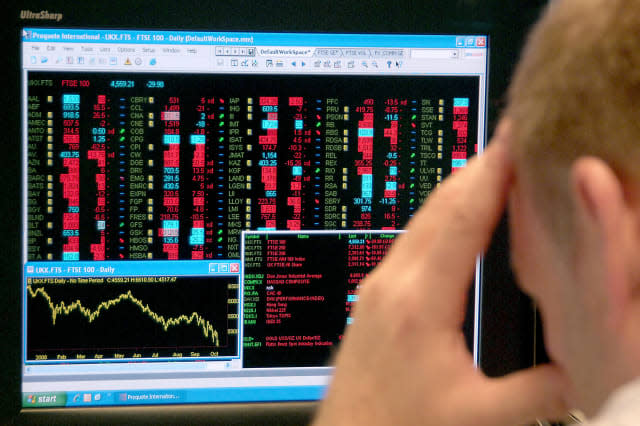

Will the FTSE 100 deliver an election surprise?

The general election campaign has kicked off with the usual round of photo opportunities and election soundbites, but the risk of another hung parliament or a surprise result has seen the FTSE 100 reverse its recent record-breaking gains.

Indeed, I suspect the market may fall further over the coming weeks, before perhaps staging a comeback after the election.

I don't have a crystal ball, of course, but there are some historical precedents. In the month leading up to the last general election - as it became clear that a hung parliament was likely - the FTSE 100 fell by 10%.

In contrast, the index was largely flat ahead of the 2001 and 2005 elections, while it gained 3% in the run-up to Tony Blair's landslide victory in 1997, in a rare example of business welcoming a Labour victory.

Conservative gains?

Historically, the stock market has tended to welcome a Conservative government, as being more likely to cut tax and relax regulation.

Given Labour's threats to inflict tighter price controls on utilities and abolish zero hours contracts, this thesis could hold true in 2015, too, and I'd expect the FTSE to rally if the Tories manage to win an outright majority.

However, as investors, we need to keep things in perspective: ultimately, the outcome of this election is unlikely to have much of an impact on the companies in the FTSE 100, many of which do much of their business abroad.

Good stocks at a reasonable price

News coverage of the FTSE 100's recent all-time closing high of 7,037 ignored one key factor: inflation.

If we factor in the effects of inflation, the FTSE 100 would have to rise to around 9,500 to match its previous high of 6,930, which was recorded in December 1999.

Back then, the index was obviously overpriced, but today, I don't think it is.

The FTSE 100 currently trades on a P/E of 15.4, with a dividend yield of 3.5%. Dividend cover across the index is a healthy 1.9, suggesting this payout is secure.

The only real risk to this valuation, in my view, would be a sustained round of earnings downgrades at some of the index's biggest companies, which would leave their shares looking overvalued.

There's no doubt that sluggish global growth makes this a possibility, but personally, I think being out of the market and missing out on the FTSE's 3.5% yield is a bigger risk.

In my view, investing in carefully chosen stocks alongside a FTSE 100 index tracker is the best way to produce steady returns over longer periods.

If you'd like to learn more about this approach, I'd urge you to take a look at this special Motley Fool report, "7 Simple Steps For Seeking Serious Wealth".

This free, no-obligation report explains how you may be able to build a market-beating stock portfolio using a simple, repeatable strategy.

Best of all, following this strategy could take as little as 20 minutes per month.

For immediate access to this free report, click here now.

Read more on AOL Money

Is the FTSE 100 on a downward spiral?

Which way will UK interest rates go next?

Reassessing: am I investing in the right way?