Motoring groups welcome fuel duty freeze

Motoring groups have welcomed Jeremy Hunt’s decision to freeze fuel duty.

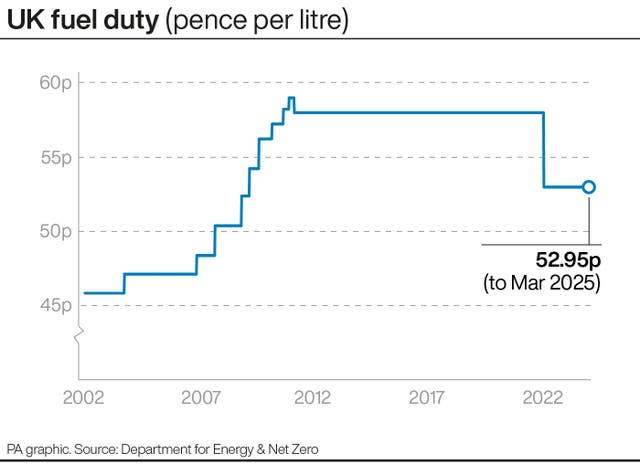

The Chancellor confirmed in his Budget that the 5p per litre cut implemented in March 2022 will be retained for another 12 months, and fuel duty will not increase in line with inflation.

This will save the average car driver £50 next year and bring “total savings since the 5p cut was introduced to around £250”, Mr Hunt said.

When the fuel duty cut was first announced, it was expected to save car drivers £100 annually.

A Treasury spokesperson said the reduction is due to the fall in the price of fuel.

Government figures show the average cost of a litre of petrol and diesel at UK forecourts is around £1.45 and £1.55 respectively.

Prices reached record highs of £1.92 for petrol and £1.99 for diesel in July 2022, largely due to Russia’s invasion of Ukraine leading to an increase in the cost of oil.

RAC head of policy Simon Williams said: “With a general election looming, it would have been a huge surprise for the Chancellor to tamper with the political hot potato that is fuel duty in today’s Budget.

“But, while it’s good news that fuel duty has been kept low, it’s unlikely drivers will be breathing a collective sigh of relief as we don’t believe they’ve fully benefited from the cut that was introduced just two years ago due to retailers upping margins to cover their ‘increased costs’.”

AA’s head of roads policy Jack Cousens said: “Even with the intense pressure to balance the UK’s books, now is not the time to rev up motoring costs for workers and families who rely on their cars to go about their daily lives, and stoke inflation.

“The AA therefore welcomes the 12-month freeze in fuel duty, despite the benefit felt being halved from its introduction.”

Mr Hunt’s decision means fuel duty will remain at 52.95p per litre for petrol and duty.

Before the 2022 cut, it had been frozen at 57.95p since March 2011.

VAT is charged at 20% on top of the total price.

RAC Foundation analysis shows tax makes up more than half of pump prices.

The motoring research charity’s director Steve Gooding said: “This freeze is welcome but comes against a backdrop of oil prices – and hence pump prices – creeping back up over the past couple of months.

“Even as it stands, the Chancellor is still getting more than 50% of what drivers spend on the garage forecourt in vehicle excise duty and VAT combined.”

The Treasury was criticised for failing to reduce VAT on public electrical vehicle (EV) charging to bring it into line with home charging.

Ian Plummer, commercial director at online vehicle marketplace Auto Trader, said the fuel duty freeze “sends more mixed messages to any motorists tempted to switch to electric vehicles”.

He went on: “Equalising VAT across public and private EV charging points would encourage people to make the switch, and for a fraction of the £6 billion cost of freezing fuel duty, so today is a missed opportunity to support the green transition.”

Colin Walker, transport analyst at non-profit organisation the Energy and Climate Intelligence Unit, said: “Electric motoring is cheaper motoring and the fuel duty freeze hasn’t changed that.

“Bringing VAT on public charging in line with charging at home will encourage more drivers to make the switch to electric motoring.

“If the Government really wants to help the UK’s drivers save money, the focus needs to be firmly on helping them make the move to EVs where more significant savings can be made.”