Travel insurance fine print that could invalidate your claim

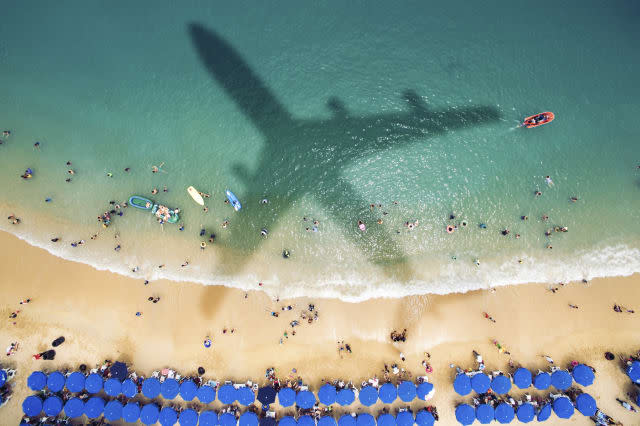

With summer now approaching at a rate of knots, one big decision is which travel insurance you go for.

While getting a cheap deal is always desirable, what's even more important is finding the right insurance cover.

As always, the devil's in the detail with insurance, so it's vital to know exactly what you are covered for, not just how much said cover will cost you.

Keep an eye out for these depressingly common travel insurance exclusions.

Exclusions when an airline goes bust

News that Alitalia entred administration earlier this week served as a reminder just how difficult conditions are for airlines in the current climate.

While the airline has pledged to honour flights for the next six months, the picture for those with flights booked thereafter could find themselves in difficulty.

Anyone affected by a failed airline would no doubt expect their travel insurer to step in.

However, research from financial data firm Defaqto found a staggering two in five single trip and annual travel insurance policies do not provide any cover in such cases.

Brian Brown at Defaqto, said: "As we head into the summer holiday period, travellers must ensure they have the right level of insurance cover if something goes wrong, or they risk their holiday dream turning into a nightmare.

"Only policies which cover scheduled airline failure will pay for the cancelled flight if the airline goes bust.

"Although some policies will also pay for other potential losses such as pre-paid accommodation, car hire and pre-booked excursions, not all will do so."

Exclusions on missing flights

One thing that should be abundantly clear by now is that while budget travel insurance policies are great so long as everything goes according to plan, they are not so great if a spanner is thrown into the works at any stage.

This loophole is a great example of that.

If you are delayed for whatever reason on the way to the airport and miss a connection, many budget policies will not cover the additional costs that you may incur as a result, things like an extra overnight stay.

Indeed some policies can get really sneaky. Good, comprehensive travel insurance policies will provide cover should your car break down on the way to the airport, and you subsequently miss your flight.

However, a number of budget policies opt to only cover public transport issues, and not private vehicles.

Going abroad? Compare insurance policies before you book

Pre-existing conditions

Not necessarily a surprising one this, but potentially a costly one. Some budget policies will not provide any cover if the customer has a pre-existing condition (perhaps heart problems) which results in a claim.

If you have any medical history which may impact on your policy in this way, be extra vigilant in ensuring that you will be covered should you suffer a flare up.

Older baggage deductions

Anyone who has ever had to claim for something on their home insurance will know that generally they can expect 'new for old' cover.

Basically, even though your items may be a couple of years old, the claim payout will treat their value as new.

One way that travel insurers are able to keep their premiums low on their budget insurance is to reduce the size of the claim depending on the age of the item involved.

So if your baggage is a bit older, the amount you can expect in your payout may significantly drop.

Close relatives

Family illnesses are always a worry, but even more so if you are about to head off on a break somewhere.

With most travel insurance policies, you will be able to claim for a cancellation of the holiday if a close relative falls ill. However, once again the devil is in the detail, this time in the definition of just what constitutes a close family member.

So a relative that you consider close, perhaps an aunt or uncle, may not fall under that category according to your insurer.

What all of this has hopefully shown is that while some travel insurance policies are staggeringly cheap, there is often a very good reason for that – your chances of making a successful claim are substantially reduced.

Yes, it's important to get a good deal that won't break your bank balance, but don't just automatically go for the cheapest deal you can find – it pays to make sure it will really cover you for what you need.