We'll be worse off no matter who wins the election

Average incomes are set to fall whoever leads the next government, the Institute of Fiscal Studies (IFS) has said, as it published analysis of the tax and benefit plans of the main parties.

The economic think tank reviewed the Conservative, Labour and Liberal Democrat manifestos and produced a damning report on the findings, accusing all sides of ignoring major problems with the tax system, plucking anti-avoidance targets "from thin air" and leaving voters none the wiser on the realities of the next Parliament.

Amongst the criticism was a claim Labour's tough rhetoric on spending cuts was not matched by its announcements. Cutting the winter fuel allowance for higher rate taxpayers was dubbed "fiscally irrelevant" and a 1% cap on child benefit increases raises "literally nothing" because of low inflation.

The mansion tax on homes worth more than £3 million could have to be set at more than £16,000 a year to deliver the £1.2 billion Labour is seeking, the research indicated.

Meanwhile, Conservative policy on benefits has a £10 billion gap which will be "neither painless nor easy" to fill, while the party's planned cut to inheritance tax lacks any clear "economic or social rationale".

Asked if any of the manifestos offered voters sound, evidence-based policy IFS director Paul Johnson admitted the think tank was "struggling" to find much to approve of.

He said: "Labour would abolish the shares for rights scheme.

"Obviously you have a choice about the benefits system - getting rid of the bedroom tax, whatever the right name for it is, is clearly not necessarily a 'bad' policy. Clearly, we are struggling."

He added: "It's very easy to be even handed (with criticism). In a sense there are lots of similarities - they have all ruled out increasing the main rate, they have said effectively the same about pensions.

"We do try to be even handed but on the whole we don't find that challenging."

In its briefing note, the IFS said: "With significant deficit reduction still to come, households can expect the tax and benefit changes implemented over the next Parliament to reduce their incomes, on average.

"There are large differences between the Conservatives, Labour and the Liberal Democrats in how they propose to do this.

"But they share a lack of willingness to be clear about the details and an inability to resist the urge for piecemeal changes which would make the overall system less efficient and coherent."

Overall, they said the Tories would cut taxes but also cut benefits. By contrast, Labour would protect benefit spending but increase taxes to pay for it.

The Liberal Democrats would plot a middle course.

The promise from both the Tories and Lib Dems to increase the personal allowance to £12,500 is of "most value to those in the middle and and upper-middle of the income distribution".

The IFS said 44% of adults already earned too little to pay income tax, while two-earner households would gain most of all.

Labour's proposed tax cut, via a new 10p starter rate, is criticised as lacking "any economic justification" as it "would be worth only 50p a week to most taxpayers" based in plans to pay for it by scrapping the marriage tax allowance.

Labour's plan to restore the 50p rate would raise "very little", with £100 million the current estimate.

The IFS concluded: "None of the parties is suggesting sorting out real problems in the income tax system."

Plans by both the Conservatives and Labour to increase tax on wealthy earners' pension contributions "harm the coherence" of pension taxes and both parties' plans would "significantly complicate" the system.

On benefits, the IFS said there was "remarkable cross-party agreement" on protecting pensioner benefits.

It added: "Despite being used as examples of 'tough choices', Labour proposals to remove winter fuel payments from higher-rate taxpaying pensioners and limit cash increases in child benefit to 1% this year and next would save next to nothing.

"More than two years after first announcing a desire to cut £12 billion from the social security budget in 2017/18, the Conservatives have provided details of just a tenth of this.

"It is hard to see how such savings could be achieved without sharp reductions in the generosity of, or eligibility to, one or more or child benefit, disability benefit, housing benefit and tax credits."

Rising pension bills mean unprotected benefits could be cut to 1990/91 levels on Tory plans.

The IFS offered polices which could raise the money. Abolishing child benefit altogether and adding compensation to universal credit could raise £5 billion, while reducing the child element of universal credit by 30% could save another £5 billion. Making all housing benefit claimants pay 10% of their rent could raise £2.5 billion.

The IFS said it reached conclusions on Labour's mansion tax based on the plan to charge £3,000 a year on homes in the £2-3 million bracket and a goal to raise a total of £1.2 billion in revenue.

In addition, Labour's announcement of a stamp duty holiday for first time buyers is likely "at least in part to increase house prices".

The think tank expressed disappointment at the failure to commit to a wider revaluation in the council tax system, saying no party had the "courage" to resolve the "absurd" system.

It added: "Fixing council tax would be preferable to layering a separate tax on top of it."

Senior research economist Robert Joyce said: "The Conservatives have continued to fail to explain how they would achieve the substantial cuts to social security they say they would deliver in the first half of the coming Parliament. These will be neither easy nor painless to deliver.

"Meanwhile Labour claims to be taking tough decisions by removing either fuel payments from a small fraction of pensioners and limiting child benefit increase to 1%.

"The former will save almost nothing - about one pound in a thousand spent on pensioner benefits. The latter is likely to save literally nothing.

"The manifestos have not helped us towards a sensible debate on the future generosity or structure of the benefits system."

Senior research economist James Browne added: "Just because a tax rise hits 'the rich' or is labelled 'anti-avoidance' does not necessarily mean it is harmless."

Liberal Democrat General Election campaign spokesman Brian Paddick said: "The IFS have been absolutely clear. Tory plans to slash the welfare budget by £12bn are 'regressive', 'undeniably painful' and hit the poorest the hardest.

"They also describe Labour's bid to reintroduce the 10p tax rate as pointless, and not as fair or worth as much to those on low incomes as Liberal Democrat plans to raise the income tax threshold.

"It just goes to show the Liberal Democrats are right to make a stability budget, to take place within 50 days of election day, as a pre-condition of any coalition arrangement."

More on AOL Money:

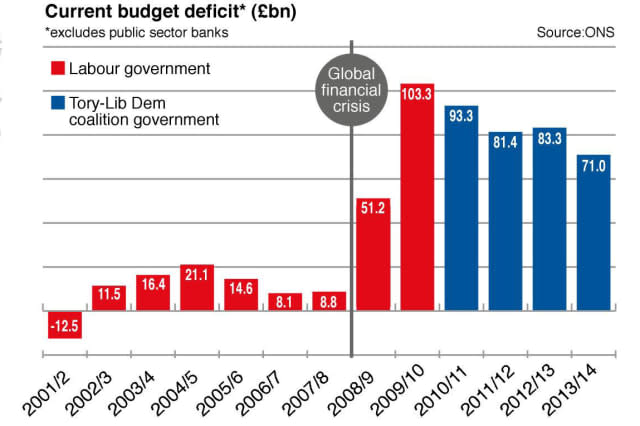

How parties plan to tackle deficit

Politicians plus maths equals the wrong answer

Where the parties stand on the NHS