What will happen to inflation and interest rates?

Following the latest inflation figures, this is what the bank, the markets and the experts think may happen to inflation and interest rates over the coming years.

The annual rate of inflation, as measured by the Office for National Statistics' Consumer Prices Index, fell to 2.4% in April, down from 2.8% in March. But it's still above the Bank of England's target of 2%.

The inflation dilemma

In his final Inflation Report as Governor of the Bank of England, Sir Mervyn King said the bank forecast that inflation would drop to its target of 2% within two years. That's a downward revision of the Bank's February forecast, when it said inflation would only drop to 2.3%.

Sir Mervyn justified the Bank of England Monetary Policy Committee's (MPC's) failure to meet its 2% target by saying: "Attempting to return inflation to target too rapidly would result in even slower growth and higher unemployment."

He continued: "But allowing inflation to stay high for too long could cause households and businesses to begin to doubt the MPC's commitment to meeting the inflation target, putting at risk medium-term price stability. Our job is to strike the appropriate balance between these risks."

Interestingly, an average of forecasts compiled by the Treasury finds that they predict inflation will still be above the 2% mark (at 2.2% to be precise) in 2017.

New figures from the Office for National Statistics show annual growth in average regular pay at 0.8% in the three months to March, compared to the current Consumer Prices Index annual inflation rate of 2.4%.

The Centre for Economic and Business Research is forecasting average total pay growth of 1.3% across 2013, so the pay squeeze is set to continue for some time yet.

How to give yourself a pay rise

More QE on the way?

Sir Mervyn refused to rule out more quantitative easing (QE) – the purchase of Government bonds (also known as gilts) designed to pump more money into the economy – in the future. Indeed, he's been actively voting for it at recent MPC meetings.

This could further drive down annuity rates for new retirees, at least in the short term, as annuity incomes are pegged to the price of Government bonds, which are going up due to QE.

Of course, all of these forecasts could be thrown off course by events in the wider world. Shortly before he left his final press conference, Sir Mervyn said: "We are very much dependent on what happens in the rest of the world including what happens in the euro area. If slow growth in the euro area persists and continues, that is going to make it much more difficult for us to get out of the difficulties that we have."

Interest rates

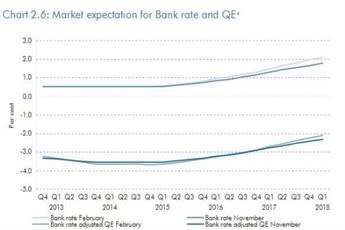

Sir Mervyn also referenced the fact that the money markets are predicting the Bank of England base rate will remain below 1% for the next four years. Those forecasts predict base rate will remain at 0.5% until the second half of 2016, as the chart below shows.

(a) The February 2013 and May 2013 curves are estimated using overnight index swap rates in the fifteen working days to 6th February 2013 and 8th May 2013 respectively

Source: Bank of England and Bloomberg

The independent Office for Budget Responsibility (OBR), which provides analysis of the UK's finances to the Government, said the market expectation was that rates would rise more quickly in its March Economic and fiscal outlook. It forecast them rising to 2% by 2017. But this would still mean a record low for six years. Here's the OBR's chart.

Meanwhile, an average of the predictions of independent forecasters – ranging from banks to economic research groups to data companies – compiled by the Treasury has rates rising to 2.50% by 2016.

Sir Mervyn said: "I'm certainly not happy about the prospect that rates will stay low for so long. I would like to get back sooner rather than later to a world of much higher interest rates, more normal levels of interest rates.

"But it won't be the lack of a wish to do that that creates the problem; it's the state of the economy. And once the economy improves then it may be possible to raise rates sooner than the current market expectation."

Fixed interest rates in the future?

His incoming successor, Canadian Mark Carney, has a reputation for announcing a future path for interest rates in advance, based on the belief that there will be broader economic stability.

That could provide those of us looking at taking out a mortgage or thinking about moving home with some firmer ground in making a decision.

For savers already struggling with low interest rates, the longer-term picture at present is not a rosy one. The extension of the Funding for Lending scheme announced in April and the forecasts above only add to the feeling that savings rates will remain low for the foreseeable future.

See the latest mortgage rates and get expert advice

%VIRTUAL-SkimlinksPromo%