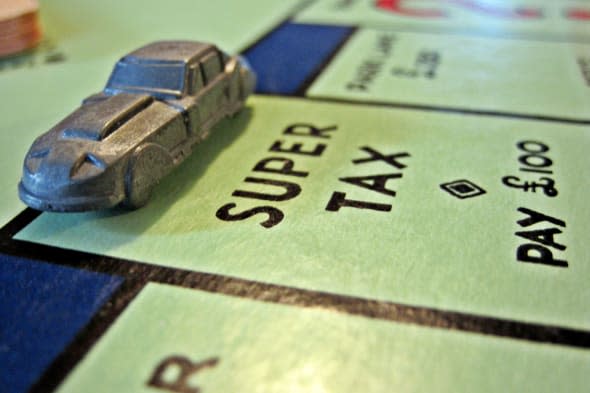

Take a tip from the government and tax yourself

Tax is a tool for the government to generate revenue and control negative habits, but if we take a tip from the taxman we could also use it to our benefit.

Ask a smoker about the cost of cigarettes and they'll tell you the price is extortionate. Of course the cost of producing, marketing and selling cigarettes hasn't gone up hugely, the tax has (apparently the average pack of 20 cigarettes now costs £8).