Mortgage increases: What Jeremy Hunt just announced and how the crisis could affect you

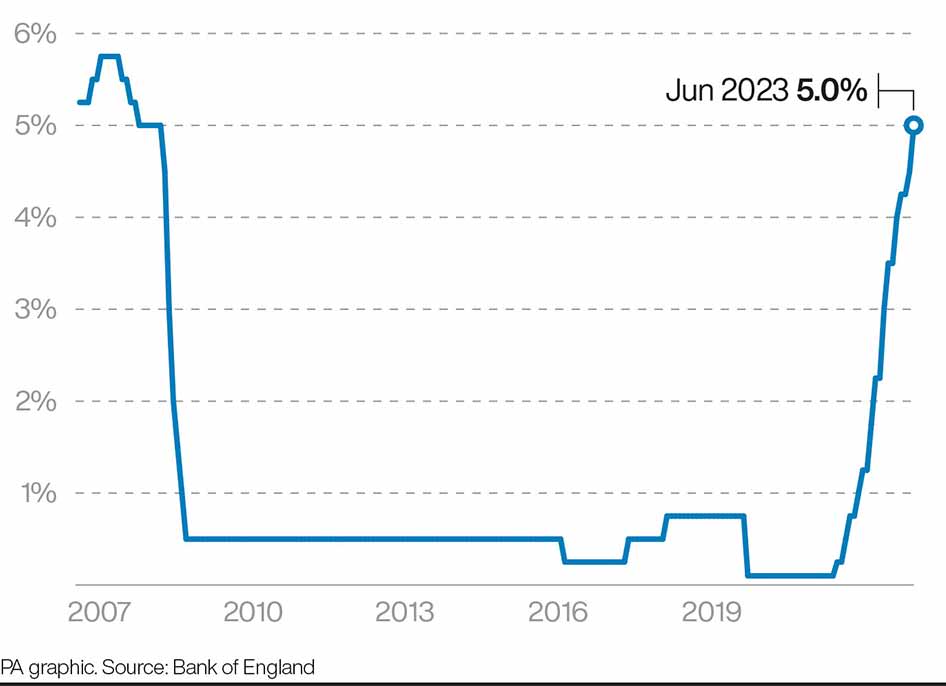

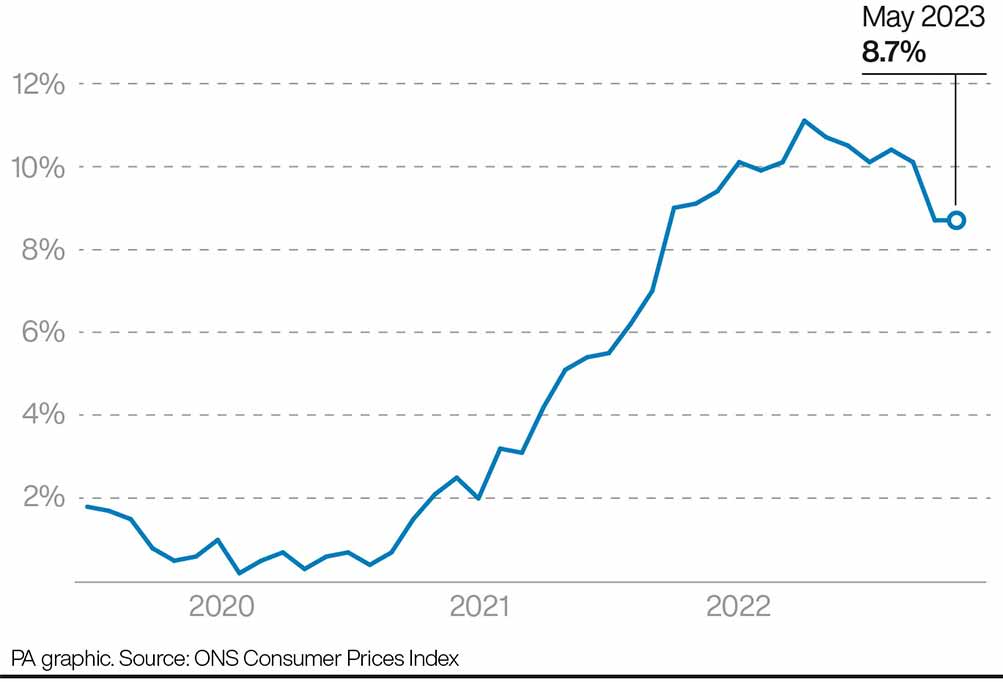

With inflation running four times higher than the government wants and millions of homeowners coming to the end of low-rate deals with their lenders, a mortgage crisis is coming.

Can anything be done to prevent families facing repossession, and how will this financial catastrophe affect renters?

We take a look.

What’s happening? The average mortgage rate available to homeowners now has an interest rate above 6 per cent. This means people are having to pay back more each month to keep their home.

Why does it matter now? More than 4.4 million homeowners will need to remortgage their property - that means agreeing a new deal on their borrowing - by December next year. The higher interest rate means many will struggle to meet higher monthly repayments.

How much will they pay? According to the Resolution Foundation, the average family will see their mortgage payments rise by almost £3,000 a year.

Ouch! Will the government help me out with payments if I'm struggling? Experts say that’s unlikely, and the government has already said it doesn’t plan to intervene to reduce payments directly. Property market analyst Neal Hudson told Yahoo News that “any support they do [give] would weaken the intended impact of higher rates so would probably be inflationary”. Instead they expect lenders to step in to help borrowers by renegotiating terms or offering payment holidays.

So what was announced on Friday? After a meeting with lenders, chancellor Jeremy Hunt confirmed a number of measures had been taken. These include: a 12-month minimum before repossessing homes; allowing struggling borrowers to extend the term of their mortgages or move to an interest-only plan temporarily “no questions asked”; no impact on people's credit score.

My formal instant response to the measures coming out of this mornings mortgage summit.

