Tesco's brutal plan to 'axe 15,000 jobs' includes removing human interaction

Britain’s biggest supermarket Tesco (TSCO.L) is reportedly about to axe 15,000 jobs, according to a report by the Mail on Sunday. One of the most jarring elements to this alleged £1.5bn ($1.98bn) cost-saving measure is that the grocer is removing most of the key moments of human interaction for customers and staff.

The job cut measures include axing positions where it would require a human being. Tesco is allegedly looking to:

Close its meat, fish and delicatessen counters — only major stores will have counters open Thursdays to Saturdays;

Overhaul in-store bakeries and using frozen dough instead of fresh dough;

Close staff canteens and replace them with vending machines.

Tesco has just celebrated its best Christmas sales since 2009. But ike the rest of the supermarket industry and other bellweather UK retailers, it is under enormous pressure to retain market share, let alone continue to expand.

READ MORE: Big Four supermarkets lose ground to discount rivals

At the beginning of this month, Yahoo Finance UK’s Oscar Williams-Grut pointed out that ‘Big Four’ supermarkets Tesco, Sainsbury’s (SBRY.L), Asda, and Morrisons (MRW.L) are all cutting prices to compete with upstart German discount grocers that are taking Britain by storm.

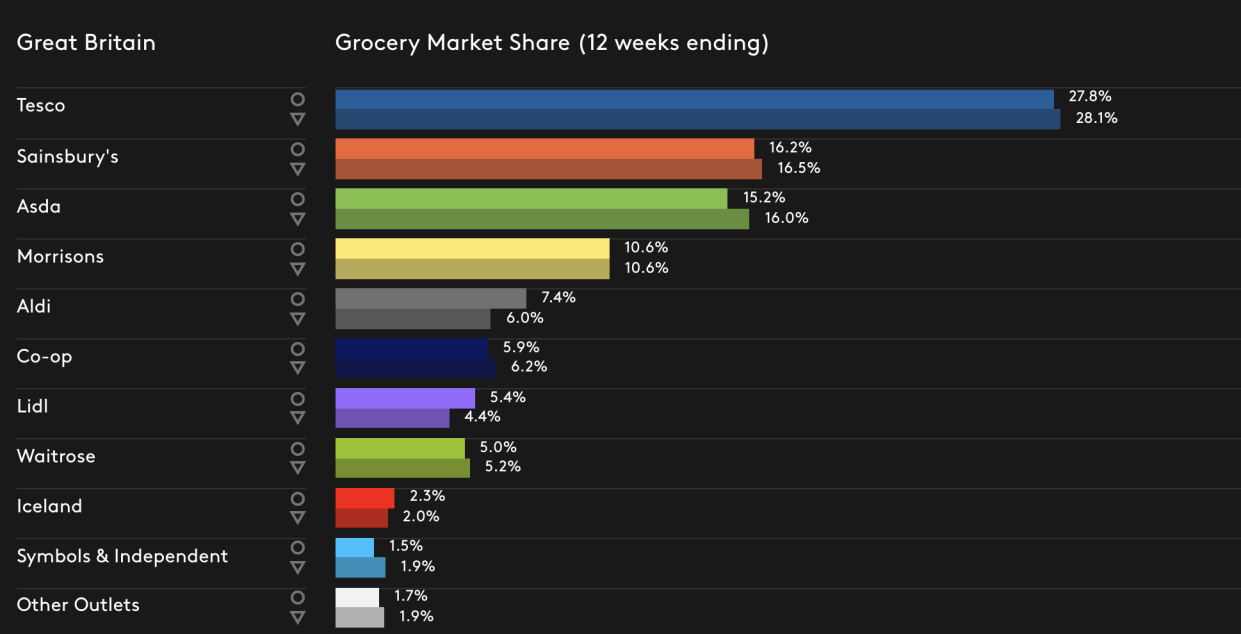

Aldi and Lidl enjoyed their highest ever Christmas market share in the 12 weeks to December 30, market research firm Kantar Worldpanel said on Tuesday.

Data shows that two-thirds of all British households went to one of the German discounters over the period, and they had a combined market share of 12.8%.

It is perhaps unsurprising that Tesco is taking further measures to cut costs, despite its stellar Christmas sales — it is losing marketshare.

This is the data from Kantar Worldpanel from 24 April 2016, versus 30 December 2018. It is the most comprehensive data gathering of its kind:

While the likes of Aldi and Lidl may seem like small players right now, it’s the rate of rapid growth that presents a long-term issue for incumbent supermarkets. The Co-op and Waitrose are long-standing UK high street brands, but now Aldi commands a greater share of the market after entering Britain in 1994.

Meanwhile, all supermarkets face headwinds over what Brexit will mean for them. The UK government has told supermarkets to stockpile as much food as possible in warehouses around the country in case of a no-deal Brexit.

Tesco, Sainsbury’s, Asda, and Morrison’s have also been asking their main suppliers to ramp up stock over concerns. Aldi has already considered stockpiling food as part of its preparations for Brexit but CEO Giles Hurley added that Aldi’s increased fresh food range would make this more difficult.