How to stop elderly parents being scammed

Every day, in many ways, older people are targeted for money. From bogus calls and mail to dodgy financial advisors, here are the scams to watch for, and signs your parents are being targeted.

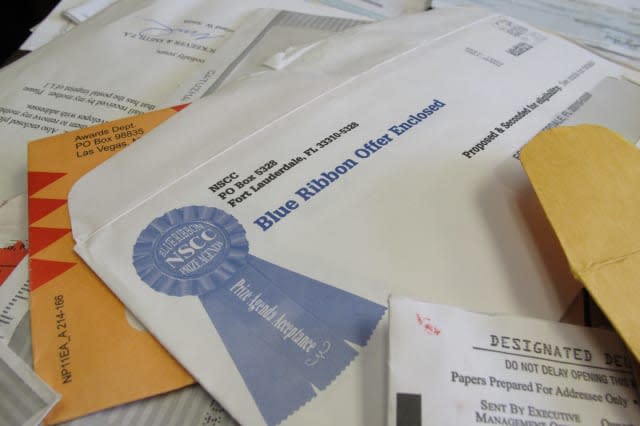

Scam letters in the post

I will never forget the tragic story of a man who was going through the estate and belongings of his dad, who had just died in his 90th year. Instead of the collection of old photographs and treasured mementos you would normally expect to find, the son found that his father – completely unknown to him – had literally sackloads of mail from firms telling him he had been entered into prize draws and begging letters.

Examination of his dad's bank account revealed that he had been paying out thousands of pounds for years to these firms and hadn't received a penny in return. Nearly all his money had gone this way and perhaps the stress and the worry of being systematically conned had hastened his end.

There was nothing the son could do but report these firms that had targeted his dad with bogus prize draws and begging letters to trading standards. But as they were invariably based overseas there was little even the authorities could do.

This is an extreme example of what can happen to elderly parents who are targeted by the scammers, but it happens in all sorts of different guises each day.

How can your parents avoid it, what are the main threats to their financial wellbeing, and what are the tell-tale signs to watch for?

Protect yourself from the new phone scam

The lottery scam

This is a remarkably straightforward, longstanding but disturbingly effective scam. The victim is contacted by phone, email or – in the case of the elderly – by post and told that they have won a prize. Usually this involves a purportedly foreign lottery such as the Spanish or Canadian. Unusually, the victim hasn't actually purchased any ticket but has been selected at random as a winner.

Of course it may seem ridiculous to think that you could win a lottery based outside the UK without ever buying a ticket; after all, what would be the point to the organisers of giving their money away without any return?

However, as one trading standards officer explained to me, many elderly people are intrinsically trusting and this is why they are targeted.

In return for the prize, the lottery organiser asks for 'administration fees and taxes' to be paid in advance – normally by money transfer – before the supposedly large cash prize is released to the winner (make that 'victim'). And yes, you guessed it, the administration fees and tax money disappear into the pocket of the scammer and the cash prize is never released.

Often it is surprisingly successful people who fall victim to this scam. I once spoke to a retired company director who lost £21,000 through a Canadian lottery scam. He was strung along by the fraudsters and kept receiving requests for more and more cash to cover fees and taxes until the victim realised they had been had.

After the last payment he was told that someone would be arriving at his house with a cheque and a bunch of flowers for his wife and guess what? No one ever came.

The bogus prize draw

A variant of the lottery scam is a prize draw with lots of fabulous sounding prizes but with a bang ordinary one hidden in the middle such as "win a car, speedboat, holiday villa, necklace or £50,000 a year for life". Spot the odd one out on this list? Yes, the necklace. There may be no car, villa or cash to be won but there are undoubtedly thousands of tatty worthless necklaces.

The victim responds again to a request to a 'prize administration fee', which can be in the hundreds of pounds but the prizes look so good that that seems a price worth paying. Only when they hand over the cash do they get the necklace or some other worthless item. This scam is illegal but again, like lottery fraudsters, very few of the crooks are actually caught.

Spotting phishing scams

This scam plays on people's greed and also in some cases their goodwill. An email or letter is received, purporting to be from someone in trouble – often based overseas – who asks to be able to access a bank account through which they want to filter their life savings. In return, they offer a one-off payment, normally of spectacular proportions for effectively helping them launder their money.

However, like the lottery scam, there are upfront fees to be paid to help with the transfer of funds and if they are given bank account details these are often used to empty them of funds.

The likes of Trading Standards, Financial Conduct Authority and Citizens Advice normally caution the public to beware such scams, do proper checks and if something sounds good to be true then it probably is. But the likes of Which? go further and say that instead of doing checks on these lotteries or bogus prize draws, just ignore them full stop.

Dodgy financial advisers

The majority of financial advisers are legitimate and do a thoroughly good job for their clients. However, there are some that operate with the express intention of getting sales rather than recommending services and products that are best for their clients. The recent banning of commission selling by financial advisers has helped end some of the worst excesses.

However, there are still 'financial advisers' who are unlicensed, who look to persuade normally elderly people, who generally have the highest value savings and property, to invest in supposedly tax efficient investments and offshore savings or agree to pension unlocking. This is when a pension pot is transferred into an investment vehicle which pays a lump sum out to the pension pot holder (normally ten to 20 per cent of the sum saved), with the remaining funds invested in high-risk, unregulated investments that often have high fees.

The upshot is that your parent may get a cash pay-out through unlocking their pension. But they will probably see the rest of their money disappear in fees or into a dodgy investment that may crash and burn.

Five signs that your parents are being scammed

Many of the signs of a parent who could be being ripped off are similar to any one in distress and under pressure. Watch for all of these:

They have become withdrawn and locked in their own thoughts.

They are borrowing money.

They have suddenly stopped spending money and seem to be living more frugally than normal.

They receive a large amount of unsolicited mail. This could mean their name has been added to a 'sucker list', which is when fraudsters sell on the details of people they have hoodwinked to other would-be fraudsters.

There is someone new in their life who wants to get them involved in investments or who is offering to take care of their finances. This person maybe a unregulated financial adviser.

More on High50:

Children in debt? Don't just give them a handout

How to find a financial adviser

Why you really need to write a will