trader (AUTO.L) jumped as much as 7% on Thursday after the company revealed that UK customers were shifting “dramatically” to online car buying.

The new and second-hand car seller said website and app visits were up 15% to 58.3 million a month on average.

It said demand, combined with periods of constrained supply, led to a year of growth for used cars, while lockdowns prompted more retailers to adopt a "click and collect" or home delivery model.

The company also saw record levels of new car buyers as retailer forecourt numbers churned significantly higher than a year ago when people were forced to stay at home to prevent the spread of coronavirus.

However, pre-tax profit fell 37% to £157.4m in the 12 months to 31 March, due to the company offering free advertising to car dealers during four months of lockdown. This included free advertising in April, May, December and February, and at a discounted rate in June 2020.

Revenue across the period slumped by almost a third (29%) to £262.8m, down from £368.9m the previous year.

Average revenue per retailer (ARPR) declined by 32% to £1,324, from £1,949 last year. However, without COVID-related discounts ARPR grew by £87 year on year as a decline in paid stock was offset by an increase in price and product.

The Manchester-based company expects to deliver “high single digit growth” in average revenue per retailer compared with 2020, and to bring its operating profit margin back in line with pre-pandemic levels.

It is also working on new innovations such as offering guaranteed part-exchange and allowing users to make reservations on vehicles.

Auto Trader has proposed a final dividend payout of 5p, and surplus cash will be distributed through imminent share buy-backs.

“There has been a dramatic shift towards buying online which means we now have more buyers than ever turning to Auto Trader to help with their next car purchase, making us even more relevant to retailers and manufacturers,” said Nathan Coe, chief executive.

“This positions us ideally to enable the buying and selling of cars online, which will materially improve the car-buying experience and the business of our customers.”

Auto Trader warned that the global chip shortage may limit car production and hit supply, as it has already affected new car advertising.

A rapid change in remote working across the globe caused higher sales of personal computers, while economists have said that consumers with more savings have splashed out on things such as TVs, new phones, and computer game consoles.

Watch: How to save money on a low income

Read more: The chip shortage bringing car factories to a standstill

The global chip shortage has put pressure on a number of carmakers who are competing directly with tech companies and the consumer electronics sector for supply.

At the beginning of the pandemic, many car manufacturers cancelled orders due to fear of a long downturn in sales. However, as sales have started to recover they have now found themselves at the back of the queue for these microchips.

Jaguar Land Rover (JLR), the UK’s largest car manufacturer, was plunged into crisis earlier this year as the shortage caused it to temporarily shut down production at two of its main plants.

Meanwhile, Nissan (7201.T) announced that it would furlough around 10% or 800 employees at its UK plant in Sunderland amid the supply chain issues, and US car company Ford (F) announced that it will cut car production.

Last year, the group raised £183m through an investor cash call to shore up its finances. It also furloughed around a quarter of its staff for almost seven weeks but it has since paid back the furlough support thanks to its strong performance.

“The drop in full-year profit announced at Auto Trader is firmly in the rearview mirror now as investors focus instead on the buoyant market conditions which are helping to drive a gear change in profitability in the current financial year,” said Russ Mould, investment director at AJ Bell.

“The company’s dominant market share means it benefits from a network effect – it is the one most visited by prospective car buyers because it has the most listings. Car retailers are therefore compelled to use its products, reinforcing its position.”

Watch: Car sales see worst start to the year since 1970 as lockdowns stall recovery