Firms and individuals should pay tax due, says May after 'Paradise Papers' leak

Theresa May has said individuals and businesses should "pay the tax that is due" in response to the "Paradise Papers" leak of secret documents laying bare the financial affairs of the global elite.

The Prime Minister refused to commit to introducing a public register of who owns offshore companies and trusts in British tax havens or opening a public inquiry into tax avoidance.

Mrs May was responding to the disclosure of 13.4 million documents which reportedly tie major companies and political figures to secretive overseas arrangements.

It includes claims that the Queen has £10 million of her personal fortune invested in an offshore tax haven.

There is no suggestion that those involved acted illegally.

Asked whether she would insist on public registers for British tax havens and a public inquiry into aggressive tax avoidance, Mrs May told the CBI annual conference in London: "We have been continuing the work that David Cameron started and he started it not just for the UK but on an international stage as well, and that's important.

"So we have seen more revenues coming to HMRC over the last few years, since 2010 £160 billion extra that they have been able to raise.

"But we do work, there's already work that's been done to ensure that we see greater transparency in our dependencies and British overseas territories and we continue to work with them.

"HMRC is already able to see more information about the ownership of shell companies, for example, so that they can ensure that people are paying their tax. We want people to pay the tax that is due."

Labour has said a public inquiry is urgently needed to restore public confidence in the tax system.

The shadow chancellor says if overseas territories want relationship with UK they have to abide by min standards of transparency #r4todaypic.twitter.com/uPt1HxTxc5

-- BBC Radio 4 Today (@BBCr4today) November 6, 2017

Shadow chancellor John McDonnell told BBC Radio 4's Today programme: "These papers have revealed widespread massive tax avoidance.

"To have such a large number of rich individuals avoiding their taxes means that we don't have our taxes to pay for vital public services like the NHS, like education, like the care of our children by local councils.

"We called for a public inquiry 18 months ago into tax avoidance and we desperately need it now to restore confidence in our taxation system."

#ParadisePapers isn't a surprise. Only last week @Peter_Dowd raised the Tories' vote in #FinanceBill to protect non-doms' off-shore trusts. pic.twitter.com/DINSUOXiEM

-- Labour Treasury (@labourtreasury) November 5, 2017

Among those said to be named in the papers are former Tory treasurer Lord Ashcroft and US president Donald Trump's commerce secretary, Wilbur Ross, who is reportedly linked to a Russian firm.

The Duchy of Lancaster, the private estate of the Queen, was found to have millions of pounds invested in offshore arrangements.

About £10 million from the Queen's private fund was paid into funds in the Cayman Islands and Bermuda between 2004 and 2005, according to reports.

A small part of the money was traced to a lender which has previously been criticised for ripping off poor customers.

#ParadisePapers - 13.4 million documents, 94 media partners, more than 120 politicians and world leaders. https://t.co/lHHyt9eLTSpic.twitter.com/mecTosLSxD

-- ICIJ (@ICIJorg) November 5, 2017

The Queen voluntarily pays tax on any income she receives from the Duchy.

A spokesman for the estate said: "We operate a number of investments and a few of these are with overseas funds.

"All of our investments are fully audited and legitimate."

'Our work is not yet done.' Support ICIJ's next #ParadisePapers and have your donation matched! - https://t.co/aHzIpEl2Ml#newsmatchpic.twitter.com/fvYqnJllDT

