Get up to 40% more from your pension savings

Freedom should never be underestimated, and having the freedom to do what we want with our pensions in retirement has proven incredibly popular. The most recent figures from the FCA show that 302,107 pension pots were accessed for the first time between April and September, last year. However, while we embrace our new-found freedom in retirement, there remains much to be said for security too.

Once we have retired, we still have regular outgoings to meet, so being able to rely on a secure income can be vital to your piece of mind. Here, a pension annuity comes into its own, because it guarantees an income for life. So for many people it still makes sense as at least part of their retirement income.

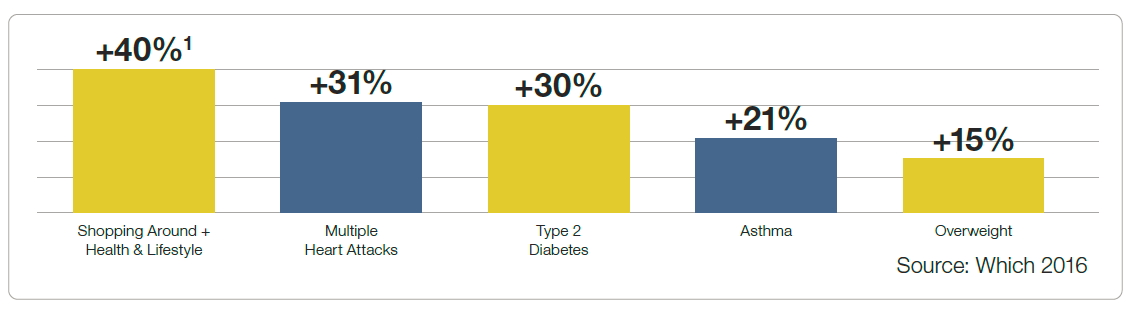

If you are considering an annuity, however, it's important to be aware that by factoring in aspects of your health and lifestyle, you could potentially increase your pension income by as much as 40%1.

Click to calculate how much Pension Income you could get >>

There are a variety of factors which could help you qualify for a higher income such as:

> How much alcohol you drink and whether you smoke;

> Being overweight;

> High blood pressure or cholesterol.

Find out how much MORE income you could get >>

Possible % increases with an enhanced annuity.

The uplift you will receive will depend on the severity of the condition, but it's always worth checking to see if any aspects of your health or lifestyle can offer you a greater pension income.

Click here to find out how much more pension income you could receive >>

Getting the best advice

Talking to an experienced specialist or Financial Advisor is imperative before you make your decision. Impartial companies like Age Partnership, can help take the stress and worry out of the process, too.

Should you be interested in an annuity, an advisor or specialist can provide all the information you need to proceed, tailored to your personal circumstances. Alternatively, should you wish to retain flexibility around changing annuity rates, they can discuss your requirements and offer a range of different retirement solutions.

To find out more, call Freephone 08000 810 815 or visit http://www.agepartnership.co.uk/pension-income/ to see if you can get up to 40%1 or more from your pension savings.

¹Research by the Moneywise in 2015 shows that the usual increase based on health and lifestyle factors is up to 40%.