This is all you need to know about gold right now: it's a bull market

This week we turn our attention to the asset class that can either make you or break you: gold miners.

2016 has been one of their better years. Can it continue?

Let's get the most important information up front: it's a bull market.

That's all you need to know about any market, really. Is it a bull market or is it a bear market? Anything else is just noise and flannel.

Gold mining stocks are overbought. But they could stay that way

Let's use the US-listed exchange-traded fund (ETF), GDXJ, as our benchmark. GDXJ tracks the share price of the small- and mid-cap gold producers (there's a UK-listed version as well, by the way, with the same ticker).

The low came in January: $16.87 was the price. Last week we touched $50. So, from low to high, it's been about a 200% gain. I don't know if any other sector has done that well this year, but I doubt it.

Normally, if you hear that a particular asset has tripled, your first instinct might be to not touch it with a barge pole. It's a party that you missed out on – tough luck – but there's no point getting involved now. All that's left is the hangover and the mess. You want nothing to do with either.

And there's plenty of evidence to back up this instinct, should you be feeling it. Almost every technical indicator is suggesting gold stocks are, to use the parlance of the trader, "overbought". RSI (relative strength index), MACD (moving-average convergence/divergence), stochastics – they're all near the top of their ranges.

Meanwhile, on the ground, or should I say, "in the ground", there are other warning signs. Companies with assets that are unlikely to ever become mines unless the price of gold goes above about $5m, or with management teams that are either incompetent or crooked, or both, are all raising capital.

Indeed, they're not just raising capital, they're having it offered to them – thrown at them, even.

Last year the taps were turned off and they had to go without. It seemed that the traditional values of prudence, caution and penny-pinching had made a welcome return to the sector.

Now the flash Harrys from Vancouver with the white teeth and the gold bracelets are back in town, and they're staying at the Savoy. You, the shareholder, are paying for it.

But this is a bi-polar sector and, in mining, such characters and antics are par for the course. That the dross is now raising capital is a warning sign, but it doesn't mean it's the end of the bull market.

Gold itself seems to be enjoying a post-Brexit breather and, while it does, we can expect its miners to do the same. Big moves tend to consolidate either in price or in time – or a bit of both.

If something goes from ten to 100, it might then need to come back to 50. But if it can meander around 80 for a few months, then it is consolidating at a higher price. Structurally, that's what you want to see in a bull market.

If gold, currently at $1,320 an ounce, can meander around here for a while, that would be constructive. It might even need to fall a bit – perhaps as low as the $1,250s or $1,260s. The miners could come back as much as 20% – it sounds like a lot, but these are volatile beasts. Such action, if it occurs, could actually be positive in the grander scheme of things.

Then again, the price could just as easily keep on pushing higher. It's a bull market and that's what bull markets do sometimes, particularly golden ones.

Getting some perspective on the gold sector's spectacular gains

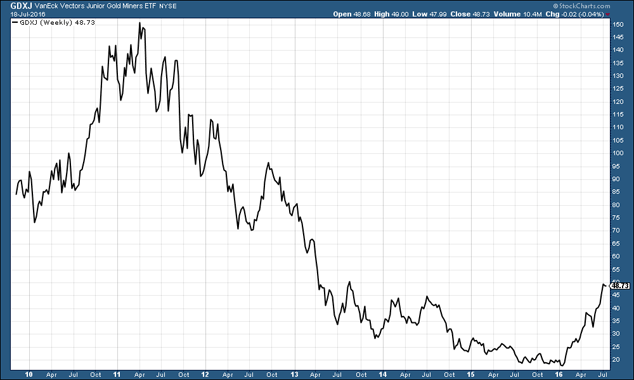

I wanted to show you a longer-term chart of the junior and mid-cap producers to put the move we have seen this year in some kind of perspective.

This chart goes back to 2009.

You can see that in 2016 the price has done little else but go up. But this is a rebound from a level at which gold miners were the most oversold they've been, just about ever. Things were even worse than they were in 1999.

In the grand scheme of things we're not even at the 2013 highs. GDXJ hit $150 in 2011 – three times where it is today. In other words, there is plenty of room for the miners to go a lot higher.

The boring academic in me wants to see sideways consolidation for a few months. The greedy bastard wants to see higher and higher prices. The bear is warning that good times like this don't last – take cover. Welcome to the inner demons of a market participant. Welcome to the wall of worry.

It all brings me back to my first point. It's a bull market. That's all you need to know. In a bull market you want to be long. It's a bull market until it isn't.

If you don't have a position, and we get some consolidation, the market gods will be giving you the chance you need. But we may not get that consolidation. As always, the best solution is pound cost averaging – drip in a little each month until you reach the required exposure you want in your portfolio.

I wrote about some more specific tips in MoneyWeek magazine earlier this year. In a coming issue next month, I'll be providing an update on what I think you should do with them now if you bought in. If you're not already a subscriber to the magazine, I humbly suggest that you sign up now – it'll be worth it.

• Dominic Frisby will be performing his show, Let's Talk About Tax, at the Edinburgh Festival this August.