Australian federal budget 2024: what we know so far and what to expect

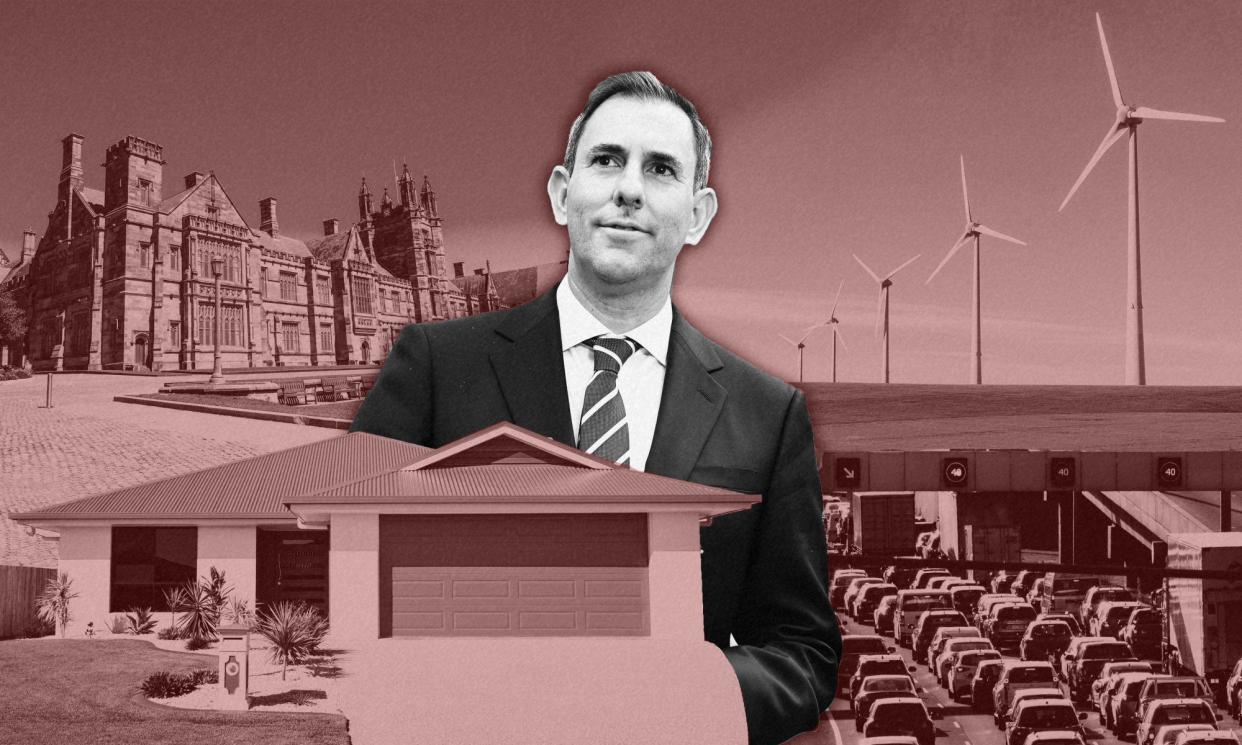

On 14 May the treasurer, Jim Chalmers, will deliver his second full-year budget.

Chalmers has promised more cost-of-living relief in a budget that he says tackles inflation but sets Australia’s economy up for growth – neither scorched-earth nor a free-for-all of spending.

A second surplus is within reach, but that’s just speculation. Here’s what we know already about what is in the budget.

Tax cuts and cost of living

The biggest element of the cost-of-living relief in the budget is the changes to stage-three tax cuts, a $359bn 10-year tax cut package announced by Labor in January and legislated in February with opposition support.

The package means all Australian taxpayers (earning over the tax-free threshold of $18,200) get a tax cut, doubling the benefit for an average income earner compared with the Coalition’s original stage three proposal.

Labor says 84% of taxpayers are better off under its proposal, although those earning more than $146,486 would have received more under the Coalition’s model.

There will be other cost-of-living measures the government claims won’t add to inflation, which might point towards extending energy price relief.

Jim Chalmers has poured cold water on the Economic Inclusion Advisory Committee’s call for jobseeker to rise to 90% of the age pension, although he and the finance minister, Katy Gallagher, have seemed more open on increasing rent assistance. Chalmers has confirmed there will be “additional steps” on poverty reduction and “new initiatives for housing”.

Education, skills and Hecs

The government will wipe $3bn from student debts by indexing Hecs and Help debts to the lower of the consumer price index or the wage price index, backdated to June 2023.

The government will also pay student teachers, nurses, midwives and social workers $320 a week during their mandatory work placements, starting from July 2025. These two measures are aspects of the government’s response to the Universities Accord, but there will be more in the budget.

The government has announced $90.6m to boost the number of skilled workers in the construction and housing sector, creating 15,000 fee-free Tafe places and 5,000 places for pre-apprenticeships.

School funding will also rise as the federal government negotiates with the states to cover the 5% funding gap, most recently offering to lift its share of funding from 20% to 22.5%. This is estimated to cost $6bn over five years, although Chalmers has been coy about whether estimates will be reflected in the budget or only be added after education and health agreements are finalised.