"The unprecedented steep rise in mortgage rates is causing a nightmare for many with variable mortgages and those coming off fixes. Therefore, the most important thing we can focus on right…— Martin Lewis (@MartinSLewis) June 23, 2023

Oh, I was hoping for something a bit more radical. Ed Davey, leader of the Liberal Democrats, wants the government to set up a £3bn mortgage protection fund to protect homeowners in crisis. Michael Gove thinks UK lenders should introduce a 25-year fixed mortgage terms to prevent fluctuations in the mortgage market. And Hudson also believes that help might be forthcoming for Help to Buy and shared owners, who are likely to be hit hardest by the affordability crisis. Martin Lewis greeted the news positively saying the chancellor "had listened".

Will lots of people lose their home? Probably not, according to Hudson - but house prices will fall. Some pundits have said the market could plummet by 35 per cent. However experienced estate agent Henry Pryor thinks prices will have a “soft landing” at a 10 per cent fall within a year. “Prices will be dictated by new buyers finding that mortgage finance is harder to get and more expensive,” he told us. “And the number of homeowners without a mortgage means that the pain of higher interest rates is only being visited on a few rather than on the many which ought to slow price falls slightly."

Oh well, I’ve never had a mortgage so none of this matters to me. Not so fast: most renters will see their monthly payments rise as a result of the impact on the wider housing market.

Wait, what? Surely this is a better time to be renting? Unfortunately not. When buy-to-let landlords, or “accidental” landlords who rent out a property because they can’t sell it, can’t afford to service their mortgage they will either push the higher costs down to tenants or sell up putting more pressure on limited rented housing stock.

I’m going to go on holiday to forget about it all! Ah, I’m afraid that will be affected too. Pushed out landlords are often choosing to rent their homes out for higher prices on Airbnb and short term let websites - pushing the cost of all holiday homes up with them.