-- ICIJ (@ICIJorg) November 5, 2017

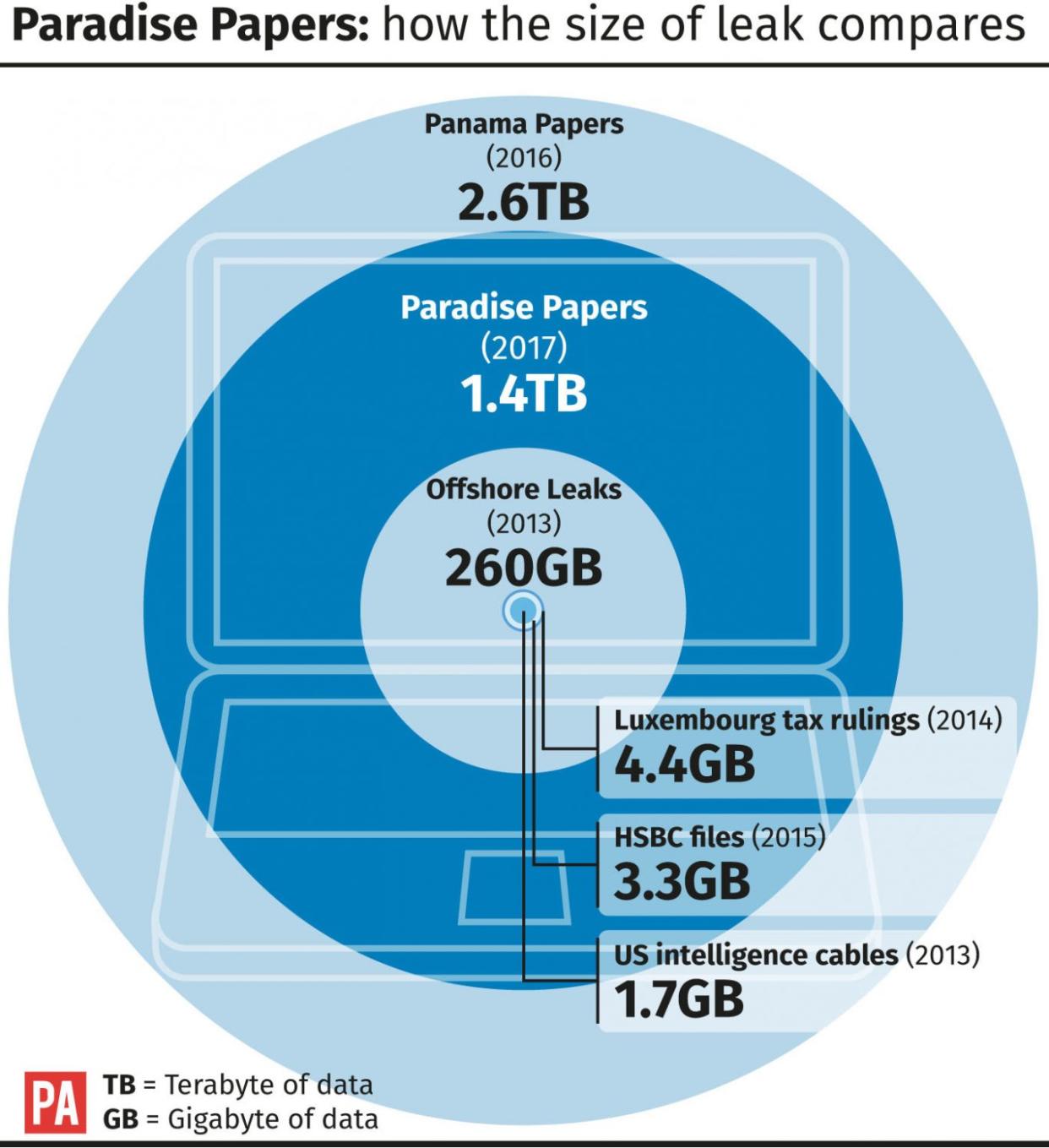

The Paradise Papers represent the biggest data leak since the Panama Papers release last year, and have been analysed by almost 100 media organisations.

Hundreds of individuals and companies reportedly have had their overseas investments exposed by the files, which are also said to reveal that major global companies have exploited offshore schemes to avoid tax.

First obtained by the German newspaper Suddeutsche Zeitung, the documents stem from two offshore service providers and company registries from 19 tax havens, the Guardian reports.

The International Consortium of Investigative Journalists oversaw the project.

(function(i,s,o,g,r,a,m){i['GoogleAnalyticsObject']=r;i[r]=i[r]function(){(i[r].q=i[r].q[]).push(arguments)},i[r].l=1*new Date();a=s.createElement(o),m=s.getElementsByTagName(o)[0];a.async=1;a.src=g;m.parentNode.insertBefore(a,m)})(window,document,'script','//www.google-analytics.com/analytics.js','ga');ga('create', 'UA-72310761-1', 'auto', {'name': 'pacontentapi'});ga('pacontentapi.set', 'referrer', location.origin);ga('pacontentapi.set', 'dimension1', 'By PA Reporters');ga('pacontentapi.set', 'dimension2', '74356a40-34c9-4d20-8d2b-78fefc7ffc5f');ga('pacontentapi.set', 'dimension3', 'paservice:news,paservice:news:uk');ga('pacontentapi.set', 'dimension6', 'story-enriched');ga('pacontentapi.set', 'dimension7', 'composite');ga('pacontentapi.set', 'dimension8', 'paasset:graphic,paasset:video');ga('pacontentapi.set', 'dimension9', null);ga('pacontentapi.send', 'pageview', { 'location': location.href, 'page': (location.pathname + location.search + location.hash), 'title': 'Firms and individuals should pay tax due, says May after \u2018Paradise Papers\u2019 leak'});