What a 2p national insurance cut means for your finances

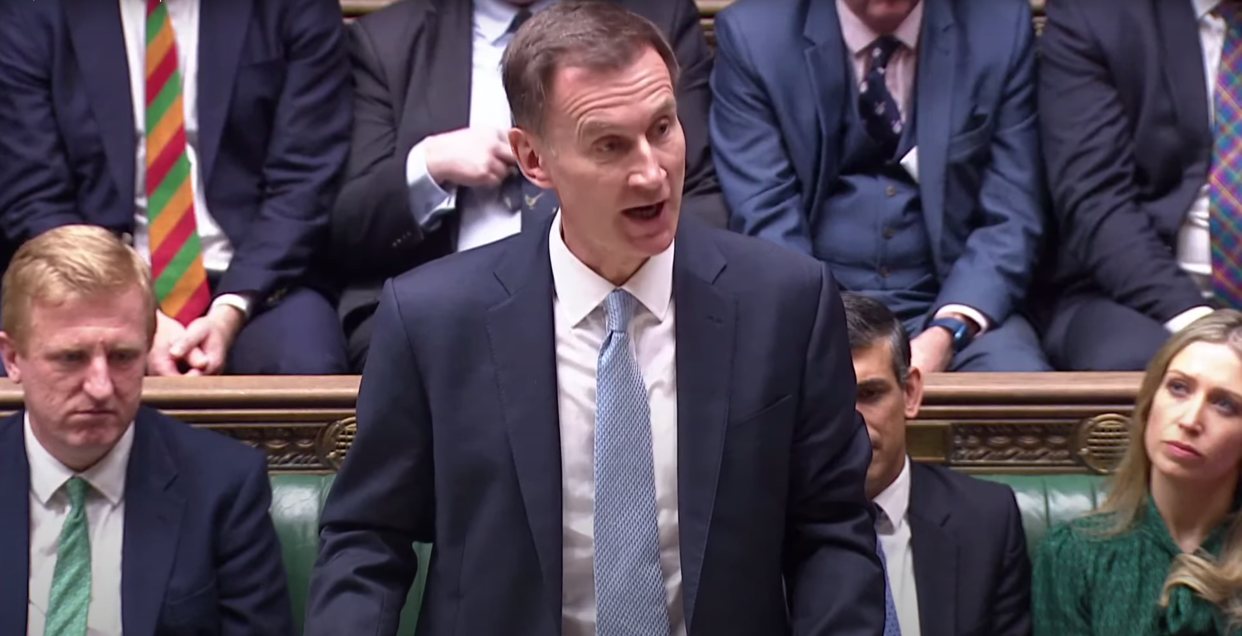

Jeremy Hunt's decision to knock two percentage points off national insurance (NI) for 27 million British workers will kick in this Saturday.

In his spring budget, the chancellor said employee national insurance would be cut from 10% to 8%, and self-employed national insurance contributions from 8% to 6%.

"It means an additional £450 a year for the average employee or £350 for someone self-employed. When combined with the autumn reductions, it means 27 million employees will get an average tax cut of £900 a year and 2 million self-employed a tax cut averaging £650," the chancellor said during his budget speech.

"Changes that make our system simpler and fairer. And changes that grow our economy by rewarding work, he added.

Hunt said the Office for Budget Responsibility (OBR) expects this will put 200,000 more people in work. He added the move will bring personal taxes to their lowest level since 1975.

"This is the second fiscal event where we have reduced employee and self-employed national insurance," Hunt said.

"We have cut it by one third in six months without increasing borrowing and without cutting spending on public services.

"That means the average earner in the UK now has the lowest effective personal tax rate since 1975 — and one that is lower than in America, France, Germany or any G7 country," he added.

Read more: National insurance cuts to take effect with 'average saving' of £900 a year

Employees and self-employed workers currently pay 10% on earnings between £12,570 and £50,270 in Class 1 national insurance contributions.

This was reduced from 12% of earnings in the autumn statement, although the threshold to start paying — £12,570 — is frozen until 2028.

Analysis by the investment platform AJ Bell showed that cutting the national insurance rate by two percentage points from 10% to 8% would be worth almost £250 to someone on a yearly salary of £25,000, with a maximum saving of £754.

How much an NI cut would save you

AJ Bell's director of personal finance, Laura Suter, said: "Hunt has pulled the trigger on the less popular but cheaper way to cut taxes: by slashing national insurance by two percentage points. The move marks the second cut to national insurance for employed workers this year and combined the changes will save those earning £35,000 a year almost £900 on their annual national insurance bill.

“The starter rate for national insurance for employed people, which is charged on the band of earnings between £12,570 and £50,270, has been cut from the current 10% to 8%. In isolation that move saves the average earner around £450 a year and saves those earning £50,270 or more a total of £754 a year.

“But lower earners won’t be celebrating the move. Someone on £15,000 a year will save less than £50 a year on their national insurance bill as a result of today’s reduction — and will save less than £100 a year if you combine today’s cut with the one made in the autumn statement."

Pensioners would not be impacted by a NI cut, nor would those who receive income from savings and investments such as property. Cutting NI is also cheaper than cutting income tax as it only applies to earned income.

Read more: When will interest rates fall and what should you do?

A cut of two percentage points in employee national insurance will cost the government about £10bn a year.

The Institute for Public Policy Research think tank calculated that nearly half the benefit would go to the richest 20% of households, while just 3% would end up in the pocket of the poorest fifth of Brits.

If the chancellor were to cut 2p off National Insurance contributions at the Budget, this would cost £10.4bn in 2024/25.

Londoners would benefit the most (£608 on average), while those in the North East would get less than £1 per day (£342 on average). pic.twitter.com/SrxFBmPjN6— IPPR (@IPPR) March 5, 2024

Rachael Griffin, tax and financial planning expert at Quilter, said: "While a cut in taxes will for some be a needed boost, it hardly turns the dial much considering we are dealing with a historic tax burden at present. However, it will certainly be a crowd pleaser with someone earning £30,000 a year being around £58 better off a month if you also take into account the national insurance cuts in the autumn statement.

"However, many people don’t understand how national insurance works and a cut to income tax would have been easier for all to understand but crucially much more expensive."

Watch: UK Budget: National insurance cut to 8%, Hunt says

Download the Yahoo Finance app, available for Apple and Android.