Budget 2015: key points

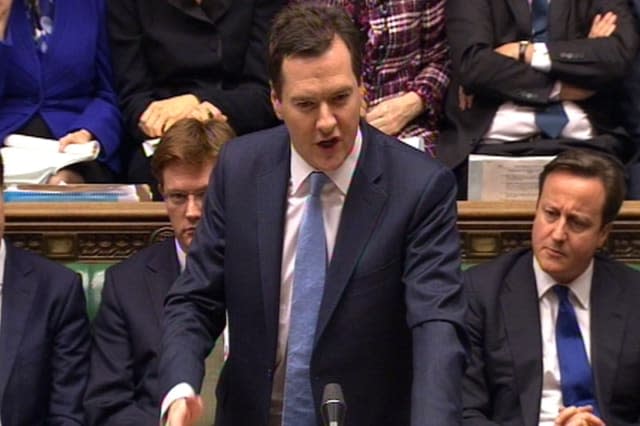

Here are the key points announced in George Osborne's final speech before the general election. As such, there were giveaways to both the 'grey vote' and aspiring homeowners.

Please note this page is no longer being updated

HEADLINE ANNOUNCEMENTS :

Help-to-Buy ISA launched: For every £200 you save for deposit, govt will add £50

First £1,000 of interest earned on all savings will be completely tax-free

The Personal Savings Allowance "will take 95% out of savings tax altogether"

Pension lifetime allowance cutfrom £1.25m to £1m

Existing pensioners allowed to cash in their annuities as well

Income tax threshold rises to £10,800 next year, £11,000 year after

Petrol duty frozen again

Annual tax return abolished

LATEST NEWS:

Nice visual aid from the BBC, summing up the key changes:

Here are the main points of UK's #Budget2015: http://t.co/feSKMV4DJMpic.twitter.com/5KGIdNMKSa

- BBC Breaking News (@BBCBreaking) March 18, 2015

Miliband's turn to talk now. He says "there's never been such a large gap between the chancellor's rhetoric and the reality of people's lives"

In case you missed it, here was David Cameron's attempt to mock Ed Miliband over his now infamous second kitchen:

And the headline giveaway, aimed at luring young voters: Osborne announces the Help-to-Buy ISA. For every £200 you save for your deposit, the government will top it up with £50 more. A phenomenal offer

Huge boost to first-time buyers. You save £12,000 Government gives you £3,000

- steve hawkes (@steve_hawkes) March 18, 2015

Big news on ISAs: You can now withdraw funds and invest them again without losing tax-free status

From April next year the first £1,000 of interest earned on your savings will be completely tax-free. Called a Personal Savings Allowance. "To ensure higher rate taxpayers enjoy the same benefits, but no more, their allowance will be set at £500".

Higher rate threshold rises to £43,300 by 2017/18

Income tax threshold rises to £10,800 next year, then £11,000 the year after

BEER DUTY KLAXON: 1p off a pint announced, 2p off cider

The annual tax return has been abolished. "Tax doesn't have to be taxing, " says Osborne

Chancellor cuts North Sea oil taxes as expected, with Petroleum Revenue Tax cut from 50% to 35% in 2016

"That's our policy! Our policy!" shouts Miliband as Cx announces plans to let Mayors keep more local business rates

- Matthew Holehouse (@mattholehouse) March 18, 2015

Banks will also be stopped from deducting compensation they make to customers for mis-sold products from corporation tax

Targeting banks: The bank levy will rise to 0.21%, raising an extra £900m a year

"The era of people who don't pay their fair share of taxes has come to an end", says Osborne.

Lifetime allowance to drop to £1 million from £1.25 million

Debt as % of GDP: 80.4% in 2014-15 80.2% in 2015-16. 79.8% in 2016-17 77.8% in 2017-18 74.8% in 2018-19 71.6% in 2019-20

- Ed Conway (@EdConwaySky) March 18, 2015

Good economic news: In 2018-19, Britain will have a budget surplus of 0.2%; followed by a forecast surplus of 0.3% in 2019-20

In lighter news, Osborne has confirmed we're getting a new £1 coin, which looks a little something like this:

Osborne: We will lock in the historically low interest rates for the long term. BoE inflation stays at 2% #Budget2015

- BBC Business (@BBCBusiness) March 18, 2015

As we already heard yesterday, minimum wage hike to £6.70 in October confirmed

"The facts show households on average will be around £900 better off in 2015 than they were in 2010."

1,000 new jobs created every day. "Britain is working again," boasts the chancellor

Growth for 2015 expected to be 2.5%

Office for Budget Responsibility confirms that Britain's growth in 2014 was 2.6%

"This Budget will take action to reward pensioners and savers," he adds

"Britain is paying its way" begins Osborne. Still not cancelled out that deficit though...

Osborne has now stepped up to deliver his Budget speech

PMQ's currently underway. Usual blarting from Cameron and Miliband

George Osborne is due to give his speech at 12:30

A quick read on why this Budget speech will be made with (more than) one eye on the upcoming election

Osborne has taken to Twitter to set the tone for his Budget speech.

Today we set out the next stage in a plan that is working, with a Budget that works for you. We will deliver a truly national recovery

- George Osborne (@George_Osborne) March 18, 2015

He'll have a job on his hands winning over some people today. In fact, a recent poll found that 61% didn't trust the chancellor.

BACKGROUND:

Here are some headline measures to look out for:

Pension freedoms extended?

As you're no doubt aware, anyone set to retire now has the freedom to choose how to spend their wealth, rather than being forced into taking out an annuity. Osborne is thought to be considering extending this to the 5 million pensioners who have already cash in their annuities (and thus unable to take advantage of the new rules).

Personal tax thresholdhike

The tax-free personal allowance will almost certainly raised further, potentially as high as £11,500 (it currently stands at £10,000.

Higher tax rate increased too?

The point at which you pay 40% income tax currently stands at just under £42,000, but Osborne could look to woo voters by hiking this as high as £50,000.

Inheritance tax changes

It's already been reported that George Osborne is planning to allow parents to leave homes worth up £1 million to their children without paying inheritance tax. Keep an eye out for more details on that front, although it's believed any change will will not come into effect for some time yet.

Business rates review

Although business rates are a big earner for the treasury (around £25bn a year), many feel the rates are restrictive an place an unfair on small firms in particular.

George Osborne already announce plans to review the rates in his Autumn Statement last December, but will likely flesh out the plan in today's speech

Beer duty cut

Surprising how popular this is, given how little it actually saves us (and thus how little it costs the Treasury). As such, you can be almost certain the chancellor will announce a further 1p or 2p reduction to beer - potentially cider and spirits as well.

And here's some Budget background reading:

Will you be a Budget winner or lose?

Are elections bad news for the economy?

Budget 2015 predictions