Childcare

There is no question childcare workers will be receiving a pay rise in this budget – the only questions are how much and how it will be distributed. With the industry in crisis due to staffing shortages, which have been exacerbated by staff leaving to work in aged care after that sector’s pay rise win, the government is expected to make wage increases for childcare workers a centre piece of the budget.

But it’s unclear whether the government will pull the trigger on scrapping the activity test, which sets a subsidy rate based on employment. It has indicated it wants to get rid of the measure as part of its plan to make childcare in Australia “universal”, though it’s not clear whether it will happen in this budget.

Health and aged care

Public hospitals are expected to get more funding, as the federal government works to finalise a new five-year agreement with the states to start in mid-2025. The commonwealth has reportedly offered to lift funding by an extra $4bn in 2025-26 and $13bn over the whole five years.

The government is also increasing funding for its medical research future fund over 13 years, with $1.1bn for existing projects plus $150m million to investigate rarely survived cancers, and $150m towards reducing inequalities in the health system. A further $500m will go to other research schemes.

The government is also yet to outline its response to March’s aged care taskforce report, which suggested new ways to pay for the system – including asking Australians with more wealth to pay more for the cost of their care.

The health minister, Mark Butler, also announced $49.1m would go toward offering longer consultations of 45 minutes or longer for endometriosis sufferers.

Among a total of $15.4bn in “unavoidable spending” to continue programs from the previous government is money set aside for palliative care, cancer supports, public health chronic conditions, and alcohol and other drug treatments.

Defence and foreign affairs

The budget will confirm that Australia’s defence spending will increase from 2.1% of Australia’s economic output next financial year to 2.4% by 2033-34, driven by a range of big-spending projects including the Aukus nuclear-powered submarines.

There will be some cuts to programs, however, with the government announcing last month that it would free up about $73bn over 10 years by cutting, delaying or changing the scope of some defence projects.

Even after these cuts are taken into account, the government says it has committed a net increase of $50.3bn for defence over the next 10 years. This includes a net increase of $5.7bn over the immediate four-year budget cycle.

This immediate funding includes $1bn over the next four years for long-range strike, targeting and autonomous systems.

In foreign affairs, the government has promised $492m for the Asian Development Fund’s 2025-28 pledging round, to “help respond to the needs of the region and deliver transformative development projects across the Indo-Pacific”.

Infrastructure

So far, western Sydney is the biggest winner in infrastructure after the minister, Catherine King, announced $1.9bn in funding for 14 road and transport projects. Those include road upgrades, planning projects and extra money for a business case to extend the train line into the city’s south-west.

Cyclists will also get a boost with $100m being set aside to build and upgrade bicycle and walking lines in cities and regional centres.

Canberra will also get a $50m injection to extend its light rail line from the northern suburbs past Parliament House and into the city’s south.

The nation’s capital are getting a good deal because $249.7m has also been announced for Australian Institute of Sport as the 2032 Brisbane Olympics inches closer.

The quarter of a billion-dollar sum will go towards refreshing the ageing site with new accommodation, an all-weather sports dome and a new training centre.

Beyond Canberra, road safety data from the states and territories will also be better harmonised with a $21m funding announcement to set up a national data hub.

Future Made in Australia

The government has announced funding for a range of projects under its Future Made in Australia policy, which aims to directly support Australian industry and innovation, particularly in green energy. These commitments include:

$1bn for the Solar Sunshot production of solar panels in the Hunter

$1bn to PsiQuantum to build the world’s first fault tolerant quantum computer in Brisbane

$840m for Arafura’s rare earth metals production in the Northern Territory

An export agreement to sell armoured vehicles made by the German defence manufacturer Rheinmetall

$566m over 10 years for GeoScience Australia to map what is under Australia’s soil and seabed

$400m in new loans to Alpha HPA for Australia’s first high-purity alumina processing facility in Queensland; and

$185m to Renascor Resources to fast-track the development of stage one of its Siviour Graphite Project in South Australia; and

$100m to speed up environmental approvals, including assistance for business.

Gender equality

The government has committed $925m for the leaving violence payment, a payment of $5,000 to help meet the costs of leaving a relationship. The existing trial will be extended and the new permanent program available from mid-2025.

The government has also said that parents will receive 12% superannuation – or about $106 a week – on their publicly funded paid parental leave from July 2025, full costings for which will be in the budget.

Indigenous affairs

The government has not foreshadowed any new major spending commitments in the Indigenous affairs space, but the budget will contain details and funding for several large programs in that portfolio that were recently unveiled.

The Closing The Gap commitments from February, including a $700m remote jobs program, and March’s announcement of a $4bn remote housing program for the Northern Territory, are expected to be the major components of the Indigenous affairs portfolio. Most of the new commitments in Indigenous affairs are typically contained in February’s Closing The Gap document rather than the May budget.

Attorney General’s Department

The government has pledged $161.3m to establish the national firearms register, and $11m for an app alerting Australians in real time if somebody tries to use their data to commit fraud.

The government will invest $166.4m to implement reforms to Australia’s anti-money laundering and counter-terrorism financing regime.