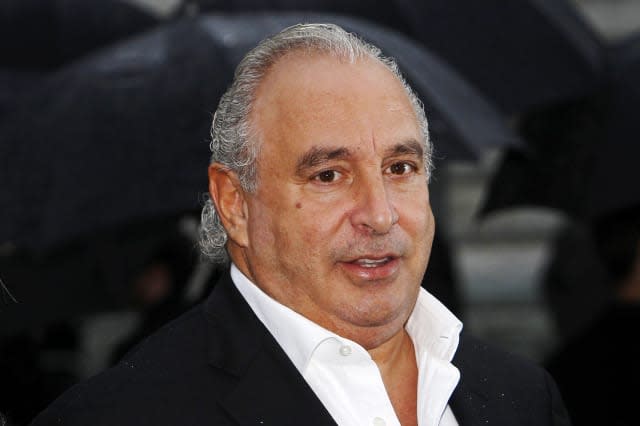

MPs accuse Sir Philip Green of 'favouring' Arcadia pension schemes over BHS fund

Retail tycoon Sir Philip Green has been accused by MPs of "favouring" the pension schemes in his Arcadia group over the retirement fund for BHS workers.

Correspondence from the Arcadia schemes' trustees to members, released by the Commons Work and Pensions Committee, shows a "giant deficit" but a "credible" plan to deal with it.

The Arcadia Group pension scheme and the senior executive pension scheme had a combined deficit of £565 million at the time of the March 31 2016 valuation.

The committee's analysis indicated that Sir Philip's recovery plan was on a "totally different scale and timeline" from the "inadequate" one he had for BHS.

Sir Philip has agreed to pay £50 million a year until August 2019 and £54.5 million from then until March 2026, compared with £24.3 million a year previously, the committee said.

The trustees' advice was that, although Arcadia is in good financial shape, this is the most the company could afford.

The 10-year recovery plan for Arcadia is in contrast to the 23-year BHS recovery plan imposed by Sir Philip in 2012, which involved £10 million annual contributions.

Committee chairman Frank Field said: "I welcome this confirmation that Sir Philip has been compelled to take his responsibilities to the Arcadia pension schemes seriously.

"This is a credible plan for tackling a giant deficit and great news for Arcadia pensioners who must have been concerned. I also welcome the overdue appointment of a professional independent trustee to oversee the scheme.

"It is though clear from these figures that Sir Philip was long favouring the Arcadia schemes over their BHS counterparts, which have more members.

"Not long after he refused to shift on a ludicrous 23-year recovery plan for the BHS scheme, he agreed a 13-year plan for Arcadia with well over double the deficit contributions.

"I imagine Sir Philip would say that Arcadia could afford it because it was profitable, whereas BHS was not. But it is clear that all his companies are run as one large tax-efficient empire in the family interest."

In February Sir Philip agreed to pay more than £360 million to help settle the schemes of thousands of former BHS workers following the collapse of the firm, which he owned for 15 years before selling it for £1 to former bankrupt Dominic Chappell.