Mortgage crisis: 'My monthly payment has gone up by £480. It's horrific'

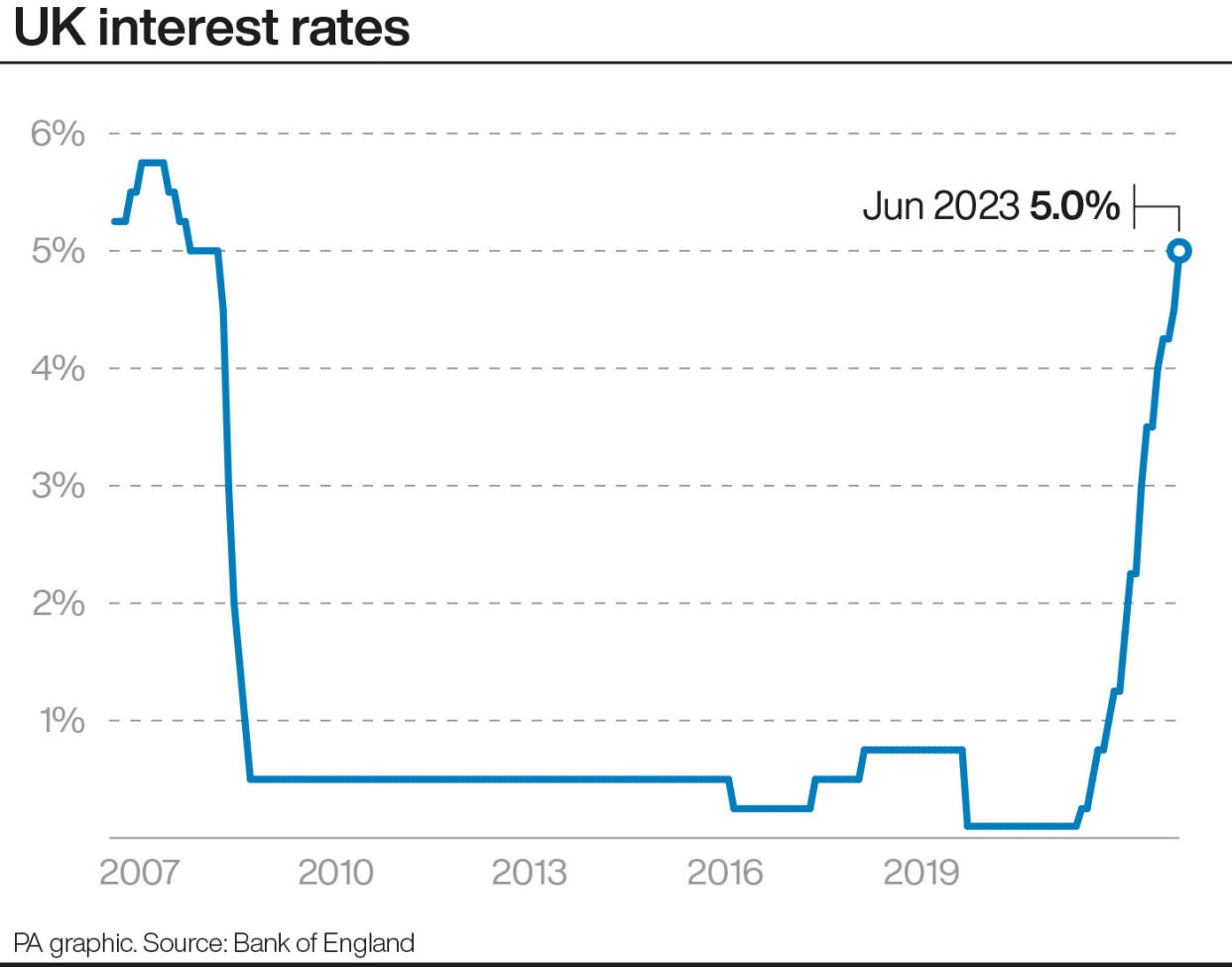

A homeowner has revealed her mortgage has gone up by £480 in the last month after interest rates hit a new 15-year high.

Mum-of-one Leanne Kearey, 33, described her new monthly house payment as “horrific” following the Bank of England’s decision to raise interest rates by 0.5% to 5% last week.

Those who are coming to the end of their fixed-rate deal, or who have a variable-rate mortgage, are now being hit hard by higher interest rates which increase their monthly mortgage repayments.

Kearey’s monthly payments have been hiked from £1,120 to £1,600 after she got a new two-year fixed deal for her home in Chadderton, Oldham, when her current one ended.

Read more: Mortgage rates: What the banks are offering following interest hikes

Kearey, who lives with her husband and young daughter, said: "We were mortified when we found out, it's horrific - how are people meant to live?

"With gas and electricity rates rising constantly too, and the cost of living at an all time high. Something's got to give.

"We’re fortunate that we both have good jobs and a stable income, however this has definitely left us in a difficult position."

Read more: Interest rate rise: Hunt agrees measures with banks after mortgage crisis talks

She added: "This is something we’re having to accept as a lifestyle change now too, the option to expand our family further is currently off the table, we couldn’t afford the cost of the mortgage on any maternity pay, and nursery fees.

"We’re lucky to have what we have, but it’s not without sacrifice.

"It’s devastating to see, and I know others are really struggling financially, it feels like things are only going to get worse."

Watch: Mortgage crisis set to deepen as interest rates hit 5% for first time in nearly 15 years

Kearey is just one of hundreds of thousands of homeowners whose mortgage repayments have become unaffordable due to increased rates.

According to online comparison site Money Expert, around 700,000 fixed-rate mortgages are coming to an end in the second half of 2023, with many homeowners coming off a deal that was significantly cheaper after buying their house when rates were much lower.

Kearey said she and her husband initially planned to remortgage with a better loan to value after undergoing an extension, but they have now discovered that they will be no better off.

Latest news on the mortgage crisis

On Tuesday, Labour will force a Commons vote on its proposals to ease the mortgage crisis, urging Tory MPs to “take responsibility” and back the plan.

Labour’s plan would see banks forced to help mortgage holders struggling with payments, with the party urging the government to compel lenders to allow borrowers to temporarily switch to interest-only payments or lengthen their mortgage period.

Meanwhile, consumer champion Martin Lewis has said it will be a “nightmare year” for some, as people deal with rising mortgage or rental costs.

The MoneySavingExpert.com founder told Good Morning Britain he expected to see increases in mortgage arrears and some people selling up.

Last Friday, chancellor Jeremy Hunt agreed with lenders that mortgage holders struggling with repayments would be given a 12-month grace period before repossessions begin, with borrowers also able to extend the term of their mortgages or move to an interest-only plan temporarily “no questions asked”.