What is the Bernanke review and what did it find?

Former Federal Reserve chairman Ben Bernanke has recommended that the Bank of England makes a series of changes to how it makes economic forecasts.

Here we explore why this review was called, what the changes are and how the Bank currently runs its forecasts.

– What is the Bernanke review about?

The Bank of England’s Monetary Policy Committee (MPC) meets eight times a year to set interest rates.

Every other time the committee meets it also releases what is called the Monetary Policy Report. This includes many things, including predictions about what might happen in the economy over several years.

It is these forecasts and how they are compiled that Dr Bernanke assessed in the review.

– Why was the review called?

In recent years, as the economy was volatile and hard to predict, there has been a feeling that the Bank’s forecasts were not as reliable as might have been expected.

In November, for instance, the House of Lords Economic Affairs Committee said that the Bank had over-relied on “inadequate forecasting models”.

That came months after the Bank in June said that it would launch a review to “strengthen” its support for the MPC’s forecasting.

It later appointed Dr Bernanke, the Nobel-prize winning economist who led the US Federal Reserve during the financial crisis of 2007 and 2008.

– What did the review find?

The review said that many parts of the way that the Bank makes its forecasts are flawed. It directed particularly sharp criticism at some of the software which is simply out of date.

It made 12 recommendations for how the Bank’s processes could be improved. They include getting better software, eliminating the fan charts the Bank publishes, put less emphasis on the forecast for what might happen to interest rates and publish alternative scenarios.

– What are some of the scenarios the Bank currently uses?

When the Bank forecasts what might happen with inflation, or gross domestic product (GDP) or unemployment it needs to make assumptions about what is going to happen in the future.

One of the things it needs to take into account is the interest rate that the MPC itself sets.

It therefore sets out two scenarios about what might happen to interest rates. The first assumes that the Bank does not change rates over the next few years.

The other scenario the Bank uses is based on what the market thinks will happen to interest rates.

– What is the downside of the “constant interest rate” scenario?

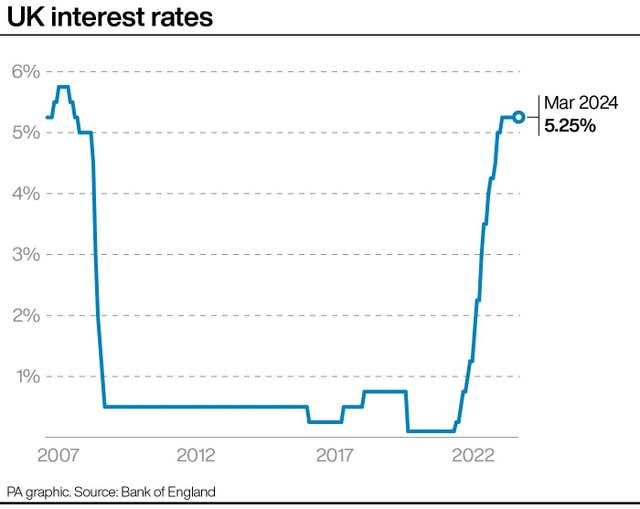

Assuming that the interest rate will not change can be useful in periods of stability. For instance between March 2009 and August 2016 there were no changes to the rate and between 2016 and 2021 the few changes that happened were fairly small.

However, since December 2021 rates have been hiked 14 times and now are expected to be cut several times in the years to come, making the “constant rate” scenario less useful.

– What is the downside of the “market-implied rate” scenario?

Basing the forecast on what markets think will happen to rates is more likely to take into account possible changes that might come, but it has downsides too.

One of these downsides is that the Bank’s report and rates decision can change the market’s expectation. That means that a forecast can make itself “immediately out of date” when it is released.

There are other downsides, including the fact that the market-implied rate is calculated as an average over a period of four weeks before the MPC meets, so it is sometimes out of date even before the meeting happens.

– What is the alternative scenario?

Many other central banks publish their own forecasts about what might happen to rates in the years to come.

Obviously this could be seen as problematic because the same people forecasting the rates are the ones who later decide what happens to rates.

However, such a system would solve some of the problems in the Bank’s current scenarios.

In his review Dr Bernanke said that this was “not a formal recommendation”.